Strong Export And Ethanol Usage, But Stocks Up On Bigger Crop

Market Analysis

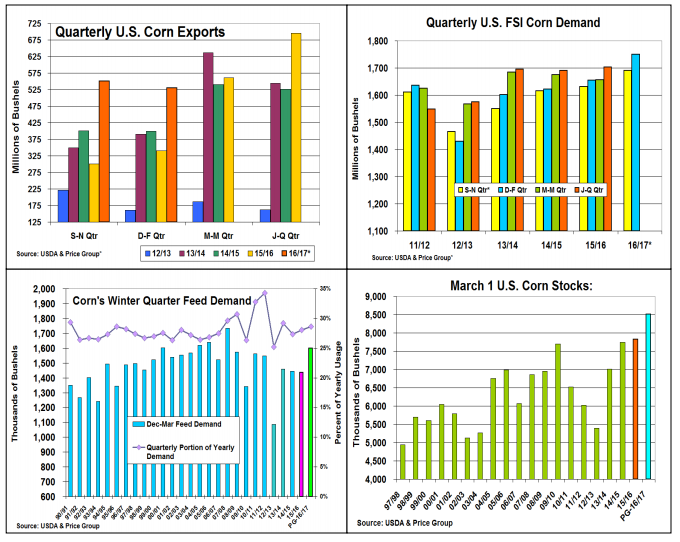

The corn market’s attention will be split on March 31 between the USDA’s quarterly stocks report and 2017’s planting intentions since both will be released on that day. After producing a record US crop last fall, record weekly ethanol output numbers has prompted this domestic demand outlook to be ratcheted up while the USDA’ has decreased its feed demand forecast by a similar amount keeping corn’s stocks generally unchanged. The upcoming quarterly stocks report will be the next barometer to see if this year’s current feed outlook of 5.55 billion bu. is on target.

To monitor U.S. feed demand, the USDA surveys elevator operations and farmers on a quarterly basis. Since corn is fed both on and off-the-farm, this important procedure is the only way to quantify the amount of domestic usage being utilized by the U.S. feed users from their previous count. Export demand and ethanol output are updated with weekly & monthly reports.

Overseas demand has pushed U.S. exports sales 200 million bu. ahead of its seasonal pace to hit the USDA’s 2.25 billion bu. forecast. However, this year’s shipments have been curtailed by PNW snows & hefty bean shipments to 551 and 530 million bu in the first 2 quarters this year. Strong bio-plant margins and record export demand has likely pushed corn’s food, seed & industrial quarterly demand to 1.75 billion bu., up 5.4% from last year.

This year‘s animal numbers are up with hog numbers leading the way with record tonnage levels since last fall. US feedlots have been staying near 100% of last year’s inventories with beef output up 2-4% in the 1st half of the year. Broilers and egg sets have been growing at 1.5-2% as avian bird flu in Asia has sparked stronger meat and eggs exports this year. We have had a warm winter, but overall numbers could produce the largest winter quarter feed demand of 1.6 billion bu. in 9 years.

What’s Ahead:

However, this month’s quarterly stocks of 8.517 billion bu. will be the highest March 31 corn stocks ever because of 2016’s record crop. The potential 11.5% jump in corn's feed demand during the past winter is a positive. This suggests no near-term change in corn’s feed demand, but the trade will continue to monitor this usage. Spring weather & lower plantings suggest holding sales ahead of March 31 reports.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more