Tech Talk: Crosses To Bear

(Click on image to enlarge)

The markets have been so great lately that picking winning ideas has been pretty easy. So let’s get back to the fundamentals – the tools of technical analysis, and how to use them to anticipate the future.

The Canadian stock charted above, West Fraser Timber, is one I bought last summer. It hasn’t done badly from the point at which I bought it, but it certainly hasn’t been a stellar performer. Call me a starry-eyed optimist, but I think that is likely to change.

If you look at the blue arrow in the chart, you will notice that it’s pointing to a “golden cross” – a bullish pattern that forms when the 50-day moving average shifts up through the 200-day moving average. Almost every stock on the major stock market indexes has had a golden cross within the last year or so. The difference in this case, is that the cross is brand spanking new. In my view, it gives credence to the trend line I have drawn. Also, you will notice on the PPO panel that the momentum is there for a technical buy signal. I’m bullish, but we’ll see.

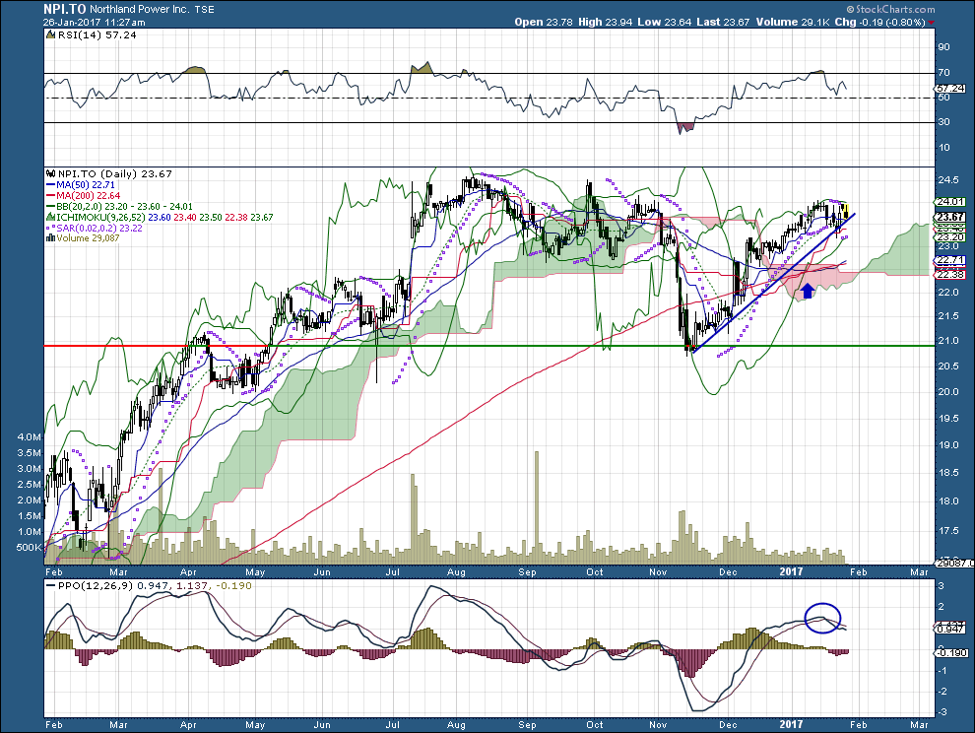

(Click on image to enlarge)

The Northern Power chart charted above also has a spanking new golden cross, which I have also indicated with a blue arrow, but the PPO panel is short-term negative. I’m in the money on this, so I will hold.

(Click on image to enlarge)

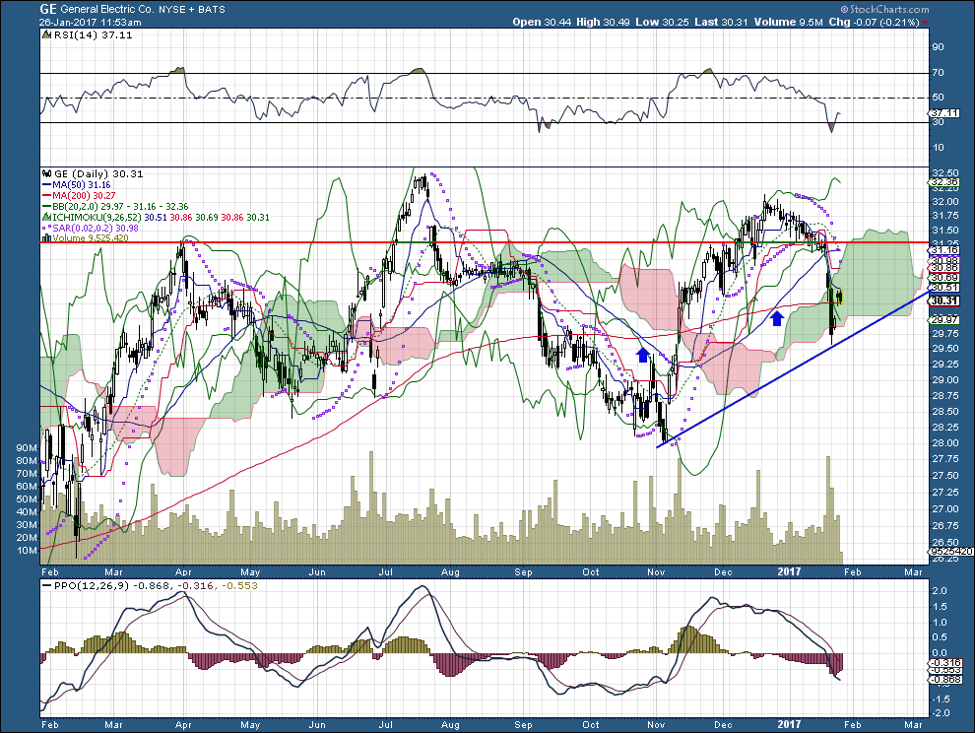

The last chart I want to show you is General Electric, which I have almost always held in my portfolio, and probably always will. I’ll come back to that in a minute. First, though, take a look at the one-year chart, above, focusing on the two big moving averages.

The first blue arrow points to a technical signal known as the “death cross.” It’s supposed to portend a collapse in stock prices. Did it? Nyet. Only two months later we got instead a bullish golden cross! This is an extremely unusual event, illustrating once again that you shouldn’t slavishly follow the rules of technical analysis. Use your head to overrule them.

The following chart shows GE over the last 20 years. Although the stock crashed during the 2008 crisis, over time it holds its value and it pays a dividend – recently, nearly a dollar a year – which I receive in shares. I like that.

(Click on image to enlarge)

Disclaimer: The analysis and ideas presented here should never be seen as a buy or sell recommendation. I am an active trader, but I discuss stocks for informational purposes only. By reading my ...

more

thanks for sharing

So, if one is long the stock should be bought now?