Tech Earnings Are Great

Tech Isn’t A Bubble

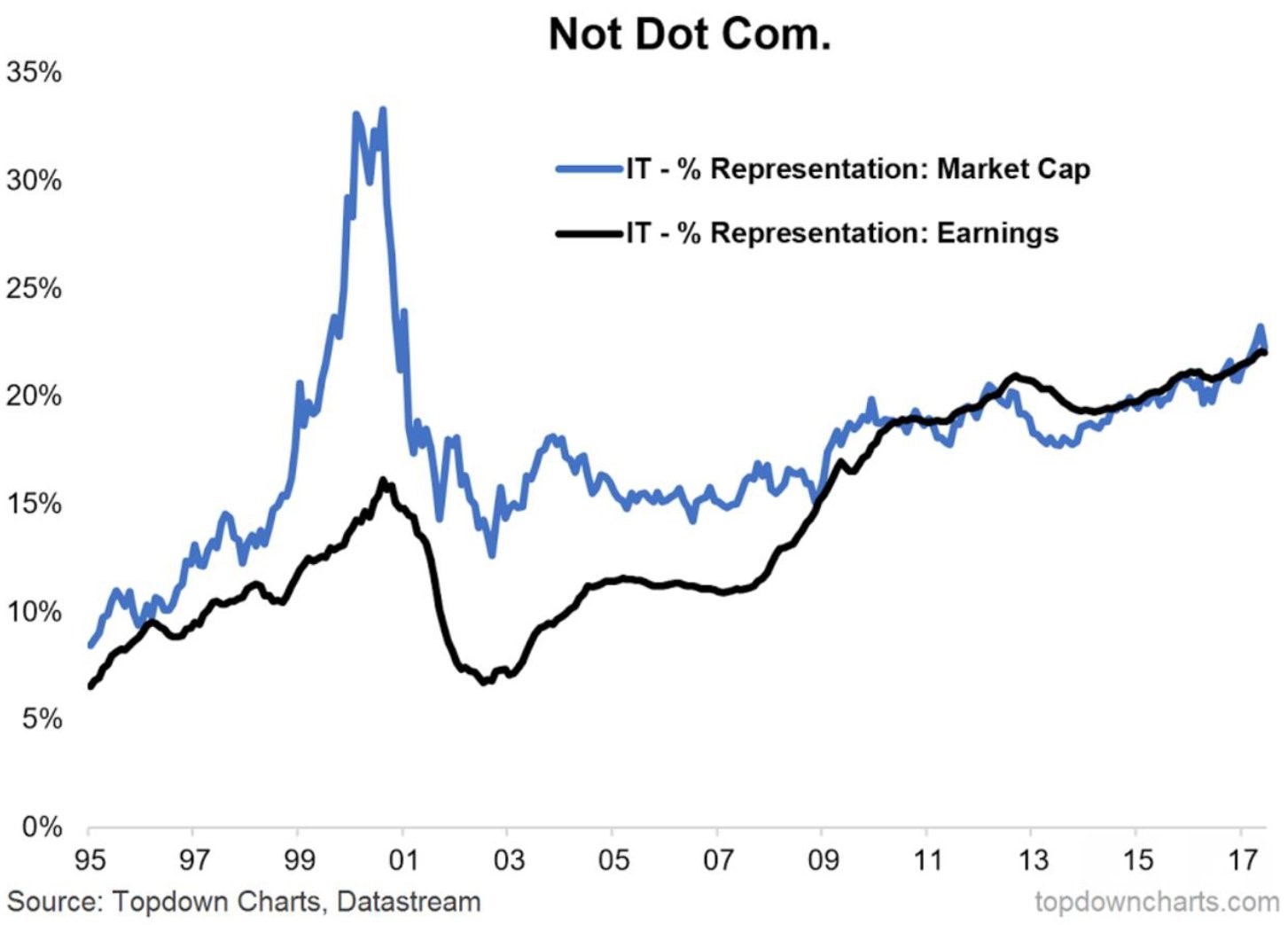

I have made it clear that the current stock market isn’t like the technology bubble of the 1990s. The biggest reason is because technology stocks aren’t overvalued compared to their earnings. The most misleading chart that bears show is the chart of the Nasdaq which makes it look like we are in another bubble just because it has surpassed the 2000 high. It matters what you’re getting when you purchase the Nasdaq; price doesn’t indicate value. Now you’re getting stronger companies with more earnings. There are expensive stocks on a P/E ratio like Netflix and Amazon, but Apple, Alphabet, Microsoft, and Facebook have been minting profits. A great example of why this rally is different from 2000 is shown in the chart below. In the 2000s, information technology’s market cap as a percentage of the S&P 500 soared while earnings didn’t reach the same level as a percentage of the market. Now earnings and the market cap are about the same percentage of the overall market.

