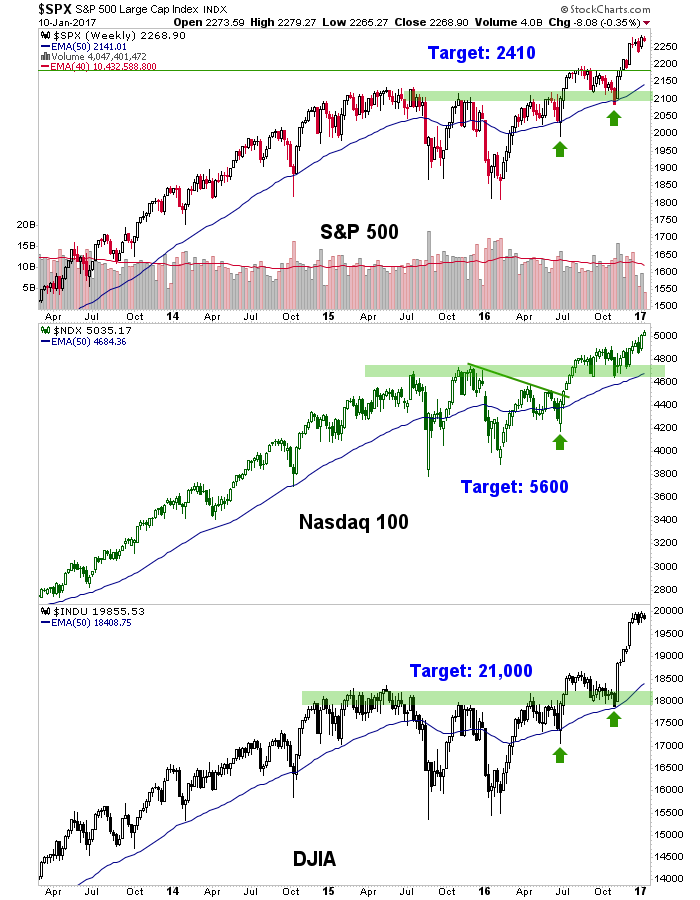

SPX: Goldman Agrees With Our Time And Price Targets

Okay, a giant Vampire Squid is probably not aware of a tiny little plankton-like organism in the waters in which it swims, but our target for the S&P 500 has for months been 2410, based on the chart below. Their target is 2400.

Where we part ways is their corrective downside target of 2300 (which, humorously, is a future all-time high yet to be registered). If sentiment continues to build on its unhealthy underpinnings and SPX hits 2400 in the spring, the resulting punishment is likely to be much more significant than 2300, which you and I could do in our sleep. No, it will be a more profound event. Not talking crash mind you, but it would be time for the various herds, playing their roles as they should, to be punished.

Admittedly, measuring a low to a support level and then adding that figure to the support level is not rocket science, but keeping the bull view intact sure did take a lot of discipline, patience and tuning out of the media on full political overload (ref. Brexit & US election) last year.

Most recently we have been noting in NFTRH that the bull stance (at high risk all along the way as dumb money creeps in and smart money slips out the back door) extends out to the March/April time frame. That is by the way another rhyme with the 1999-2000 period, that the current phase has so many correlations to (just one of which being a 2-term democrat handing off to a republican tax cutter/deficit spender).

Why Goldman sees only 90 good days for U.S. stocks in 2017

Goldman’s guy goes on to rationalize thusly, but I think it is simply time. An anomaly in the presidential cycles says so (demo to repub hand off is negative on average in year 1) and several other indicators and cycles say so.

But investors are too optimistic when it comes to how low Trump can actually cut taxes and that will scupper the rally from the second quarter, Kostin warned.

“My expectation is that investors are giving more credence to the idea of tax reform than perhaps what is ultimately going to take place,” Kostin added.

“The debate over the federal deficit is going to kick off in March and there’ll be recognition that if all these proposals were to go through, there would be a significant increase in the size of the deficit. It’s not clear that could go through Congress,” he said.

So the Squid and the Rabbit Hole say March (to April). Be open to revision to time and price, but it’s a rough sketch and I think Mr. Kostin here is on the right track, obviously.

Disclosure: Subscribe to more