Stable Shakeout

So here's an interesting concept. Rather than simply accepting the extreme volatility that is inherent in cryptocurrencies, a project called Basis just raised $133 Million to create a new stablecoin.

The idea is to implement an algo-driven monetary policy, similar to what central banks do but without human interference. Of course, as with most crypto-related projects the success will hinge on marketing and implementation.

It would seem rather difficult to start in places where the home currency is already rather stable so it looks likely that Basis will be looking to third world countries to get started.

Though this project could likely provide an excellent case study for economists I do believe that it's going to have a very difficult time obtaining their first million users. Competition is stiff in this space and I'm not sure that being stable is enough of a unique selling point to convince citizens of the third world to make the change.

Today's Highlights

- Bonds Under Pressure

- Carney May Not Hike in May

- That's One BIG Crypto-trade!

Traditional Markets

Once again, the bond markets are under pressure. Just like the sell-off in early February, analysts do seem to have trouble explaining why this is happening.

Here we can see the Yield on the US 10 Year Treasury since the beginning of the year.

(Remember, Yields going up means investors are selling bonds.)

(Click on image to enlarge)

This is putting a bit of pressure on stocks at the moment. Though not many investors are going to give up a stock position in favor of a 3% bond yield, the current volatility in the more stable bond market does have a way of shaking out the weaker hands in the more volatile stocks.

US Indices fell yesterday and Asian markets followed their lead. European markets are somehow holding in green so far this morning.

(Click on image to enlarge)

For those searching for stability in their portfolios, commodities may have an answer. Here we can see that Gold and Oil are outperforming the S&P500 and EUROSTOX50 so far this year.

(Click on image to enlarge)

Carney's Gilt

Last night the Governor of the Bank of England Mark Carney caused a stir with this headline...

Until now it was widely believed that the BoE was preparing to raise their interest rates at the coming meeting on May 10th. It seems that now Carney has everyone guessing.

It's not uncommon for a central bank to keep their options open and this could be a smart move even if they do plan on going for it in the end. One thing that is for sure is that this will add a layer of uncertainty around the Pound Sterling and increase volatility up to and during May 10th.

The GBPUSD has been rising steadily since the lows of January 16th. Now that the depreciation from the Brexit referendum has been recovered the Pound will be looking for its next direction.

(Click on image to enlarge)

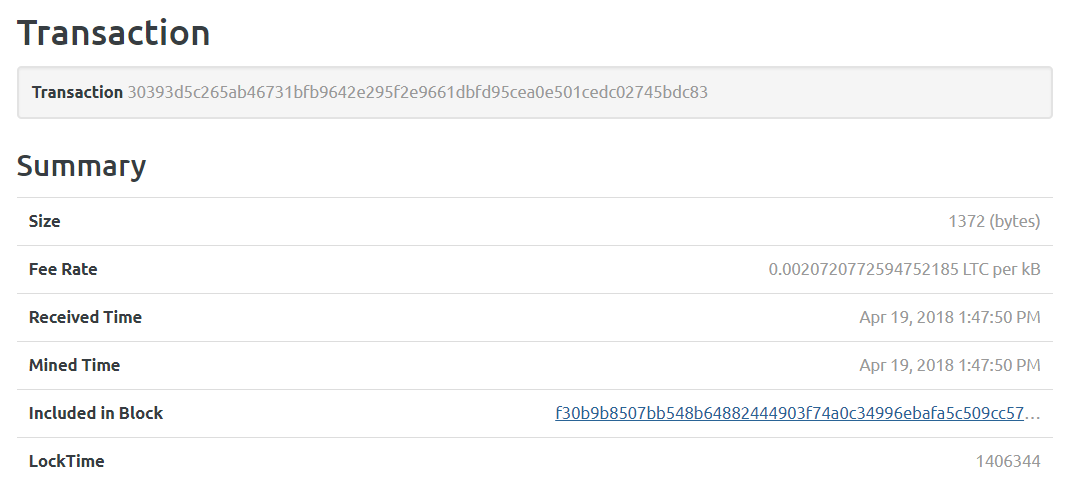

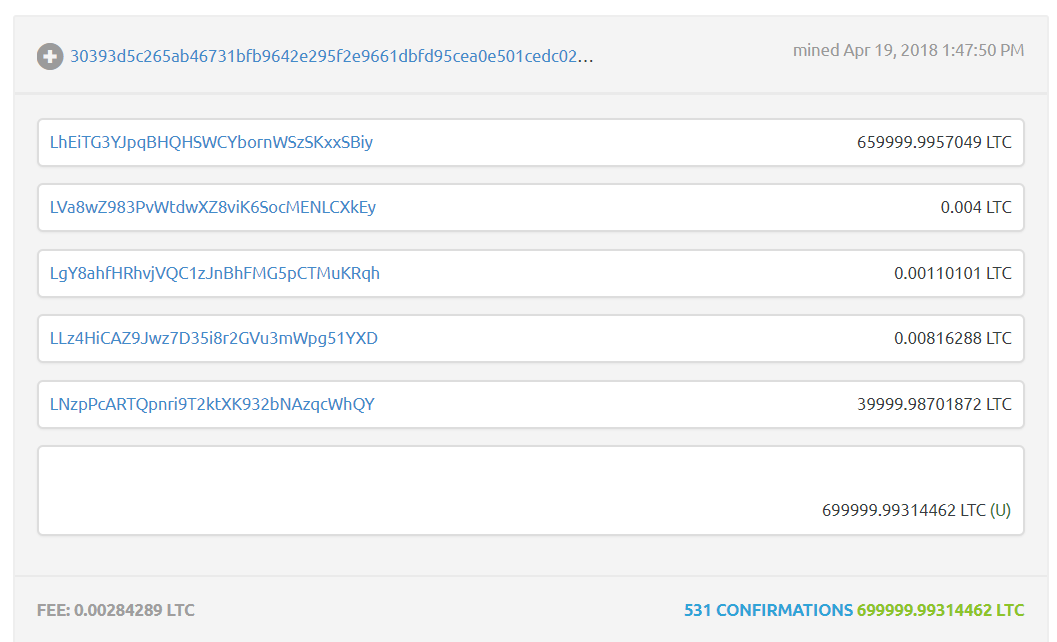

Huge Litecoin Trade

A single transaction has just attracted a lot of attention. The amount was 700,000 LTC at the approximate price of $140. In more conventional money terms that comes to about $99 Million USD.

Here we can see the transaction summary...

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

The stunning thing is that it took the Litecoin network approximately 2.5 minutes to confirm the transaction and the total fee paid was just 40 cents.

With the recent crypto-rally seeming to gain steam, Litecoin is now testing it's long term resistance line.

(Click on image to enlarge)

Let's hope for a few breakouts over the weekend. :)

Disclaimer: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of ...

more