Tech Indices Breakout

After a solid setup yesterday, the Nasdaq and Nasdaq 100 broke higher today. Supporting the breakout was an increase in volume, marking confirmed accumulation. Technicals also remained aligned with bulls, staying net bullish.

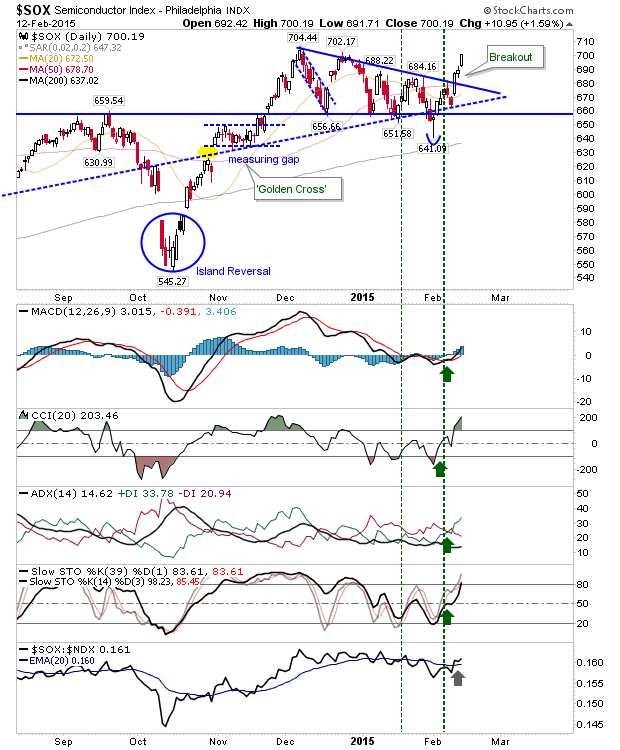

Supporting the gain in the Nasdaq and Nasdaq 100 was the 1.6% jump in the Semiconductor Index. It looks to be completing its two month consolidation, and readying for its next move higher. The measured move target from this consolidation is 790.

The S&P is pressuring the 'Santa Rally' high of 2,093. The breakouts in the Nasdaq and Nasdaq 100 should provide positive feedback, enabling a fresh breakout in the S&P, although some pause at 2,100 can be expected.

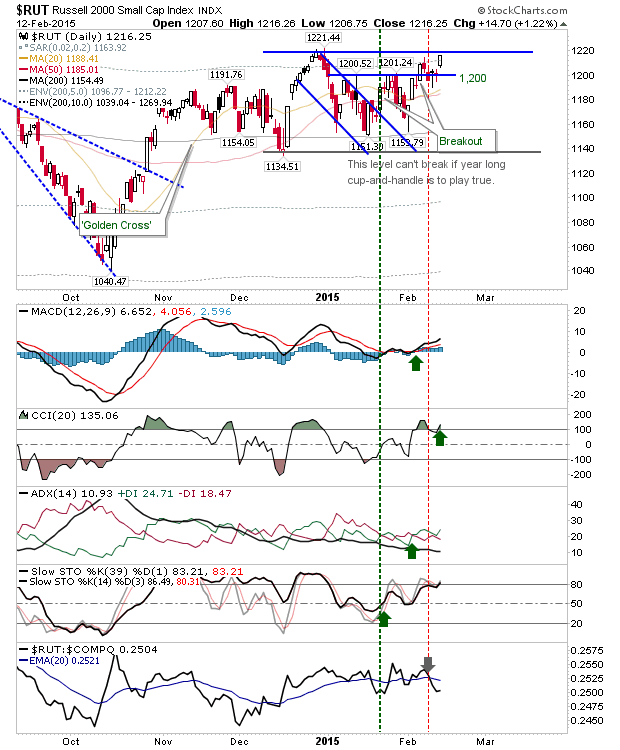

Likewise, the Russell 2000 is setting itself for new highs, but unlike the S&P, a breakout here could kick start a new rally given its under-performance throughout 2014.

For Friday, keep an eye on the Russell 2000 and S&P. While breakouts in these indices are unlikely, it will be important to see price action hold tight to resistance. Bears best hope are 'bull traps' in the Nasdaq and Nasdaq 100, although it would take a larger sell off in the Semiconductor Index for such traps to stick. However, this seems unlikely given the 15 year under performance of this index, offset by its current renaissance from 2009 lows.

Disclosure: None.

LOL, the semiconductor cycle never disappoints when it comes to cyclical collapses. You're lucky if prices only drop 50%.

At some point, semiconductors will emerge from the doldrums. Sure, Semis could take a big haircut: the Philly index is up 350% from its 2009 low (ahead of the 285% gain for the S&P), yet still well off its highs. But to look for a 'lucky if prices only drop 50%,' misses what a canary-in-the-mine sector like Semis has done in a weak economic environment.