Stocks Are Set Up To Move Higher

Market Summary

Investors cautiousness heading into the presidential election have got November off to a dismal start for the stock market. However stocks reversed the trend and are setup to maintain November historically positive performance.

Jeff Hirsh in the Stock Trader’s Almanac talks about how November begins the “Best Six Months” for the DJIA and S&P 500, and the “Best Eight Months” for NASDAQ.

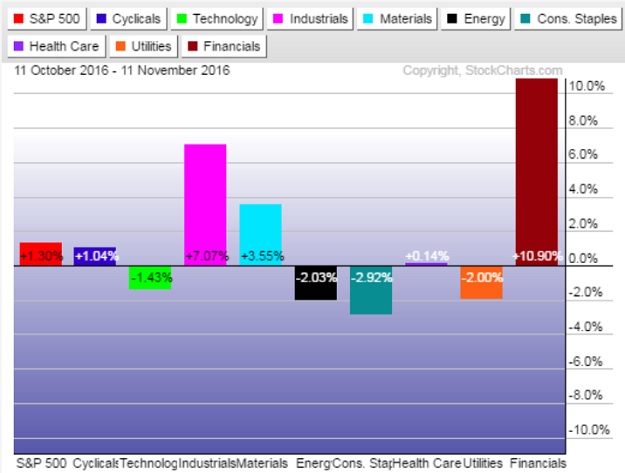

Small cap stocks start percolating in November but don’t usually take off until the end of the year. November is the number-three DJIA and number-two S&P 500 month since 1950. Since 1971, November ranks third for NASDAQ. November is also a very strong month for the Russell 2000. November maintains its status among the top performing months as fourth-quarter cash inflows from institutional investors drive November to lead the best consecutive three-month span November-January. In the updated S&P sector graph below, investors seem to be anticipating a December Fed rate increase which generally benefits the bottom line of financial institutions. Also, Republicans are expected to rescind Dodd-Frank financial regulations which is another reason financial sector stocks are taking off. The next best performer over the past month is industrial stocks which are presumed to benefit from a Donald Trump administration focus on infrastructure projects. Now might be good time to look for an entry price for stocks on your watch list or consider low priced option call spreads to minimize trading risks heading into year-end.

Disclaimer: Futures, Options, Mutual Fund, ETF and Equity trading have large potential rewards, but also large potential risk. You must be aware of the risks and be ...

more

thanks for sharing