SPX Bounced Off A Record High

VIX declined to the lower Ending Diagonal trendline and an all-time low on Wednesday before reversing to challenge Intermediate-term resistance at 11.16 on Friday. It closed above weekly Short-term support/resistance at 10.22, alerting us to a probable aggressive buy signal The Cycles Model suggests a reversal may have arrived. Once confirmed, the upside move may be very fast.

(ZeroHedge) The plunge in US equity markets continues - led by big tech names...

Sending VIX soaring to 11 for the first time in 3 weeks.

As stocks slip, and VIX spikes, liquidity is also disappearing from futures markets, setting ETFs up for a potential flash-crash...

SPX remains elevated above the Ending Diagonal trendline

SPX reversed from an all-time high on Thursday, remaining above its Ending diagonal trendline and Cycle Top at 2470.79. However, rally volume is diminishing while declining volume is rising. SPX appears to be due for a possible Master Cycle low to follow in the next week or so.

(ZeroHedge) Magnitude unknown but huge. Brokerages push it to new heights.

Stock and bond market leverage is everywhere. Some of it is transparent, such as NYSE margin debt which was $539 billion as of the June report. But the hottest form of stock and bond market leverage is opaque, offered by financial firms that usually don’t disclose the totals: securities-based loans (SBLs) — or “shadow margin” because no one knows how much of it there is. But it’s a lot. And it’s booming.

These loans can be used for anything – pay for tuition, fix up that kitchen, or fund a vacation. The money is spent, the loan remains. When security prices fall, the problems begin.

NDX stumbles at an all-time high

NDX rallied to a new all-time high near 6000.00. However, on Thursday it made an outside reversal, falling 2.5% from the top on missed earnings from Amazon. This may signal an end to the summer rally and a top of this Cycle.

(CNBC) July's jobs report and Apple earnings are the big events for a stock market that suddenly has become a shade less confident.

A crack showed up in the tech rally this past week, when the Nasdaq staged a nasty reversal Thursday after breaking to new highs. Technicians say it could be a warning sign for a potential further sell-off in an index that is up nearly 19 percent this year so far. That also puts the spotlight on tech just ahead of Apple's earnings Tuesday afternoon.

"I think [the focus is on] Apple just for the sole reason that it's the biggest stock. It's going to have the most pronounced impact of any stock. ... There is a high bar for Apple to deliver. It's still in the cult stock regime," said Peter Boockvar, chief market analyst at The Lindsey Group. Apple's earnings per share are expected to rise nearly 11 percent, and revenue is expected to climb 6 percent to more than $44.8 billion.

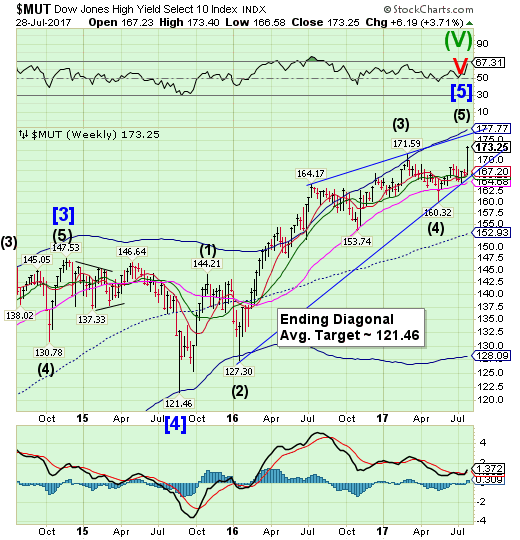

High Yield Bond Index rallies to an all-time high

The High Yield Bond Index vaulted to a new all-time high this week. It appears to be making an inverted Cycle high instead of a low. The Cycles Model suggests a top maybe near.

(Bloomberg) The recent zeal for U.S. investment-grade bonds has been well documented.

Companies are selling the debt at a record pace, and investors are so hungry for it that they're accepting lower and lower yields to own it.

But there's been less focus on the fact that these notes have been lower quality on average with longer maturities. And that is going to be a problem in the long run because one hiccup could have substantial effects. Entire indexes could easily go into a tailspin if one big company gets downgraded just a few notches or if longer-dated rates rise.

