SPX, Gold, Oil And G6 Targets For The Week Of December 3

The SPX broke above the 2647 weekly buy pivot on Monday, and proceeded to advance 100+ points. As a result, there’s a higher low in place and the trend from bearish has turned to neutral. It will remain so until the SPX climbs above the November 7 high (bullish) or breaks below the November 23 low (bearish). Trump and Xi kicked the can down the road, which should be bullish for the markets despite market breadth nearing overbought levels already.

It is also interesting to note that as of Friday, November 30, a third of the S&P 500 stocks are trading above their September 21 high, while only 20% are trading below their October 29 low.

Current signals: Daily Buy, Weekly Buy, Monthly Sell

Weekly Sell pivot at 2740

The projected trading range for next week for SPX is 2700-2800:

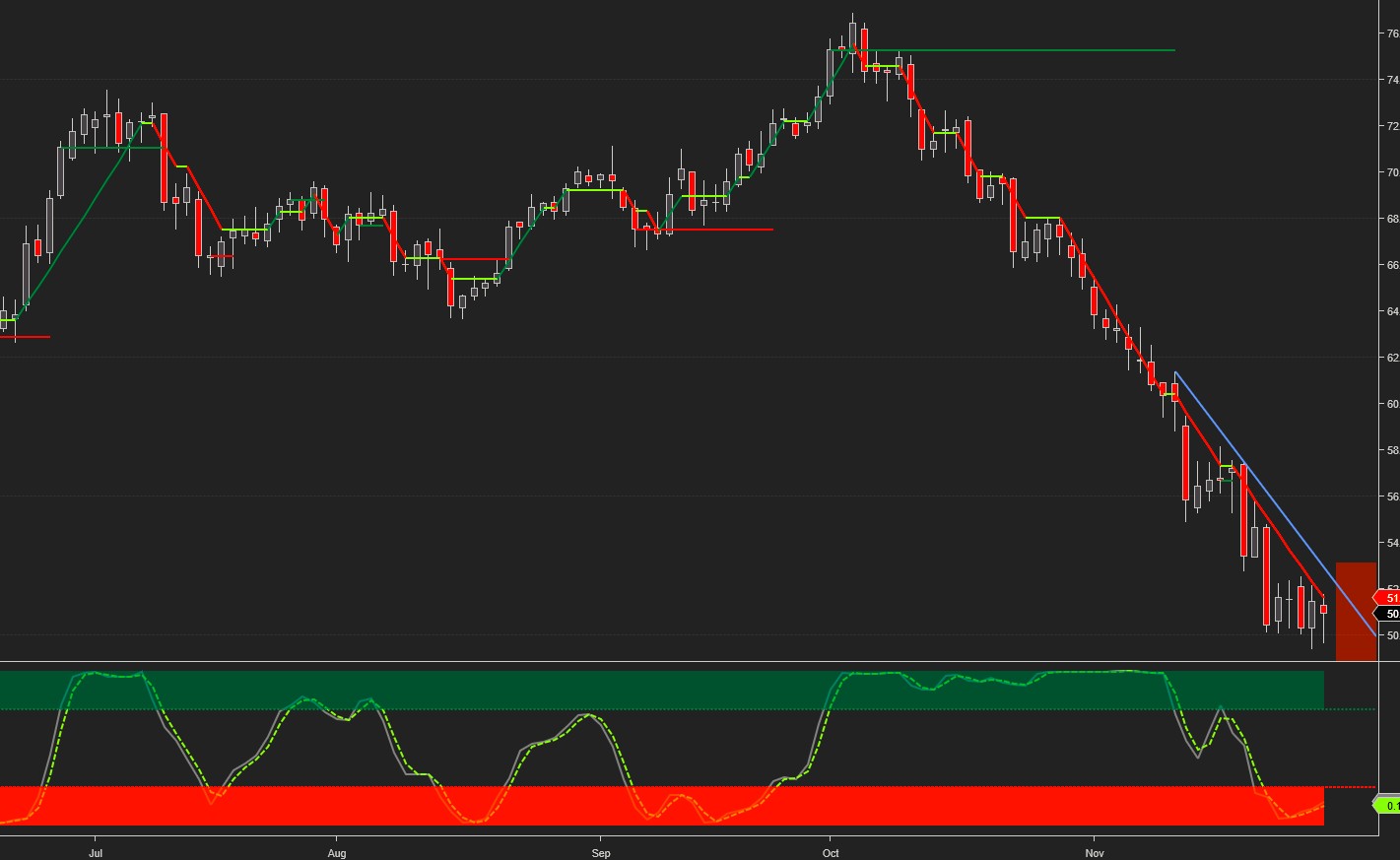

Oil continues trading within the confines of the two month long bearish channel and came to within 40 cents of our downside weekly target. Although there’s support building around the $50 level, only a break outside of the down sloping channel will signal that a bottom is in place.

