Tariffs, Tariffs, Tariffs

As mentioned earlier in a tweet about the ISM Manufacturing report for July, talk and concern about tariffs is just about everywhere in the manufacturing sector. In addition to the ISM Manufacturing report, we’ve also seen a major uptick in tariff conversation during the latest round of Q2 earnings conference calls. We’ve been tracking all of the conference call transcripts of companies in the S&P 500 that have reported earnings so far and with just about half of all companies reporting, the percentage of conference calls where tariffs have been brought up has more than doubled relative to Q1 (39.8% vs 16.6%). For the entire Q1 earnings season, the word “tariff” came up 290 different times in S&P 500 conference calls (in some calls, the word came up more than once), while during this earnings season, the term has already come up 609 different times. Remember, we’re only halfway through this earnings season.

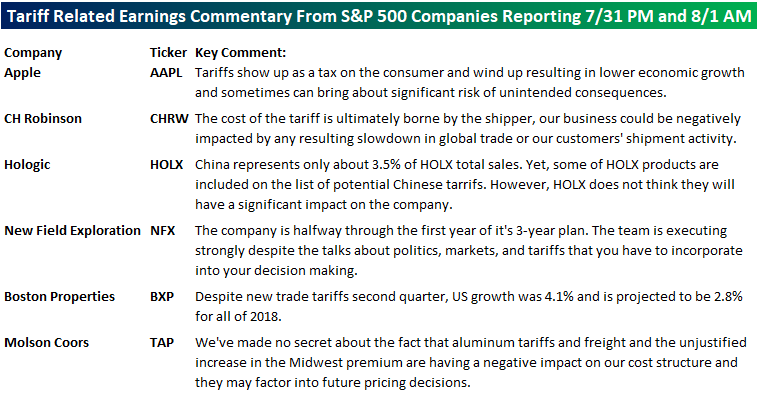

The table below breaks down the percentage of companies that have mentioned tariffs in their Q2 conference calls by sector. For each sector, we have also included the conference calls where the term has come up the most frequently. Three sectors have seen “tariff” mentioned in half of the conference calls (Industrials, Materials, and Consumer Staples), and all three sectors have lagged the market considerably this year. Sectors where tariffs have been least mentioned are Telecom Services, Health Care, and Real Estate.In terms of individual companies, given all the headlines Harley Davidson (HOG) created when it was targeted by the President for saying it would move production outside of the US in response to tariffs, the fact that tariffs were mentioned the most on its conference call isn’t much of a surprise. Right behind HOG, Stanley Black & Decker (SWK), and Mettler-Toledo (MTD) round out the top three.

(Click on image to enlarge)

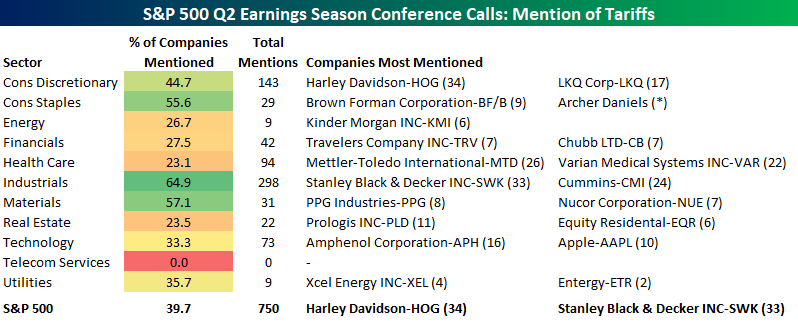

Finally, we also wanted to highlight a few excerpts from conference calls that have taken place between the close on Tuesday and the open Wednesday.Apple (AAPL) is the most notable of the six companies mentioned and gets right down to the bottom line with its statement that “Tariffs show up as a tax on the consumer…and sometimes can bring about significant risk of unintended consequences.” We couldn’t have said it better ourselves!

(Click on image to enlarge)