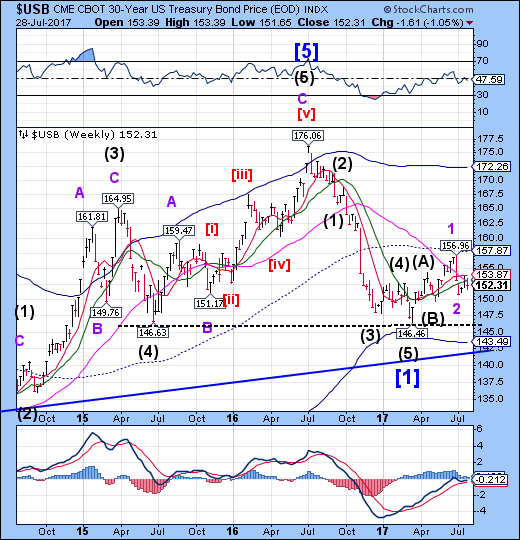

USB struggles beneath Long- and Intermediate-term support

The Long Bond appears to have been repelled by Intermediate-term resistance at 153.08 and Long-term support at 152.92. That may soon change as treasuries begin their period of strength. The rally has quite a distance to go, since it must complete the right shoulder of a potential Head & Shoulders formation near 165.00 before a major reversal..

(FoxBusiness) Treasury prices recovered from earlier weakness on Friday, pulling down yields after a rebound in second-quarter economic growth, but a lack of accompanying inflation and wage growth cast doubt on the likelihood of another rate increase this year.

The yield on the benchmark 10-year Treasury note fell less than a basis point to 2.304% from 2.312% in the previous session, while the yield on the 30-year Treasury bond, lost 1.4 basis point to 2.912%, compared with 2.928% on Thursday.

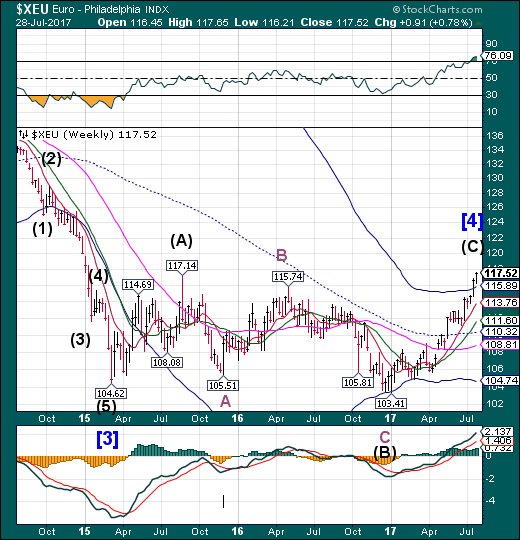

The Euro broke through Cycle Top resistance

The Euro continued its rally above the Cycle Top at 115.89 this week. The Cycles Model suggests that the period of strength may be ending shortly and calls for a major reversal. The challenge of the Cycle Top may be a sucker’s play. A decline beneath the Cycle Top may be a sell signal.

(Reuters) - The euro is the year's best-performing major currency against the dollar, but a shrinking interest-rate advantage and the weight of the bets on the single currency are making a retreat ever more likely.

The euro reached its highest point since January 2015 on Thursday at $1.1777, with a variety of factors contributing.

Chief among them were increasing talk the European Central Bank will soon begin to wind down its bond-buying stimulus and the dollar's decline to 13-month lows against a basket of other major currencies .DXY.

EuroStoxx retests the Head & Shoulders pattern

The EuroStoxx 50 Index the Head & Shoulders neckline at 3235.00 for the third time in a month. A break through the neckline may set a cascade unto motion. The Cycles Model suggests the decline may be overdue.

(CNBC) European stocks closed were lower on Friday after Amazon's earning miss and tobacco stocks took a tumble.

The pan-European Stoxx 600 slid more than 1 percent at the end of trading with only the oil and gas sector in positive territory. For the week, the benchmark fell almost 3 percent, the FTSE 100 dropped more than 1 percent and the Dax slipped 0.7 percent.

On Wall Street, U.S. equities fell on Friday as large-cap tech stocks followed Amazon.com lower on the back of its earnings miss in the previous session. The Stoxx 600's technology sector dropped 1.33 percent.

The Yen rallies through resistance.

The Yen rallied above Long-term resistance at 89.69 this week in a period of strength that may last another week or longer. The longer-term trend may be recognized by speculators as it breaks out above its prior highs. The Yen is on a full-blown buy signal.

(ForexNews) On early Thursday, the yen partially reversed yesterday’s losses after statistics out of Japan showed a surprise improvement in domestic consumption and the labour market. This is said to put the BOJ’s recent arguments for maintaining current policy into question and will likely encourage policymakers to scale back their ultra-loose stimulus program in the future.

In June, the unemployment rate in Japan beat forecasts according to the Japan Institute for Labour, falling from 3.1% in May to 2.8%, while analysts anticipated the figure to slip to 3% instead. The availability of jobs which is measured by the jobs to applications ratio rose slightly to 1.51, exceeding the 1.49 observed in the previous month and the 1.50 forecasted. Despite the marginal increase, the ratio climbed for the fourth consecutive month reaching the highest on record in 43 years.