Current signals: Daily Sell, Weekly Sell.

Weekly Buy pivot at 52.5

The projected trading range for Oil for next week is 49.25 – 52.5:

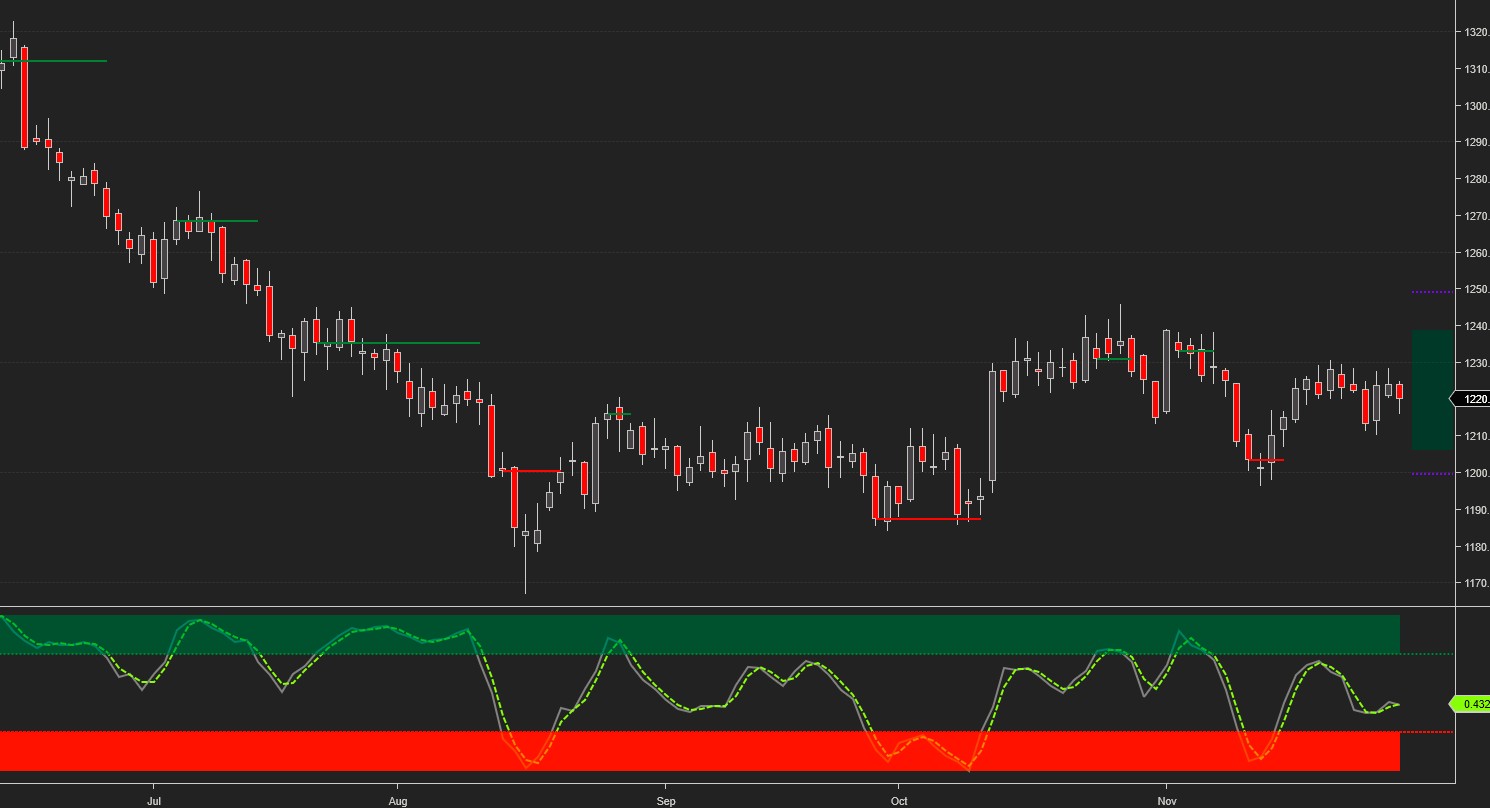

Gold continues trading in a flat narrow range, unable to reach any of our targets.

