S&P 500 Snapshot: Four-Day Rally Ends

The S&P 500 got off to a reasonably good start following the pre-market Goldilocks inflation data (not too hot, not too cold), and retirees learned they would get a 1.7% Social Security COLA for 2015. The index hit its 0.41% intraday high about two hours after the open. It then began drifting lower with some accelerated selling the final hour. It closed with a -0.73% loss, just off its -0.74% intraday low, and snapping a four-day rally.

The popular press, always ready to explain market behavior (e.g., CNBC), seized on the gunfire near Canada's Parliament and the plunging price of oil as prime causes of the selling.

The yield on the 10-year Note closed at 2.25%, up 2 bps from yesterday's close.

Here is a 15-minute chart of the past five sessions.

Volume on today's decline was relatively unremarkable -- about the same as yesterday's advance.

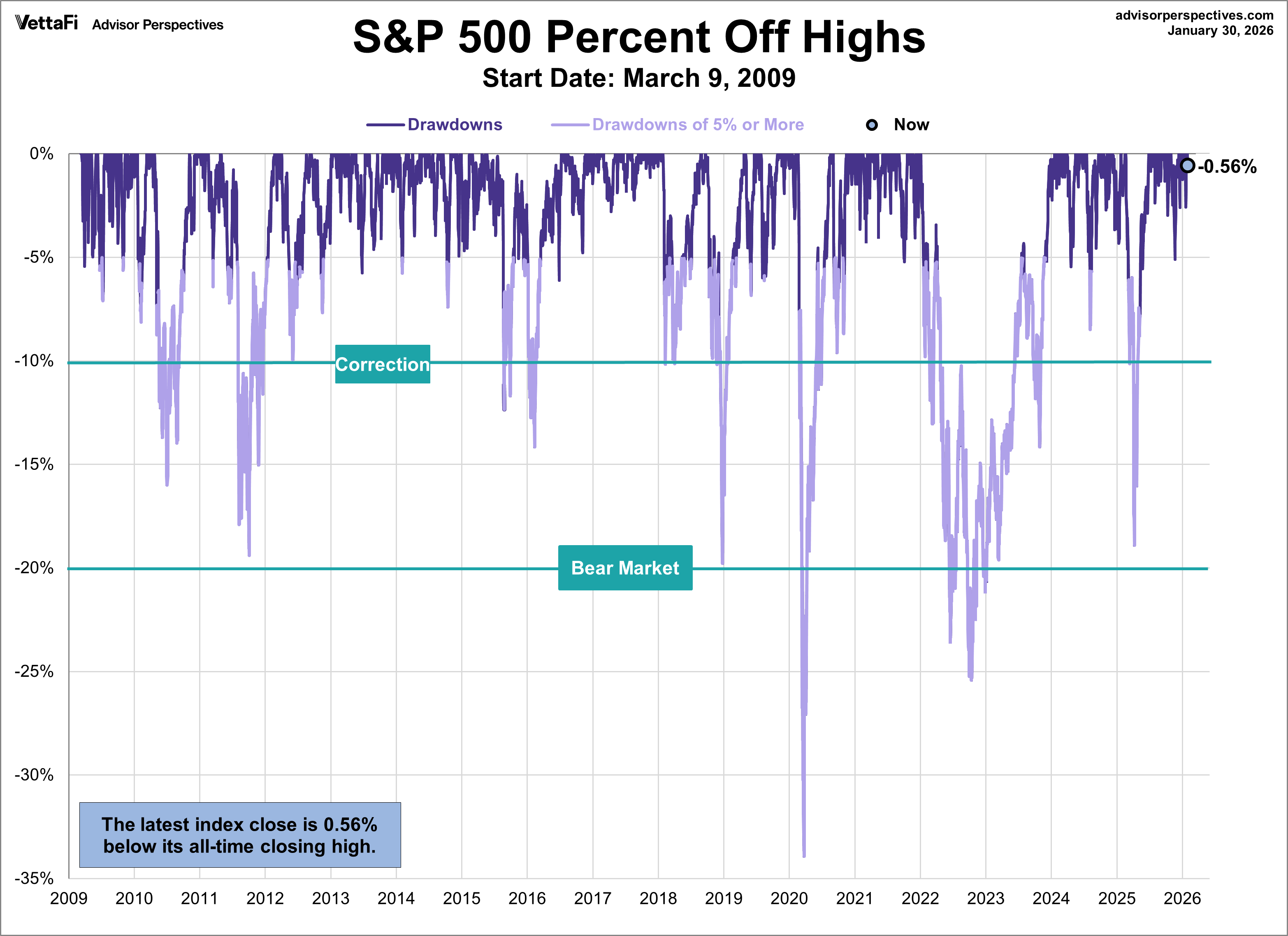

A Perspective on Drawdowns

How close were we to an "official" correction, generally defined as a 10% drawdown from a high (based on daily closes)? The chart below incorporates a percent-off-high calculation to illustrate the drawdowns greater than 5% since the trough in 2009.

