Strong Export & Ethanol Usage, But Stocks Up On Bigger Crop

Market Analysis

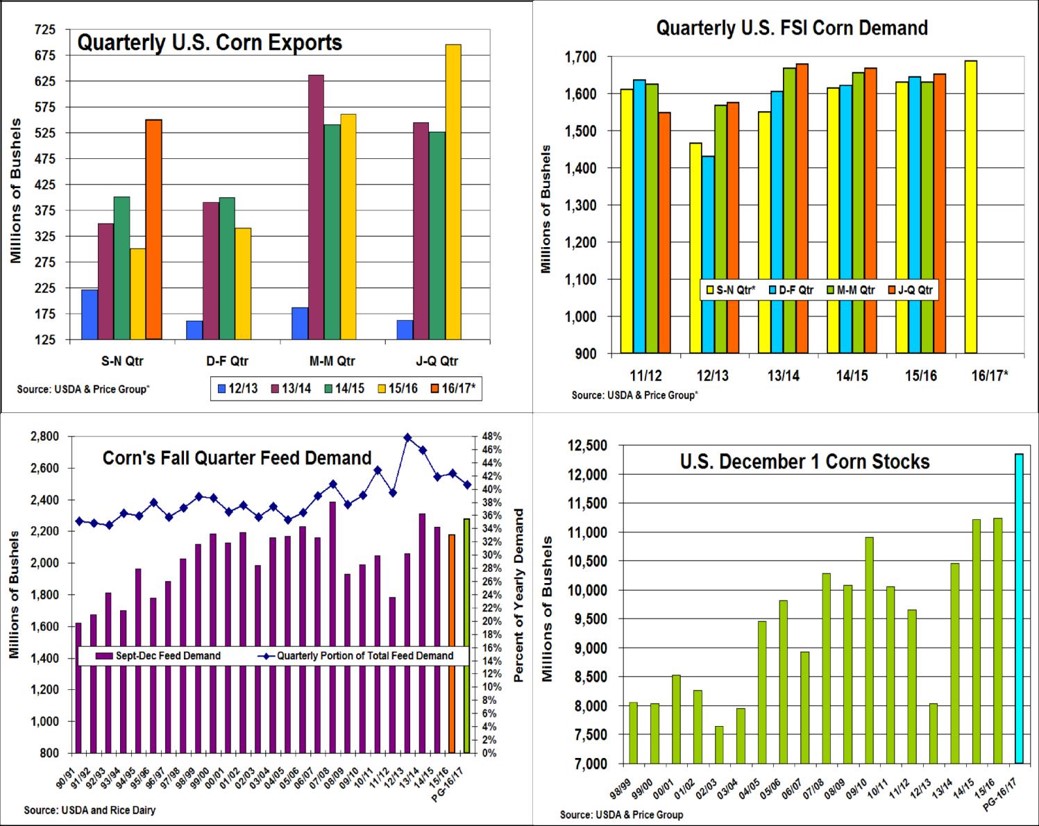

Similar to US soybeans, record US ethanol production and strong overseas demand have combined to help utilize a sizable portion of 2016’s record US corn production. The combination of expanding US driving demand and world ethanol trade along with the last year’s sharp in Brazil’s second crop corn crop because of drought have helped jump this year’s seasonal corn usage by 15.8% for these two prominent demands over their first quarter 2015/16’s levels.

This month’s USDA Grain Crushing report, which updates the US corn utilization level for America’s fuel ethanol along with other industrial outputs from the nation’s wet and dry corn processing plants, rose 44 million from 2015/16’s first quarter. Looking at fuel ethanol portion of this industrial demand, this major demand jumped 2.9% over last year or a 38 million higher bushels during the September to November period according to the USDA’s Grain Crushing report released earlier this month.

Utilizing, this year’s November Census Bureau exports which were released earlier this month. 2016/17’s first quarter corn exports totaled 550 million bu. according to this government agency. This is the highest fall corn shipments since 2007/8 crop year and 249 million bu jump in exports from last year or 82.7% annual increase in exports in one year.

A combination of buyer complicacy about a corn price advance and a slightly less (99%) than capacity cattle-on -feed numbers the last couple months of 1st quarter may have sliced this year’s feed demand. Poultry slaughter and egg production built during the quarter for a positive for feed demand. However, a larger-than-expected December hog inventory of 4% probably helped up corn’s fall usage by 110 million over 2015 to 2.285 billion bu., which has us expecting a 12.335 billion bu. December 1 corn stocks—a record amount by over a billion bu.

(Click on image to enlarge)

What’s Ahead

Given the recent tendency for corn’s final crop size to decline (6 out last 10 yeas), the combination of a slightly smaller crop and a modest increase in corn’s overseas demand could decrease corn’s ending stocks by 125 million to 2.278 billion this month. However, some additional South American crop issues are likely needed to open March corn’s potential above $3.80 till spring in the US.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more