Current signals: Daily Buy, Weekly Sell

Weekly Sell pivot at 1220.

The projected trading range for Gold for next week is 1200 – 1240:

All G6 pairs had a kneejerk reaction to the dovish Powell statement. However, the initial surge against the USD faded shortly thereafter.

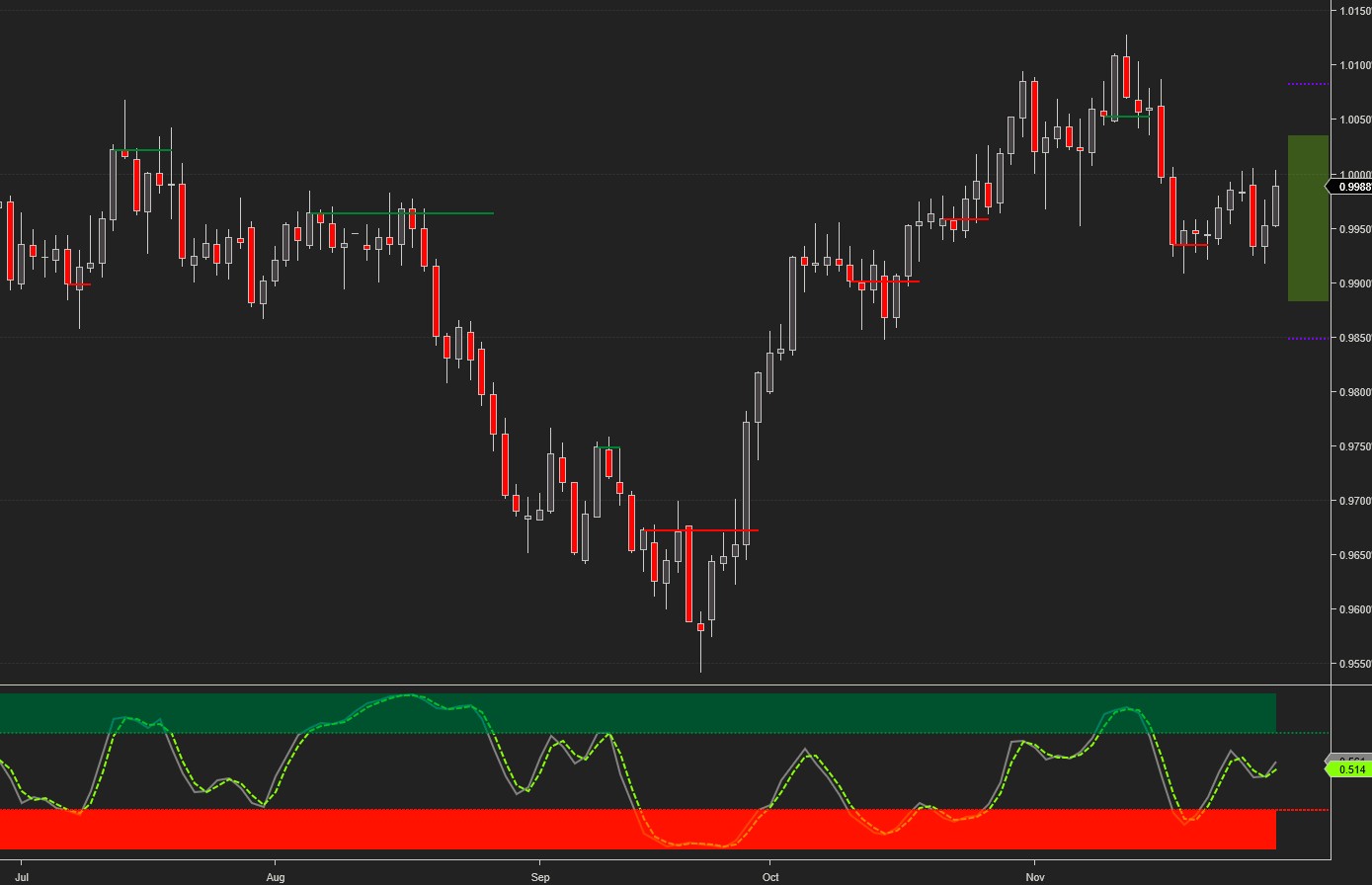

USDCHF traded within last week’s range and closed on Friday a little short of the upper weekly target.

