Tech Momentum Shines In Turbulent First Quarter

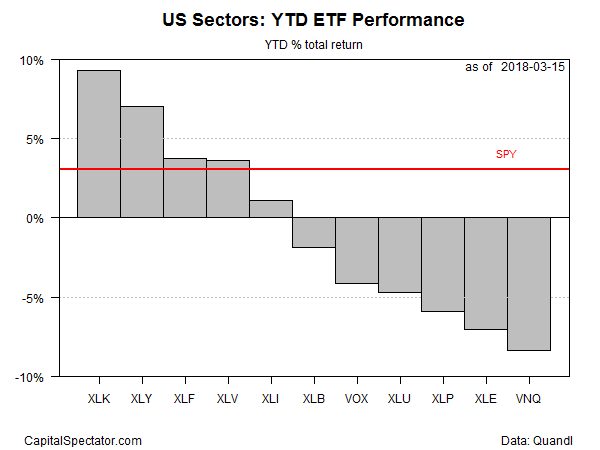

It’s been a turbulent year for US stocks so far, but technology shares are an exception as this corner of the market roars higher in 2018. These firms have outperformed both the broad market as well as the other major sectors on a year-to-date basis, based on a set of ETF proxies.

Technology SPDR (XLK) is up 9.3% for the year through yesterday’s close (Mar. 15). That’s a moderate premium over the second-best sector performer: Consumer Discretionary SPDR ETF (XLY), which is ahead by 7.0% so far this year.

The gap in favor of tech looks even stronger vs. rest of the field, which is nursing a fair amount of red ink. The worst performer this year so far: real estate investment trusts (REITs). Vanguard Real Estate (VNQ) is off 8.4% through Thursday’s close.

Tech stocks are also beating the broad market, based on the SPDR S&P 500 (SPY), which is up a bit more than 3% so far in 2018.

Tech led the market last year and some analysts are looking for a repeat performance. The fundamental driver, says Lindsey Bell, an investment strategist at CFRA Research, is the ongoing embrace of all things tech. “Our economy in general and our world in general is becoming more connected digitally, and this is an area that’s going to continue to thrive as time goes on.”

Tech’s upside momentum vs. the other sectors stands out over the trailing one-year window too. As the chart below shows, XLK’s leadership over the past 12 months (black line at top of graph) has been unchallenged for months.

Ranking the sector ETFs by current price relative to 200-day moving average also highlights the tech sector’s strong momentum. XLK closed yesterday at close to a 15% premium over its 200-day average, well above the comparable numbers for the other sector ETFs.

Tech also tops the sector performances for risk-adjusted results, based on the trailing one-year period. XLK’s Sharpe ratio (SR), which adjusts returns for volatility, is a high 2.2.

For additional research on the sector ETFs cited above, here are links to the summary pages at Morningstar.com:

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

Financial (XLF)

Healthcare (XLV)

Industrial (XLI)

Materials (XLB)

Technology (XLK)

Utilities (XLU)

Telecom (VOX)

Real Estate Investment Trusts (VNQ)

Disclosure: None.