Take A Ride On The Bearish Bond Train?

Interest rates are forecast to rise across the board.

We live in exciting times, don’t you think? November, punctuated as it was by wrenching changes in financial market expectations, was thrilling indeed. Equities, gold, the US dollar and domestic interest rates – pick one – they all jumped or dived substantially following Election Night.

Not that it was just the election that had investors electrified. Take interest rates, for example. Rates for the long government bond bottomed back in July at 2.11 percent. Yields had already risen more than 50 basis points by the time ballots were counted on Election Night. And now? Well now we’re at 3.12 percent.

As rates rise, of course, bond prices decline. As do bond funds like the iShares 20+ Treasury Bond ETF (Nasdaq: TLT) which has sunk more than 16 percent since its July peak (see the chart below).

Rates are headed still higher, at least according to traders at the short end of the yield curve. Built into Fed Funds futures pricing is a near certainty (can we even say “near certainty” anymore?) of a rate hike coming out of the upcoming December FOMC meeting. That would put the rate target at 50 to 75 basis points. After that, the futures term structure reveals traders’ expectations tipping toward another rate hike to a 75-100 bip target at the June meeting (see the chart below).

Now, remember, these are expectations not certainties. Things could go either way – toward faster or slower rate hikes – as we head into the new year and a new administration. Also keep in mind that Fed Funds are most directly influenced by FOMC actions. The long end of the curve’s driven more by inflationary and macroeconomic expectations. That makes the long end more volatile, pricewise. That said, you shouldn’t be surprised by a TLT price target of $101, a level last visited at the end of 2013 (the fund’s trading at the $118 level now). Let’s call $101 a long-term objective, not necessarily reachable by June or even December. After all, it took nearly three years to get from $101 to $142, though prices tend to fall faster than they rise.

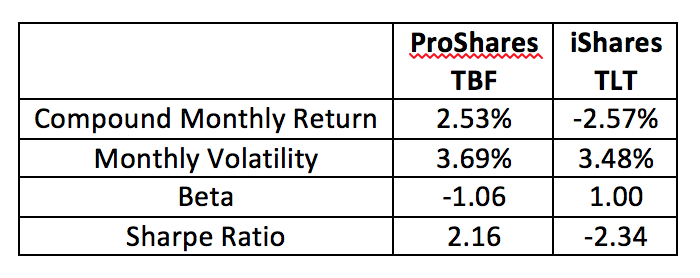

Should you bail from bonds? Not necessarily. If you’re a hold-‘til-maturity type, you can wait this out and continue collecting coupon payments. Besides, finding non-correlated assets isn’t easy. Speculators, though, can ride the bearish train by jumping on board the ProShares Short 20+ Year Treasury ETF (NYSE Arca: TBF). The unlevered TBF portfolio is pretty much the polar opposite of TLT with an r2 of 99.87. Here’s how the funds have stacked up against each other since July:

Interest rate expectations have already pushed TLT’s price down hard, so it serves us all to keep in mind economist Murray Rothbard’s contention that “expectations speed up future price reactions.” Speculators should position themselves carefully for the ride ahead.

Disclosure: Brad Zigler pens Wealthmanagement.com's Alternative Insights newsletter. Formerly, he headed up marketing and research for the Pacific Exchange's (now NYSE Arca) ...

more