Current signals: Daily Buy, Weekly Buy

Weekly Buy/ Sell pivot at 1.00

The projected trading range for USDCHF for next week is 0.986 – 1.005:

USD/JPY came to within a few pips of our upside weekly target but sold off after the Powell speech.

Current signals: Daily Buy/Hold, Weekly Buy

Weekly Sell pivot at 113.19

The projected trading range for USDJPY for next week is 112.8 – 114.2:

EUR/USD bounced off the lower weekly target, staged a brief counter-trend rally, and sold off again at the end of the week.

Current signals: Daily Sell, Weekly Sell

Weekly Buy pivot at 1.1402

The projected trading range for EURUSD for next week is 1.128 – 1.15:

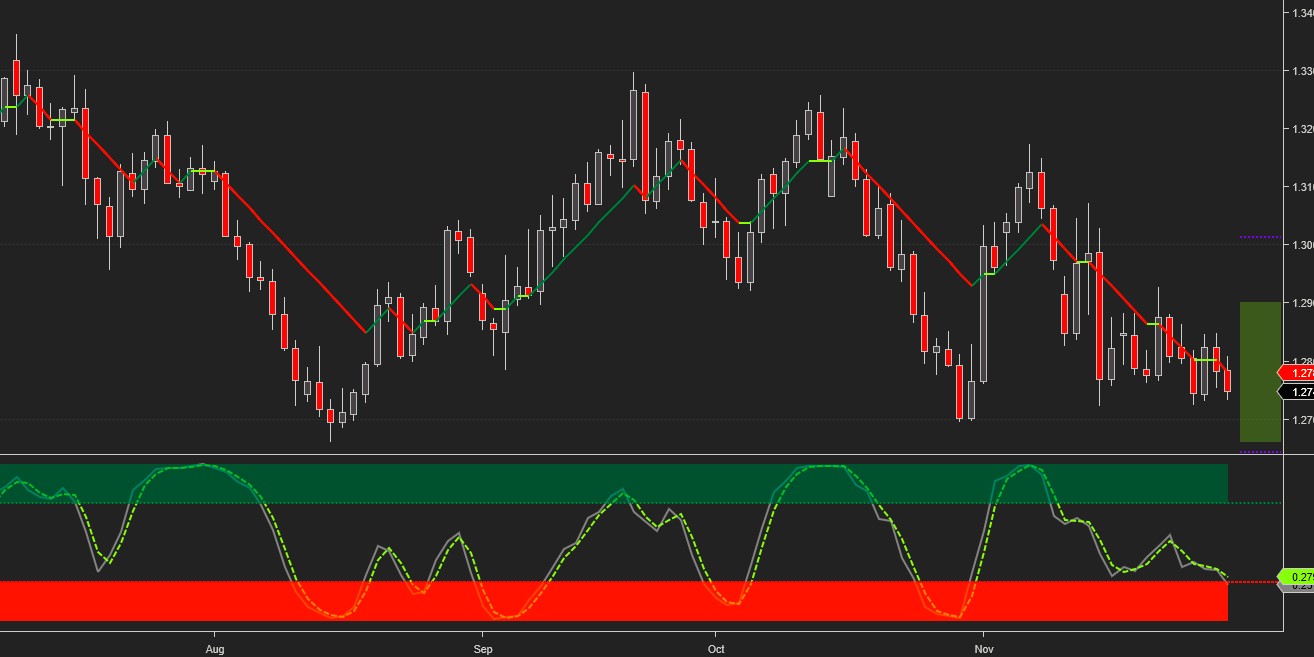

GBP/USD remains victim to the sorry state of Brexit negotiations and was unable to muster any show of strength. On the bright side, it hasn’t been able to break below the November 15th low, which acts as support for the time being.

Current signals: Daily Sell, Weekly Sell

Weekly Buy pivot at 1.286

The projected trading range for GBPUSD for next week is 1.266 – 1.29:

USD/CAD broke above the upside weekly target, sold off after Powell, then broke above again, and finished the week a few pips above it.