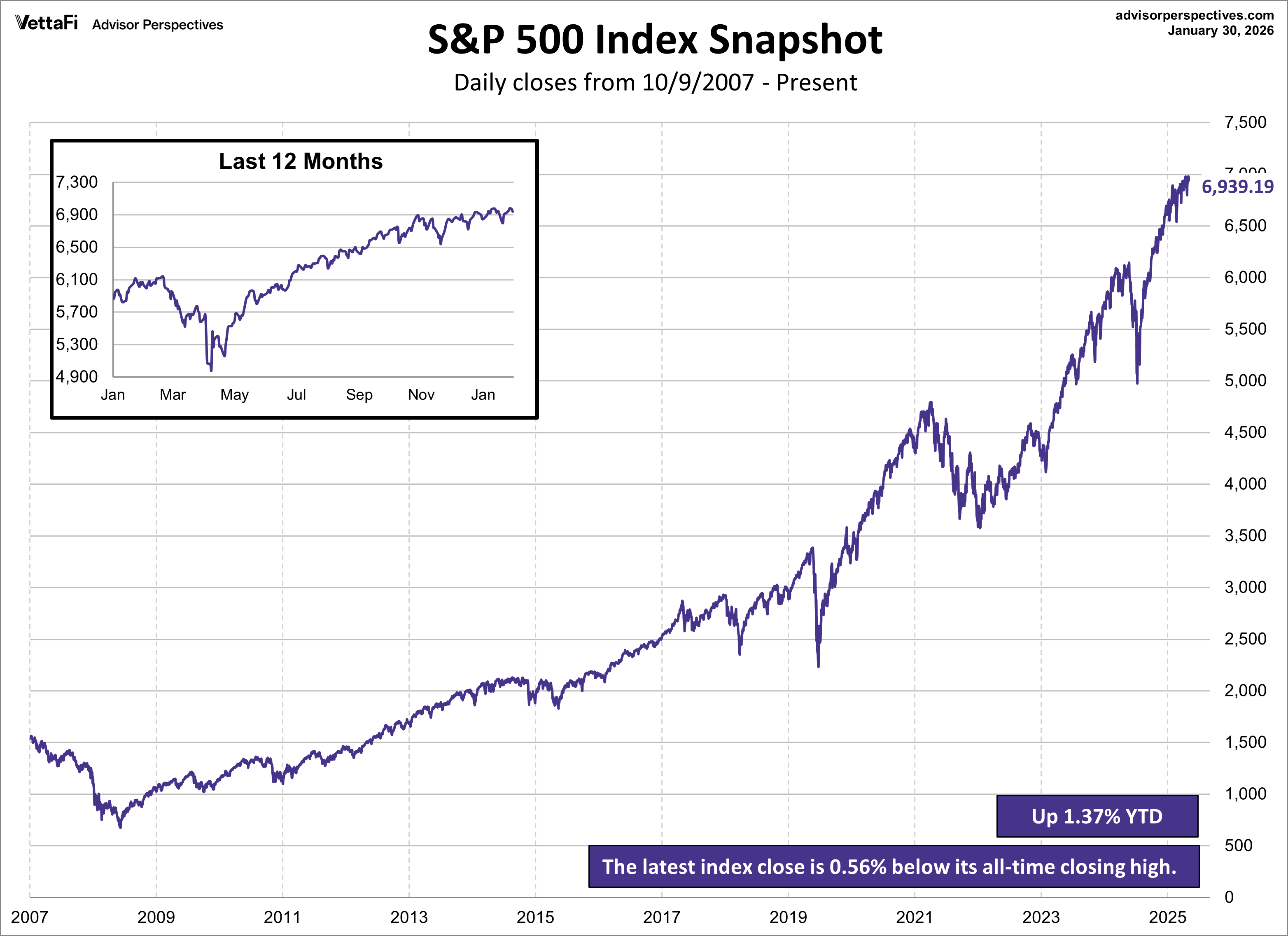

For a longer-term perspective, here is a pair of charts based on daily closes starting with the all-time high prior to the Great Recession.

Disclosure: None