Strong Export & Ethanol Use, But Big Corn Crop Keeps Stocks High

Market Analysis

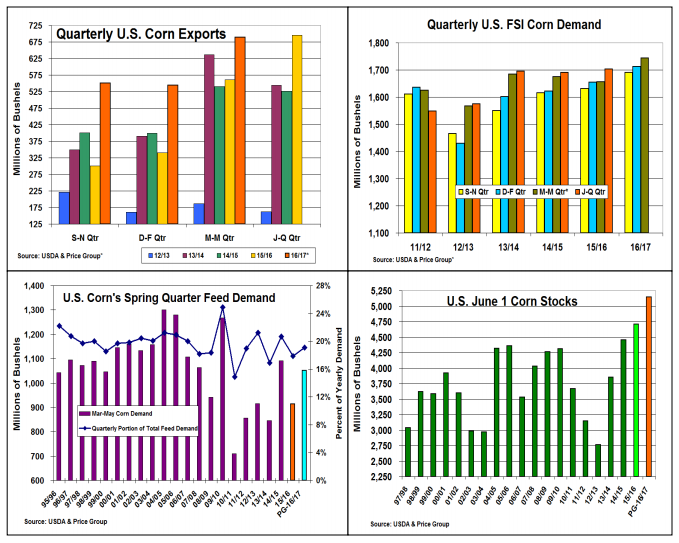

The corn market’s focus will be split on June 30 between the USDA’s quarterly stocks report and 2017’s acreage report, which will be both released on that day. Record weekly ethanol output numbers have pushed this domestic demand outlook up 150 million bu. from last fall while the USDA has decreased its feed demand forecast by a similar amount keeping corn’s stocks generally unchanged. This year’s US export outlook has also remained unchanged at 2.225 billion bu. since last fall.

To track US feed demand, USDA surveys elevator operations and farmers on a quarterly basis. Since corn is fed both on and off-the-farm, this important procedure is the only way to quantify the amount of domestic usage being utilized by the US feed users from their previous count. Export demand and ethanol output are updated with weekly & monthly reports.

Overseas demand has pushed the past quarter’s US exports to a new record 689 million bu. and kept shipments 125 million bu ahead of corn’s 5-year average pace with just 3 months left in the year. With shipments needing to be only 440 million this summer to reach the current forecast, this demand may rise by 50 million bu next month. Strong domestic & export demand has pushed corn’s food, seed & industrial quarterly demand to another record 1.743 billion bu., up 5.2% from 2016.

The USDA just raised its yearly grain consuming animal units to 97.3 million(+0.7 million) in this week’s Feed Outlook report because of stronger cattle numbers in feed yards and dairy animals on farms in the second half of 2017. With hog numbers continuing their record slaughter pace and broilers and egg sets advancing at 1- 3% as Asia and Europe recover from avian bird flu outbreaks over the winter, 2017’s 3rd quarter feed demand could jump by 15% to 1.05 billion bu. this quarter. Corn’s June 1 stocks of 5.15 billion are the highest since 1980s.

What’s Ahead:

Despite being a month away from corn’s highly important US pollination period, the market has already experienced weather concerns this growing season. 90-degree heat moving into the Midwest by mid-June (earliest in 4 year) were quelled by thunderstorms this week. However, 2017’s erratic US weather pattern keeps the market nervous. Hold remaining old-crop sales until pollination weather is better known.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more