Tech Sector Sell-Off Provides Much Needed Volatility

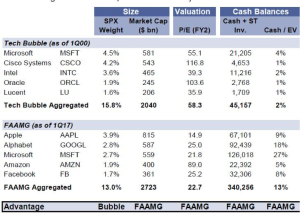

The summer doldrums are here, or are they. Last Friday’s market action or reaction to some minor headlines shook up the tech sector. In a note from Goldman Sachs on the FAAMG (Facebook (FB), Apple (AAPL), (AMZN), Microsoft (MSFT) and Google (GOOG)) stocks, the firm gave warnings on valuations and offered concerns that their volatility has become extraordinarily low. In fact, the stocks had become closely correlated to safe haven plays, like bonds and utilities. In the report from Goldman, the firm also compared the FAAMG stocks to those it reviewed from the 2000 tech bubble i.e. Lucent, Oracle (ORCL), Cisco (CSCO) and Intel (INTC). The biggest problem Goldman cited with the FAAMG stocks was that the current tech darlings were actually behind the curve when it came to a side-by-side profit comparison.

Comparison of FAAMG stocks to 2000 tech bubble leaders

While the FAAMG names have a great deal more cash than the tech bubble 2000 names mentioned, this didn’t seem to save the Nasdaq or the FAAMG stocks last Friday. The sell-off accelerated in the afternoon with the Nasdaq falling 2.4% and Facebook and Apple falling 4 percent on the day. The S&P tech sector was down 3.3% Friday but was still up more than 15% for the year. Tesla (TSLA) isn’t named in the FAAMG stocks, but the electric-tech auto company also had a nasty intraday reversal. After opening the trading day at $376, the share price found itself tumbling lower throughout the day, closing at $357.32.

It’s highly unusual that such a sector sell-off manifests itself into a 1-day event. I own Facebook and Microsoft in the Golden Capital Portfolio fund for clients. Neither has retraced, even with Friday’s sell-off, back to where I had sold portions of the positions in the Portfolio and where I had found reason to believe valuations were a bit stretched. I’m of the opinion Friday wasn’t the end of the selling pressure in the FAAMG names even if there is some “dip buying” near term. As such, I would urge investors to monitor these names closely over the next 5-10 trading sessions and before taking any definitive or long-term actions.

Moreover, the FAAMG sell-off created enormous volatility in the markets last Friday. It was truly an amazing day! I offer this characterization because there was an extreme in the VIX (fear gauge/volatility) that hit in the early part of the day and before it spiked alongside the tech sector sell-off.

As shown in the graph of the VIX above, the volatility index fell to an 11-year low of 9.37 on Friday. One more time for those who might need it repeated… an 11-year low of 9.37. In an article titled The VIX Will Achieve Its Lowest Levels Ever...In Time, I largely discuss the nature of volatility that will logically produce new trading lows over time. While Friday’s low was not an all-time trading low for the VIX it certainly validates my theses, forecasts and points to the eventuality of the VIX. Having said all of that, why not an amazing spike of the VIX 11-year bottom to extend the eventuality right? And that is exactly what happened as identified in the graph above. As the tech sector sell-off gathered momentum, so did the VIX.

Golden Capital Portfolio invests heavily in VIX-leveraged ETPs, namely ProShares Ultra VIX Short-Term Futures ETF (UVXY). In an article titled Comey's Testimony, European Central Bank & U.K Snap Election May All Produce Greater Volatility This Week, I walked investors and traders through the identified reasons as to why on Monday June 5, 2017 I was covering UVXY short positions held in the Portfolio. Fortunately after covering many short shares of UVXY at $10.19 and 10.44 earlier in the week, the opportunity became such that I was able to recapture these short positions at a higher price in the latter half of the trading week. And with Friday’s spike in volatility, I was even able to execute an intraday scalp of significance from the spike in UVXY’s share price. I shared this intraday trade with one of my friends on StockTwits as depicted in the screenshot below:

As it pertains to the VIX and the recent trends that it demonstrates, something is becoming very transparent. VIX sub-10 is very difficult to maintain for any more than a day or two. At least, that is the current trend. While all trends are made to be broken, they are not meant to be fought with aggressive trading or aggression period…and period. It’s with this in mind that those investing or trading volatility and VIX-leveraged ETPs may need to modify their trading strategies. I am presently conducting due diligence on this subject matter and will articulate the findings in the coming weeks. For now, steady as she goes and tread cautiously as the week ahead finds not just some uncertainty with FAAMG and the tech sector as a whole, but with a Fed rate hike that WILL come to pass. Most market participants fully expect a .25% rate hike from the Fed this coming week. Nonetheless, it always proves to create volatility in the markets.