Current signals: Daily Buy, Weekly Buy

Weekly Sell pivot at 1.3242

The projected trading range for USDCAD for next week is 1.318 – 1.338:

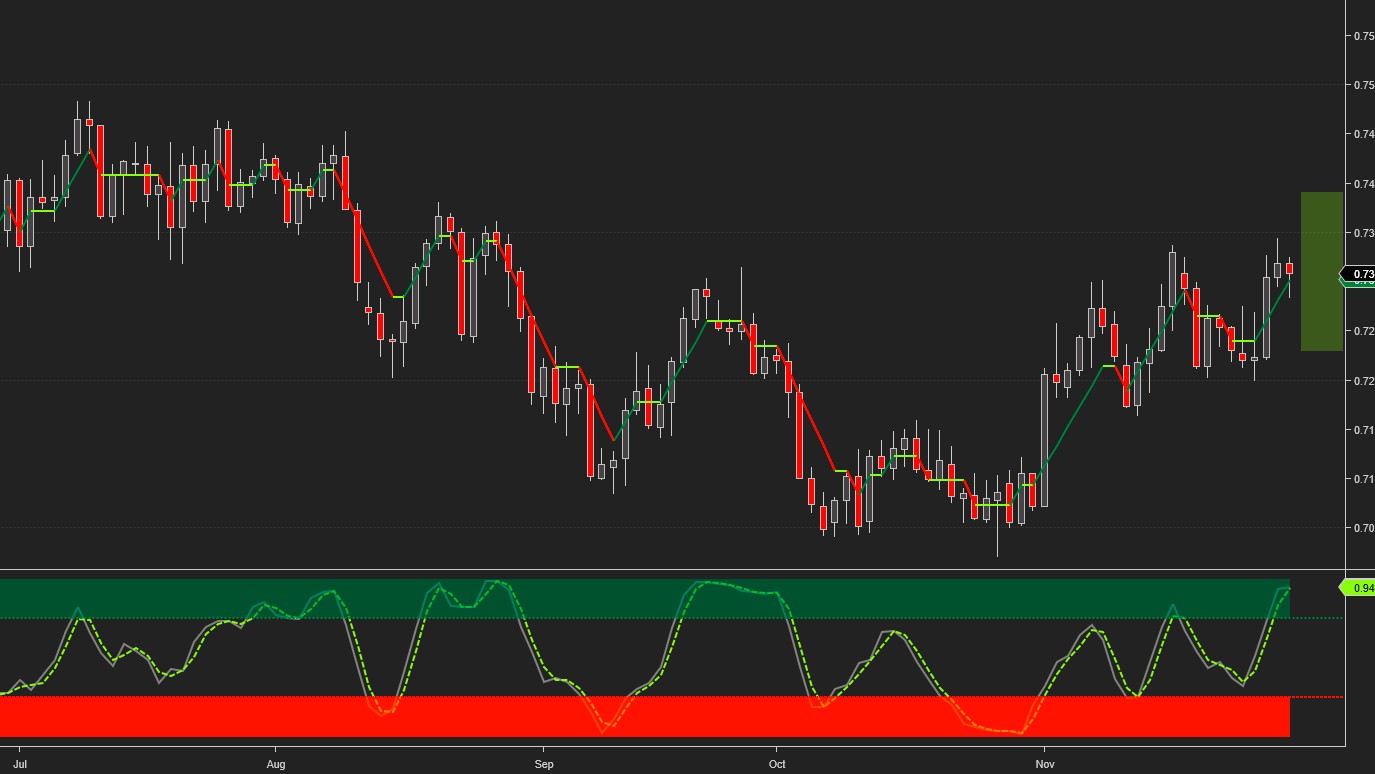

AUD/USD, despite a violent reaction to the Powell statement which brought it to within a few pips of our upside target, couldn’t hold onto the gains and sold off the rest of the week.

Current signals: Daily Buy, Weekly Buy

Weekly Sell pivot at 0.728.

The projected trading range for AUDUSD for next week is 0.722 – 0.739:

*Please note that the trading signals are in effect as of the close on Friday and may change as soon as the markets re-open. When the current signal is hold, we may also include the preceding buy or sell signal (e.g. Buy/Hold or Sell/Hold). Hold signals followed by a buy/sell signal in the direction of the preceding buy/sell signal can be considered for pyramiding the position.

Charts, signals and data courtesy of OddsTrader, CIT for TradingView and NinjaTrader 8

For intraday charts and update follow us on TradingView

Disclaimer:Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that ...

more

So good

Yes!

Indeed