Nikkei declines below 20000

The Nikkei declined beneath Short-term support at 20045.27 and round number support at 20000.00. The Nikkei may be on a sell signal. Further confirmation of the decline lies at Intermediate-term support at 19642.58.

(EconomicTimes) Japan's Nikkei share average fell on Friday after tech shares dropped sharply following weakness on the Nasdaq market, while investors stayed cautious as the dollar slipped against the yen.

Semiconductor equipment makers tumbled, with Tokyo Electron Ltd diving 7.2 per cent and Advantest Corp declining 5.0 per cent, together contributing a hefty 53 negative points to the Nikkei benchmark.

The Nikkei dropped 0.6 per cent to 19,959.84. For the week, it declined 0.7 per cen ..

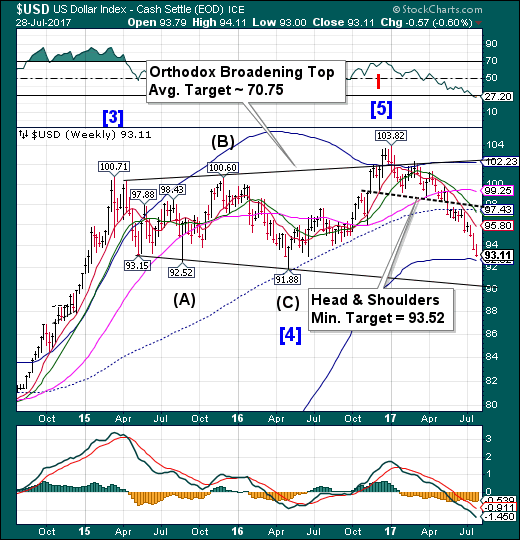

U.S. Dollar meets time and price targets

USD has met both time and price targets for a potential Master Cycle low. However, it may extend another few days to challenge the weekly Cycle Bottom support at 92.62 before a bounce begins.

(Reuters) - The International Monetary Fund on Friday said that the U.S. dollar was overvalued by 10 percent to 20 percent, based on U.S. near-term economic fundamentals, while it viewed valuations of the euro, Japan's yen, and China's yuan as broadly in line with fundamentals.

The IMF's External Sector Report - an annual assessment of currencies and external surpluses and deficits of major economies - showed that external current account deficits were becoming more concentrated in certain advanced economies such as the United States and Britain, while surpluses remained persistent in China and Germany.

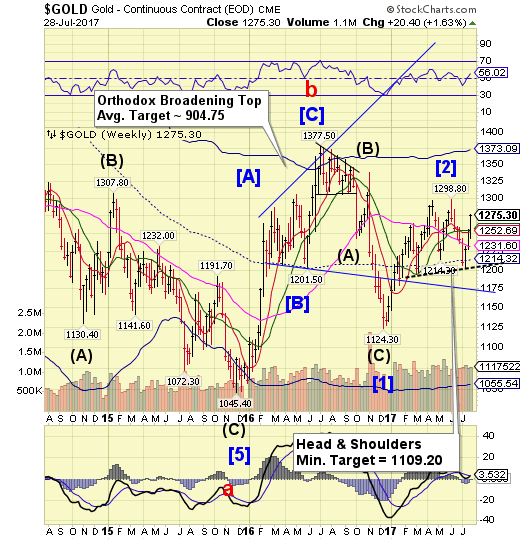

Gold completes a right shoulder

Gold appears to have completed the right shoulder of its double headed Head & Shoulders formation. The Cycles Model suggests a probable decline may begin in the next week. Gold may go into freefall beneath the Broadening Top trendline at 1175.00.

(CNBC) Gold is on pace for its best month since February, rising nearly 2 percent in July as the U.S. dollar weakens. And some strategists are forecasting further upside for the asset typically seen as a safe-haven play.

Gold futures rose in Friday trading to a six-week high of $1,276.60 per troy ounce, extending the gains it made Thursday following weaker-than-expected inflation data and a second-quarter gross domestic product reading that was in line with expectations.

In a technical sign of strength, gold is now trading well above its 50- and 200-day moving averages

Crude breaks above mid-Cycle resistance

The Crude rally broke through mid-Cycle resistance at 45.94, challenging Long-term resistance at 49.62. The Cycles Model calls for a reversal next week. A decline beneath the Head & Shoulders neckline is bearish and must be treated with respect. Crude remains on an Intermediate sell signal.

(CNBC) Crude oil just hit its highest level in two months and is up more than 8 percent in the past 4 days—and the technician who correctly called the move said the rally is far from over.

