Stocks Rally In The Face Of Weak Estimates

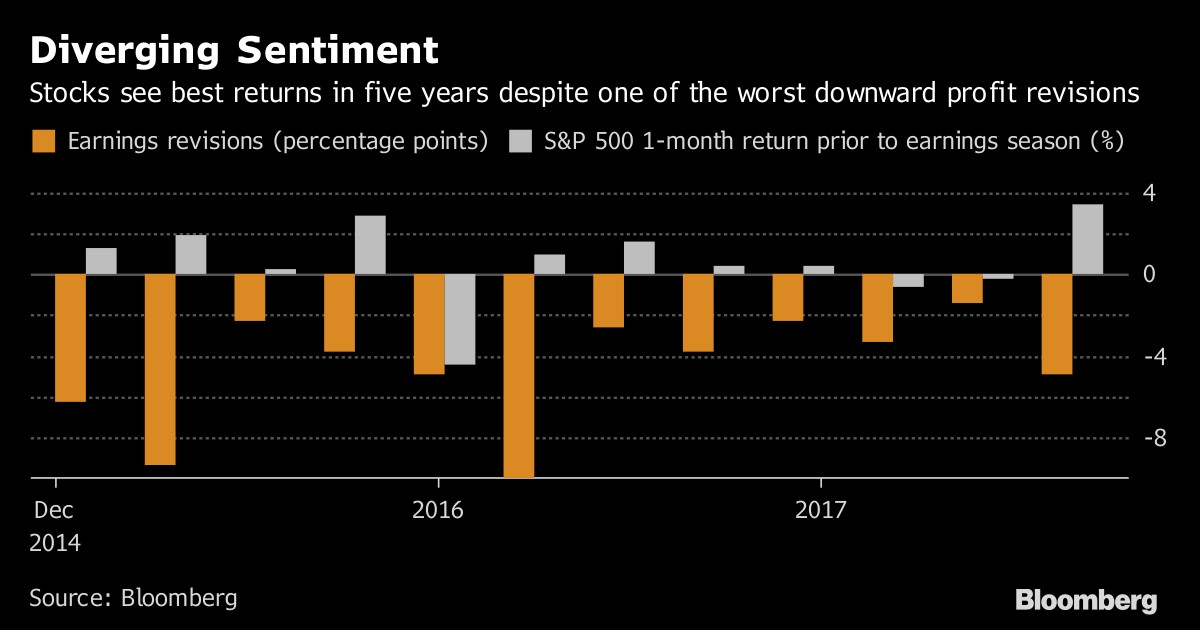

With earnings season about to get underway next week, the story about how much earnings expectations have fallen in the past two months is being reported by the media. This could change the sentiment in the market which has been riding high in the past two months. Even though stocks were modestly down on Monday as the Nasdaq QQQ ended its 9 day winning streak, the market still is on a remarkable run. As you can see from the chart below, the 1 month return prior to earnings season is the best in five years despite the fact that earnings revisions are the worst since the earnings recession. There was a 2 quarter stretch this year where we finally saw a return to solid earnings growth as estimates weren’t cut much and then they were beat. That combination had been rare since 2014. Now after reaching the 2014 height, estimates are crashing. The question is whether this is a new trend or a one off. Are the trailing twelve month earnings about to have a double top? If that occurs, stocks will be way overvalued because they rallied in the time it took for earnings to recover.

It may seem like I’m overexaggerating the divergence because stocks have only rallied 3.6% in the past month. However, the S&P 500 is up 4.91% in the past 7 weeks while this decline in estimates has been happening. According to Factset, S&P 500 earnings growth is only expected to be 2.8% year over year. Some investors who claim stocks are a buy as long as earnings are increasing, are perma bulls. You can’t say that 2.8% growth is positive after we had double digit growth in the first half. As I have been saying, the guidance given in Q3 will determine my stance on stocks. Bad guidance implies that this weakness is sustainable; it would cause me to switch to being bearish on stocks. On the other hand, if this is all about the hurricanes, then stocks won’t miss a beat. The S&P 500 will break the record long streak without a 3% correction and the streak without a 5% correction. The chart below shows the expectations rebounding in Q4 and the first 3 quarters of 2018. The counter point to this optimism is that many investors were optimistic about Q3 a few months ago, so the same decline can be repeated. At the end of last year, earnings estimates for 2017 earnings growth were in the low to mid teens and now it’s only expected to be 9.2%.

All 11 sectors have seen declines. This makes you think a more sustainable trend of weakness might be afoot. Insurers are expected to see a 41% decline which makes sense because of all the claims from the damage the storms caused. Allstate has seen an 82% drop in earnings expectations and Chubb has seen a 110% drop in expectations. The automakers and airlines are expected to see a 9% drop. There were complaints about how airlines price gouged right before the storm, but the truth is that these companies weren’t making huge profits as a result of these higher prices as fuel costs increased. The chart below shows the Q3 dollar level change in earnings since September 5th. Some industries which are in this chart, but not yet mentioned in this paragraph might be hurting because of the location of the headquarters of some large businesses within them.

There’s a double whammy effect on the difference between domestically oriented stocks internationally oriented stocks this quarter as the hurricanes hurt domestic firms more than the international firms and the weak dollar is helping the international firms more. There could be a reversal of this trend if the tax cuts are passed, but as of now we have the results seen below. The chart shows over 100% of the earnings growth in Q3 will come from firms with over 50% of sales coming from outside America. This trend is good for the major indexes which include large caps since they usually have high international exposure. Besides the trends I mentioned, many economies like China and Brazil are rebounding to further help companies with a presence there. It’s another double whammy. The better international economies do, the weaker the dollar. Both trends help international earnings.

As I said, guidance after the Q3 results will be important to determine how Q4 will look. However, it’s not just guidance that’s important. The actual results will tell us if the analysts were rightfully bearish. I think the results also important because all companies report earnings while not every firm gives guidance. The chart below shows the recent expectations versus results. As I said, the first and second quarter were great because good expectations were met with great results. It does look concerning to see two straight quarters of deceleration. It makes it look like the main reason why we saw growth was because of easy comparisons. If it wasn’t for the crash in the dollar this year, earnings growth might be negative. The only way this quarter will be redeemed in my opinion is if earnings grow 6% or more. That would be a lower beat than the last 2 quarters, so it’s not impossible. The idea that we might be near peak margins must be concerning to the bulls unless Q4 shows re-acceleration.

Conclusion

The only explanations for why stocks are rallying in the face of disastrous expected results is that either the analysts are wrong or this is a one off weakness caused by the weather. You can also argue this is a one off strong quarter because the year over year declines in the dollar won’t continue much longer. If the dollar stays where it is now, the next 2 or 3 quarters will get that tailwind. It’s not a sustainable trend just like the decline and rebound in energy were temporary. These effects are noise. The real trend appears to be earnings deceleration unless we hear something different when firms start reporting next week.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more