To further kill the narrative that we are in a second technology bubble, the chart below shows technology’s forward P/E compared to the forward P/E of the S&P 500. Now both forward P/Es are about the same. This is even while the technology sector’s earnings are growing faster than the market. This compares to the outrageous valuations of the early 2000s where the sector had an over 40 forward P/E. The companies are much more stable now. A great example of the sobriety of the current market is the beating Snap stock has taken. The company is seeing slowing user growth and no signs of profitability. As a result, it is getting hammered. In the early 2000s, companies were given a free pass much like some of the latest ICOs are getting.

Companies in the early 2000s and the current ICOs didn’t have a solid business plan yet were/are being bid up to enormous levels. Even Netflix (NFLX), while it has a high multiple and negative free cash flow, is much different from the tech stars in the tech bubble. Netflix has over 100 million subscribers. Companies like Pets.com and other failures never came close to that success level. You can argue that Netflix is still overvalued, which is fine, but I am comparing apples to apples by looking at the expensive Pets.com because Netflix is considered to be the face of the expensive valuations in tech as it is the “N” in FANG. The other obvious firm is Tesla (TSLA). I can’t defend Tesla’s business model or valuation in any way, but I think Tesla is an example of a cult stock because of the prowess of Elon Musk instead of a representation of the whole market. For example, Chipotle (CMG) was a hot stock which had a huge blow-up amid this strong bull market and the market didn’t miss a beat. The fact that crashes like Valeant (VRX), Chipotle, and the entire biotech sector can occur shows that there isn’t froth in the market.

In the back of your head whenever you see a company, industry, or entire market have high profits you wonder whether margins are unsustainably high. The chart below is one example of an industry which might be at unsustainably high margins. Semiconductors and semiconductors equipment companies are highly cyclical as you can see in the chart below. All the industries are near their record highs in the chart. It looks like information technology has trended higher over time. Since it makes more of S&P 500 profits than ever before, it will push total margins higher. Even though it appears the sky is the limit for tech margins, there will soon be a ceiling. Cycles don’t last forever.

Republicans Still Confident

On Thursday, the Bloomberg Consumer Comfort index was released. The headline number improved from 47.0 to 47.6. The expectations index fell to 47.0 which was the lowest level since early December. Zero Hedge is claiming that means the Trump optimism is over. The chart below reviews the breakdown between Democrats and Republicans. Interestingly, the Democrats which were already opposed to Trump are the ones losing the little faith they had in him. The real key will be when Republicans lose hope. The best way to get them to lose hope is if tax reform doesn’t pass. Rand Paul still believes tax reform will pass by the end of the year. That’s interesting because the healthcare plan is in peril. It doesn’t look as good as I thought it would look last week now that John McCain’s health has taken a turn for the worse.

The point is that if Republicans had their consumer comfort indicator join the Democrats in the gutter, it could impact consumer spending. I have previously talked about how these surveys aren’t that useful, however, tax reform not happening would be a negative catalyst for the economy even though many investors are already in that camp. There’s no way around a selloff occurring if tax reform doesn’t pass even if it isn’t priced in. It’s such a powerful factor because of the repatriation tax holiday.

Conclusion

Technology is the most important sector to S&P 500 returns and it looks healthy. Microsoft (MSFT) reported earnings on Thursday and traded flat after hours. Its revenues beat expectations for $24.27 billion coming in at $24.7 billion. The most exciting business for Microsoft is Azure which grew revenues by 97% as more business shifts to the cloud. That’s good news for Amazon’s AWS service unless Microsoft took share from it. I’m expecting more good results from Amazon and the rest of the tech names as they continue their profit momentum. Although the top 5 tech names don’t have an historically outsized effect on the market, their rally will be able to push stocks even higher for the rest of the summer.

Obviously, I was wrong to have so much optimism on the GOP’s chances of passing healthcare by August. To be fair, I didn’t expect John McCain to have health problems. Even with the disarray, Republicans are still optimistic. Let’s see how they feel in the next few weeks as the confusion on healthcare continues.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more

Thanks sir