Tech Stocks Signal Market Pause

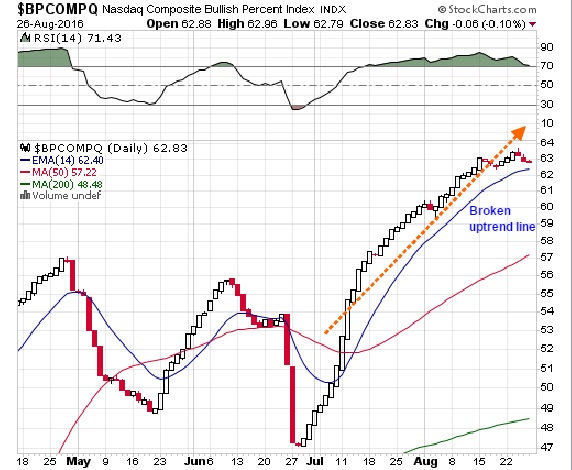

A few weeks ago we opined on how Nasdaq and small capitalization stocks have led the overall market higher since the post-Brexit plunge. The original article mentioned “…Strength in technology and small cap stocks are primarily propping up the market. As long as the BPCOMPQ remains in an uptrend expect the overall stock market to remain near the current highs. However, just as these shares have led the market higher, if they start to falter that will probably signal the next significant price pullback…” See this link for the previous article

We suggested monitoring the Nasdaq Composite Bullish Percentage Index (BPCOMPQ) and looking for a break in the uptrend line. In the updated chart below we highlight a break in the uptrend line. This is a signal to begin evaluating potential bearish or neutral trend trades. If recent history is a guide, any price pullback will probably be sudden and of short duration. Also, if the stock market does retrench that should be the next opportunity to bid on bullish positions.

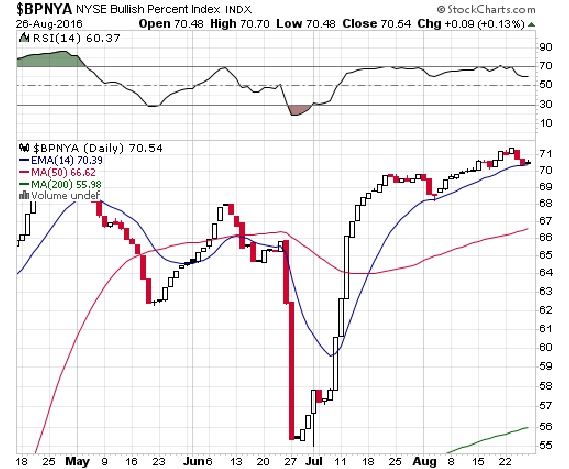

The NYSE Bullish Percentage Index is continuing to move sideways. Stocks in the Dow Industrial will be disproportionately adversely affected by a Fed rate increase. This will probably keep a lid on a bullish uptrend in the Dow index.

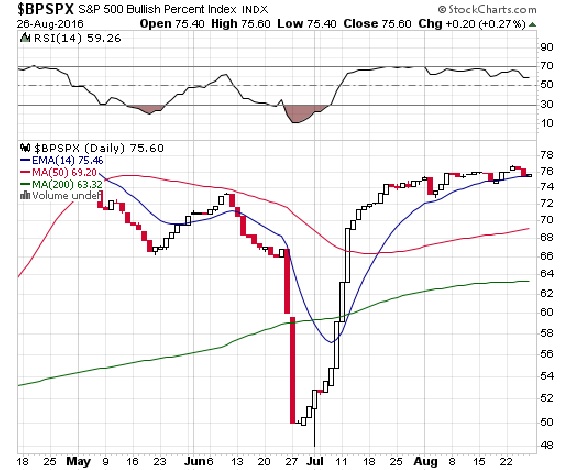

Similar to the BPNYA Index, the S&P 500 Bullish Percentage Index is also continuing to trend sideways. Recently, the S&P 500 has been the weakest of the major equity indexes.

more

Thanks for sharing