Starbucks Finishes Up Lackluster 2017 Despite Ubiquity

Starbucks Corporation (SBUX ) purchases and roasts high-quality whole bean coffees and sells them along with fresh, rich-brewed, Italian style espresso beverages, a variety of pastries and confections, and coffee-related equipment primarily through its company-operated retail stores. In addition to sales through its company-operated retail stores, Starbucks sells whole bean coffees through a specialty sales group and supermarkets. Additionally, Starbucks produces and sells bottled Frappuccino coffee drink and a line of premium ice creams through its joint venture partnerships and offers a line of innovative premium teas produced by its wholly owned subsidiary, Tazo Tea Company. The company's objective is to establish Starbucks as the most recognized and respected brand in the world.

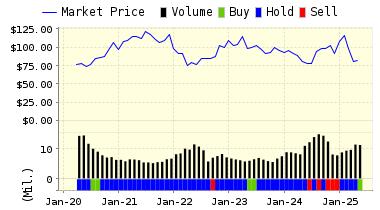

2017 was not a banner year for Starbucks. Despite the fact that the company often seems to have location on every corner, share prices finish the year just a bit higher than they were at the start of 2017.

The company creates animosity among some by running out smaller, family-owned and/or local coffee houses. It has also lost its reputation as a purveyor of fine coffee due to competition from higher quality--albeit far smaller--competitors such as Philadelphia's La Colombe

While some analysts think the company is due for a growth spurt thanks to some recent moves--such as ditching the Tazo Tea and Tevana businesses, and the potential for alcohol sales later in the day--others are not so optimistic about future growth.

Still, anecdotally one has to note that in many places the line at the local Starbucks, or the turnpike Starbucks, or the airport Starbucks, is often so long that one walks away in frustration. But, even with so many locations, perhaps the company is unable to truly gobble up all of the premium coffee drink dollars floating around out there? Analysts who do take a positive view expect that foreign markets will provide the lion's share of any future growth.

Our models remain unimpressed with the company. As you can see from the chart below, we have had a pretty consistent HOLD recommendation on the stock for years now.

ValuEngine continues its HOLD recommendation on Starbucks Corporation for 2017-12-27. Based on the information we have gathered and our resulting research, we feel that Starbucks Corporation has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE Company Size but UNATTRACTIVE Book Market Ratio.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

57.13 | -0.25% |

|

3-Month |

56.74 | -0.93% |

|

6-Month |

55.68 | -2.77% |

|

1-Year |

55.57 | -2.98% |

|

2-Year |

52.64 | -8.08% |

|

3-Year |

50.93 | -11.07% |

|

Valuation & Rankings |

|||

|

Valuation |

8.25% undervalued |

Valuation Rank(?) |

|

|

1-M Forecast Return |

-0.25% |

1-M Forecast Return Rank |

|

|

12-M Return |

0.72% |

Momentum Rank(?) |

|

|

Sharpe Ratio |

1.02 |

Sharpe Ratio Rank(?) |

|

|

5-Y Avg Annual Return |

16.03% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

15.78% |

Volatility Rank(?) |

|

|

Expected EPS Growth |

11.89% |

EPS Growth Rank(?) |

|

|

Market Cap (billions) |

42.96 |

Size Rank |

|

|

Trailing P/E Ratio |

27.23 |

Trailing P/E Rank(?) |

|

|

Forward P/E Ratio |

24.34 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

2.29 |

PEG Ratio Rank |

|

|

Price/Sales |

1.92 |

Price/Sales Rank(?) |

|

|

Market/Book |

12.36 |

Market/Book Rank(?) |

|

|

Beta |

0.73 |

Beta Rank |

|

|

Alpha |

-0.14 |

Alpha Rank |

|

Disclosure: None.