SPX Is In A Medium-Term Downtrend

SPX is in a medium-term downtrend based on the chart below. It was overdue for this, but so far it hasn't shown much weakness at all. The SPX trend is down unless the close next week is above 2383, then the trend is assumed to be higher again.

(Click on image to enlarge)

The market didn't do much today despite the headlines, and maybe that says a lot about its underlying strength.

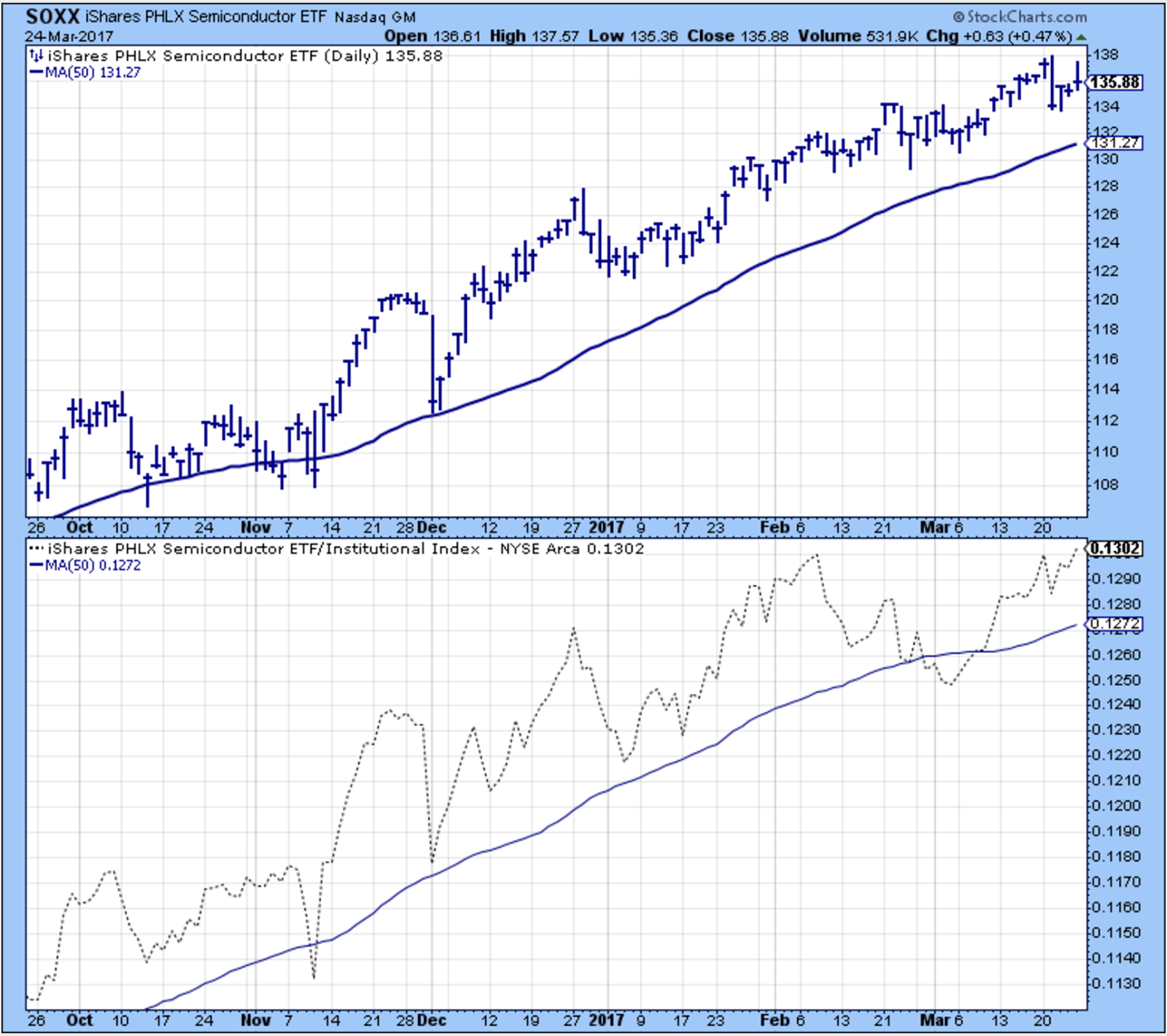

For instance, semiconductors aren't showing a lot of weakness. As long as this group shows strength, the bears are going to be disappointed.

(Click on image to enlarge)

The financials / utilities ratio is closely correlated to longer-term treasury yields. From the looks of this chart, I would say we are headed towards lower yields.

(Click on image to enlarge)

The Short-Term Trend

The PMO is oversold and starting to move higher, but just a little. The trend remains down, at least until the SPX breaks above the 20-day.

(Click on image to enlarge)

Outlook

The long-term outlook is positive.

The medium-term trend is up down as of March 21

The short-term trend is down as of March 21

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, ...

more