Stocks Up Dollar Down

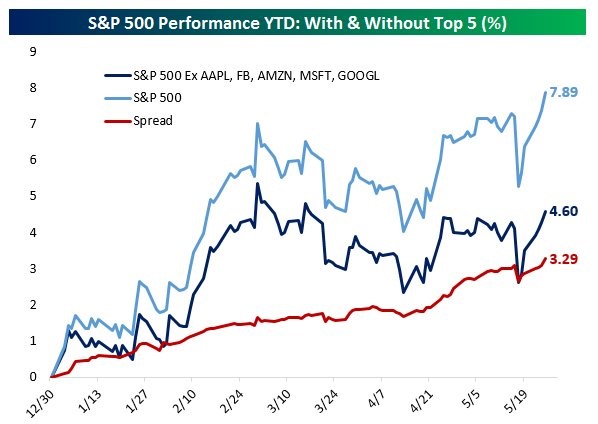

Looking at the major stock market indexes it looks like the market has not cared that the U.S. macro surprise index has been negative while the European macro surprise index soars. Looking in more detail, there has been an underlying trend in markets which reflects the economic shift. The Russell 2000, which consists of firms which do most of their business in America, is only up 2% year to date. The big technology stocks continue to soar. They may be net beneficiaries of the shift because they do most of their business overseas and the weak economic data is pushing the dollar lower which helps earnings. As you can see from the chart below, the S&P 500 is only up 4.60% without the top 5 tech stocks. The spread between the S&P 500 and the S&P 500 without the top tech stocks is growing, showing that the market has been relying on these top stocks even more lately.

As you can see from the chart below, the euro versus the dollar has increased from 1.05 at the beginning of the year to 1.12. While firms like Alphabet are hurt by any American weakness, they benefit from the European strength and the dollar weakness. The dollar index has fallen from $102.78 to $97.31 this year.

The short term VIX hit a record low on Thursday. It only started being tracked in early 2011 which means we can’t compare this bull market to others, but it does show that the current near term volatility is the lowest in this cycle. As you can see from the chart below, the VIX just had its 11th sharpest 6-day decline, looking at data since 1990. As you can see, the VIX started this crash at the lowest point out of any of the top 15 streaks. The large tech stocks I mentioned earlier are driving this decline in the VIX.

The S&P 500 rallied 0.44% on Thursday despite the crash in oil. WTI fell to $48.90 which was almost a 5% decline. The S&P energy sector fell 1.79% because of the crash. The crash was driven by disappointment over the reports coming from the OPEC meeting in Vienna. Reuters reported that the cuts would meet expectations and be extended 9 months. It appears Iran and Nigeria will be exempt from the cuts although the Iranian oil minister told CNBC he supports the cuts. Maybe he meant he supported the other OPEC and non-OPEC nations doing the heavy lifting with the cuts. Even if Iraq agrees to go along with the cuts, it has exceeded previous caps, which makes traders skeptical of Iraq’s future statements.

My understanding of this situation is that OPEC overplayed its hand. By constantly making statements and manipulating the oil market in the past few weeks, OPEC effectively priced in the news of cut extensions. This led to a buy the rumor, sell the news trade for oil. Saudi Arabia and Russia no longer control the price of oil. As you can see from the chart below, the U.S. production is expected to reach a new record high in 2018, drilling 9.96 million barrels per day. If OPEC and non-OPEC nations abandoned their cuts, oil would fall into the $30s. At that point, U.S. shale producers would be hurt and they would slow their production growth. Unfortunately for the large oil exporting nations, they can’t handle an extended period where oil falls into the $30s because they have set their budgets based on higher oil prices.

As I have mentioned, the odds of a rate hike from the Fed have been increasing even though inflation has been decreasing. I have showed how many Fed surveys are showing price indexes declining. The CPI and PCE have also fallen off recently. The chart below is the bond market’s estimate of inflation. Since early 2017, the breakeven inflation rate has fallen from about 2.10% to about 1.80%. Inflation spent just a few months near 2% which is the Fed’s goal, yet the Fed still wants to raise rates 75 basis points this year. The difficulty with inflation is when various measures show differing rates. In this economy, almost all measures are showing disinflation, so you would think the Fed wouldn’t be able to call it transitory.

The latest spat of economic news has caused investment banks to lower their Q2 GDP forecasts. According to Moody’s Analytics, the average GDP forecast fell from 3.4% to 3.0% after weak trade data. Besides the weak trade data, wholesale inventories declined 0.3% month over month in April which is the weakest report since November as you can see in the chart below. The biggest driver of the weakness was the 0.5% decline in motor vehicle inventories. No economists were expecting the report to show a decline. It was expected to grow 0.2%. Retail inventories were also weak as they also fell 0.3%. That was the weakest report since October.

Expectations for Q2 GDP falling put the Fed in a bind because the Q1 hike was the weakest growth rate with a hike since 1980. The Fed would like to avoid setting a dubious record for the weakest growth quarter with a hike in June. The economy needs a sharp rebound in Q2 to hit the Fed’s target up just below 2% growth. The President’s goal of 3% GDP growth is not feasible this year. If a few bad GDP reports come out, I can see the President changing the direction of monetary policy with his Fed chairperson pick.

Conclusion

The stock market is being driven by the top 5 tech stocks. The release of the new iPhone in September will have a large impact on the S&P 500. Facebook’s staling growth in ad load is going to slow revenue growth. The firm will need to focus on growing the ARPU for Instagram users if it wants to keep its stock rising and the S&P 500 rising.

The Fed is ignoring the weak trade data, weak wholesale inventories growth, the weak retail inventories growth, and the disinflation. I have stated that the auto sales decline isn’t transitory. We saw that thesis supported by the weak auto inventories growth.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more