In a recent interview on CNBC's "Futures Now," Scott Redler, chief strategic officer of T3Live.com, said we could see crude make a run toward $50 in the coming days. Crude came within 25 cents of the key psychological level on Friday.

Shanghai Index challenges mid-Cycle resistance

The Shanghai Index rallied to challenge mid-cycle resistance at 3246.95, but reversed on Friday, leaving a lower high. The Shanghai Index now enters the negative season through October. It may have a fw more days of strength before reversing. The potential for a sharp sell-off is rising.

(ZeroHedge) As Foxconn promises to bring 10s of thousands of jobs to Wisconsin amid billions of dollars of investment in new plants, one wonders what is going on in China that makes this economic(aside from the $3 billion 'incentives')...

Perhaps this...

Statista's Isabel von Kessel writes that in 2016, the Ministry of Human Resources and Social Security (MOHRSS) in China registered 1.8 million labor disputes – an increase of almost 118 percent compared to the previous year.

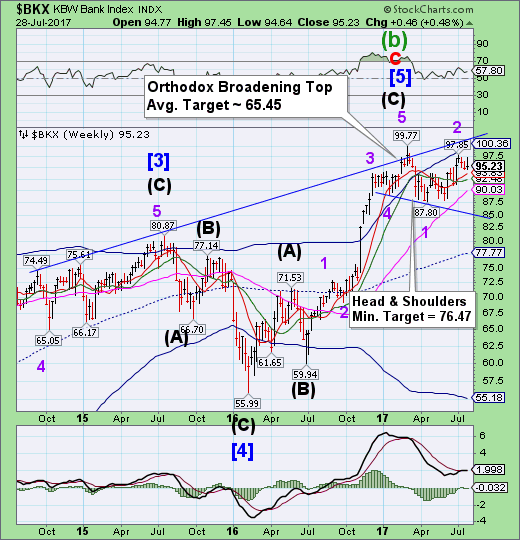

The Banking Index bounces but no new high

-- BKX bounced this week, but no new high was made. Weakness may develop next week as BKX declines beneath its Intermediate-term support at 92.48 again.

(MishTalk) If there is a run on the bank, any bank in the EU, you better be among the first to get your money out.

Although it’s your money, the EU wants to Freeze Accounts to Prevent Runs at Failing Banks.

European Union states are considering measures which would allow them to temporarily stop people withdrawing money from their accounts to prevent bank runs, an EU document reviewed by Reuters revealed.

The move is aimed at helping rescue lenders that are deemed failing or likely to fail, but critics say it could hit confidence and might even hasten withdrawals at the first rumors of a bank being in trouble.

(ZeroHedge) In an unexpected announcement, earlier this week the U.K.'s top regulator, the Financial Conduct Authority which is tasked with overseeing Libor, announced that the world's most important, and manipulated, benchmark rate will be phased out by 2021, catching countless FX, credit, derivative, and other traders by surprise because while much attention had been given to possible LIBOR alternatives across the globe (in a time when the credibility of the Libor was non-existent) this was the first time an end date had been suggested for the global benchmark, which as we explained on Thursday, had died from disuse over the past 5 years.

(Reuters) - A U.S. judge on Friday said investors may pursue part of their nationwide antitrust lawsuit accusing 12 of the world's biggest banks of conspiring to rig the $275 trillion market for interest rate swaps.

U.S. District Judge Paul Engelmayer in Manhattan said 11 of the banks, including Bank of America Corp (BAC) and JPMorgan Chase & Co (JPM), must defend against claims that from 2013 to 2016 they boycotted three upstart electronic platforms for swaps trading, hoping to destroy them.

Investors seeking damages in the proposed class action said banks did this to preserve their 70 percent market share, and boost profit by making trading more costly. Engelmayer dismissed all claims against the 12th bank, HSBC Holdings Plc (HSBA).

(ZeroHedge) Wells Fargo is in boiling hot water. Again.

One day after the NYT reported the latest major scandal involving Warren Buffett's favorite bank, in which the bank was busted less than a year after its miss-selling fraud cost the former CEO his job, revealing that the bank charged some 800,000 customers for auto insurance they did not need (with some still paying for it), the demands for resignation have arrived.

In a statement from NYC Comtroller Scott Stringer, he demands that Wells Fargo must immediately "jump-start" necessary board change by replacing Chairman Stephen Sanger with a new independent chairperson following the latest "mismanagement" revelations.

In surprisingly harsh words, Stringer does not hold anything back against the worst performing bank stock today (WFC -2.8%):

Have a great weekend!

Disclaimer:

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a ...

more