Stocks Flat Despite Great Earnings From Amazon & Microsoft

Friday was yet another example of stocks shrugging off great earnings results as the tech heavy Nasdaq was flat despite earnings beats from Amazon and Microsoft. Even though there are some rational explanations for why stocks aren’t moving after great results, namely rising interest rates, it’s still amazing to see it in action because it is so unprecedented. I’m afraid to wonder what will happen to the market if Apple reports bad results, which I think is possible.

Amazon Beats Earnings Estimates By A Long Shot

Amazon stock was up double digits at one point, but only closed up 3.6% on its great earnings report. It reported $3.37 in EPS which beat estimates for $1.26. The company has turned on the profit machine. The firm has been profitable for 12 straight quarters. While some investors were worried about why the stock traded at such a high valuation while it wasn’t profitable a few years ago, the firm was investing its cloud service which now dominates profits.

The Amazon Web Services division turned 10 years old this quarter. It’s amazing how this company is riding so many secular tailwinds at once. It is leading the charge in cloud services, online shopping, automation, and drones. Amazon will gain a lot from the ability to use more machines in its warehouses. The firm can utilize its economies of scale to improve its positioning in each of these growth areas.

The chart below gives a visual description of my point about how Amazon is riding multiple secular growth trends. Revenue was $51.04 billion which beat estimates for $49.78 billion. It’s amazing to see Amazon growing so quickly at such scale. The AWS revenue was $5.44 billion which beat estimates for $5.25 billion. AWS sales were up 49%. It had $1.4 billion in income which was 73% of the entire firm’s operating income.

Jeff Bezos, who should be considered the greatest current CEO in America, made one of the most astonishing points I’ve ever heard in his prepared comments on the conference call. He said, "AWS had the unusual advantage of a seven-year head start before facing like-minded competition, and the team has never slowed down." It’s quite something to have your most profitable business be 7 years ahead of the competition. That’s the type of result expected from visionary leaders like Steve Jobs and Bill Gates. Bezos is now one of them.

In past articles, I have mentioned that Alphabet’s biggest competitor was Amazon. This is because Amazon is the biggest seller on the internet. That makes it closer to the purchase point than Google which is just a search engine. We saw that thesis play out in Amazon’s other revenue category, which includes its advertising division. It added $2.03 billion in sales which was a 139% increase year over year. Amazon could be a beneficiary from any scrutiny which comes Facebook’s way. Facebook is also becoming a direct threat to Amazon as it is promoting its Marketplace where friends sell their items to each other, like a personalized version of eBay.

With all three firms investing in digital content services as well, we’re seeing a coalescence of what these firms do. In terms of subscriptions, Amazon is in the best shape by far as it has over 100 million Prime members. The subscription division of the firm grew revenues by 60% to $3.1 billion. The Prime service gives Amazon the capital to invest in new capabilities to deliver goods quicker to customers. Essentially, customers are paying Amazon to improve its moat, which is its logistics technology. The way Amazon has created this cycle is by investing in the new capabilities before raising the price of the subscription. Therefore, it’s valuable to keep paying after the price increases.

The membership was raised to $119 per year from $99. It’s still a great deal to get quicker shipping and other benefits such as video and music content. Furthermore, Prime keeps shoppers off other websites. It’s a psychological/budgeting decision to make use of the subscription to make it worth the cost. Once again Amazon is getting users to pay the firm to increase its moat; in this case, making consumers less likely to shop elsewhere. It’s a self-fulfilling business model which is churned by investing in new initiatives which provide the customer with more services.

Finally, Amazon provided in-line revenue guidance and better than expected profit guidance. In past quarters, we’ve seen Amazon be too conservative, so great guidance is a sign an amazing quarter is coming. Jeff Bezos has been widely quoted as saying he knows what the quarterly results will be 3 years in advance. That’s the type of certainty Wall Street loves. Specifically, the firm expects $51 billion to $54 billion in revenues (analysts expected $52.2 billion). It expects $1.1 billion to $1.9 billion in net income, blowing away estimates for $1.01 billion.

Microsoft Also Beats Results

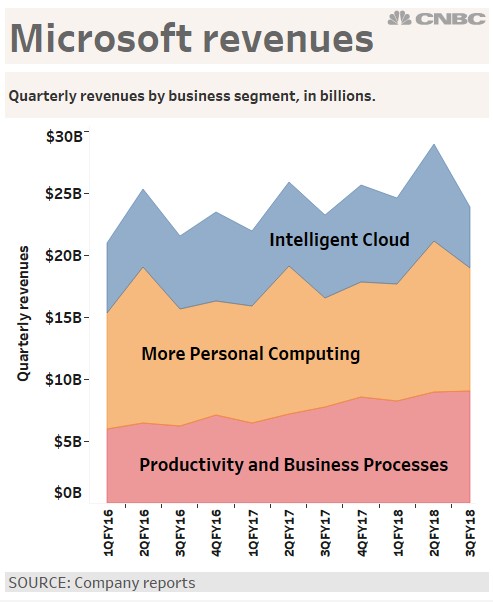

Microsoft stock was up 1.65% on great results. EPS was 95 cents which beat estimates for 85 cents. Revenues were $26.82 billion which beat estimates for $25.77 billion. The chart below shows the revenues from each division. All three beat estimates. The More Personal Computing division was up 13% to $9.92 billion which was above estimates of $9.25 billion. This division includes Xbox gaming, Bing Search, and Windows. Intelligent Cloud, which competes with Amazon Web Services, saw revenues increase 17.73% to $7.9 billion which beat estimates for $7.68 billion. The Azure business specifically saw 93% revenue growth which was down slightly from last quarter’s growth of 96%. Even though this growth rate is faster than Amazon, the firm still trails behind Amazon. Finally, the Productivity and Business Processes unit which includes Office and LinkedIn saw revenue growth of 16.8% to $9.01 billion which beat estimates for $8.73 billion.

The slide below shows the specifics of the More Personal Computing segment. As you can see, gaming revenue was up 18%. Xbox software and services revenues were up 24% on the backs of strong 3rd party games and a 13% increase in Live monthly active users to 59 million.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more