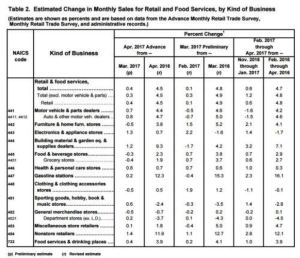

And speaking with a macro-market perspective, a key piece of economic data will be due out this coming Wednesday from the Census Bureau. It’s monthly retail sales time yet again. All eyes, as they generally are, will be on the department store retailers and statistics from the retail sales report. Department store retail sales have been in a downward spiral over the last few years, accelerating downward into 2017. This anomaly has presented itself as an adverse affect from the proliferation of digital/online shopping. Last month’s retail sales failed to meet estimates and found the trend away from department store retail sales continuing, albeit at a lesser pace than in previous monthly reports.

It’s safe to say that very few investors and economists are expecting any change in the trending of segmented retail sales. Should there be any light at the end of the tunnel in the May retail sales report for department stores, however, expect a big reaction from investors.

Many retail stocks received a relief rally in the form of a sector rotation last Friday. As money spilled from the tech sector it found its way into the retail sector. Target (TGT), Kohl’s (KSS), Bed Bath & Beyond (BBBY), J.C. Penney (JCP), Macy’s (M) and many other retail names rose 2% and better on the news that the Freedom Caucus desired to have the Border Adjustment Tax removed from the proposed tax cut legislation.

“But the Freedom Caucus chairman suggested that Congress move on from one part of Brady's plan — the border-adjustment proposal to tax imports and exempt exports — since it has faced a lot of pushback from lawmakers. Meadows said that Congress should acknowledge that "the political facts are there is not consensus to have a support for the border-adjustment tax.”

While such news proved beneficial for retail names on the day and the relief rally may continue into early this coming week, it doesn’t overshadow the headwinds these retailers continue to face. For many investors in these retail names, the relief rally may prove to be an optimal place to lighten ownership in these names. For others, like myself, it may be just the ideal opportunity to execute a standing, swing trade. I recently acquired shares of TGT for a swing trade at $54.72 for Golden Capital Portfolio. My desired exit for this trade is $57.50 or better. We’ll have to wait and see if the opportunity to exit shows itself this week.

Of the many retailers named within, I think Target is positioned and executing best on its objectives. By no means does this identify I’m willing to invest in the name long-term, but as a point of emphasis when compared to its peers it is executing from a point of strength and dominance in the retail sector. Other retailers like J.C. Penney, Bed Bath & Beyond, Macy’s and Sears Holdings are all operating from a point of weakness and with a lesser business model. Having said that, these retailers are aiming to adapt to the newer retail landscape with many initiatives in place. I discussed some of these retailers and their initiatives recently in an interview titled Tarnished Target, Suffering Sears: Seth Golden Sorts Out the Retail Wreckage, with David Moadel.

As interesting as the previous week proved to be and with its many macro-headlining events, I’m yet again expecting this coming trading week to be filled with ups and downs. Having said that, I will be expecting the ups and downs as I lounge with family on the beaches of Mexico and Grand Cayman, sipping my virgin, Pina Colada...but that's neither here nor there. The downs may prove to be more substantial than the ups for the time being. An odd set of considerations have presented themselves with financials and retailers rallying as techs sell-off. But always remember: Earnings drive markets, always have and always will...long-term! I will not stay thirsty mis amigo!

Disclosure:I am long TGT, FB and MSFT. I am short UVXY