S&P 500 And Nasdaq 100 Forecast - Thursday, June 14

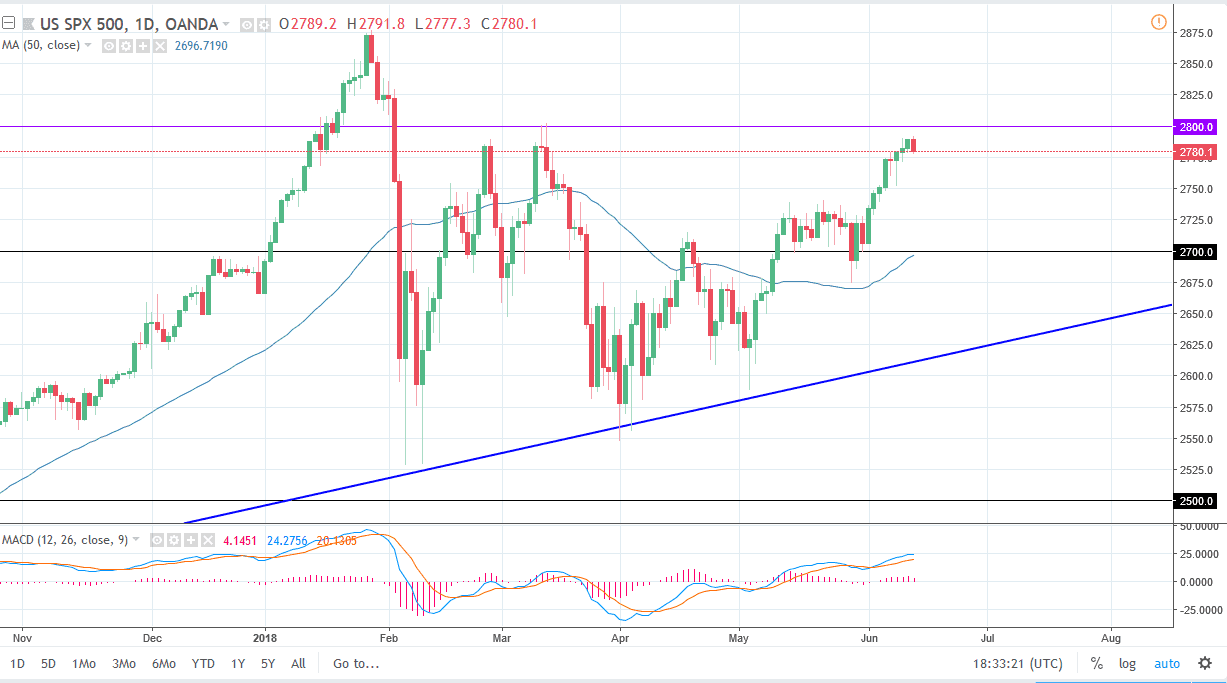

S&P 500

The S&P 500 fell a bit during trading on Wednesday, after the Federal Reserve announced and interest rate hike. While this was not a huge surprise, the market is digesting a lot of gains to begin with, so therefore it makes sense that we would struggle just below a psychologically and structurally important level such as the 2800 handle. I think that if we can break above that level, the market is likely to continue to go to the upside, perhaps the 2850 handle. In the meantime, I would not be surprised at all to see some type of pullback towards the 2750 level, but I think that will simply offer value that you can take advantage of in a large uptrend like we have been in recently. I believe that the 2700 level is going to be a bit of a “floor” in this market.

(Click on image to enlarge)

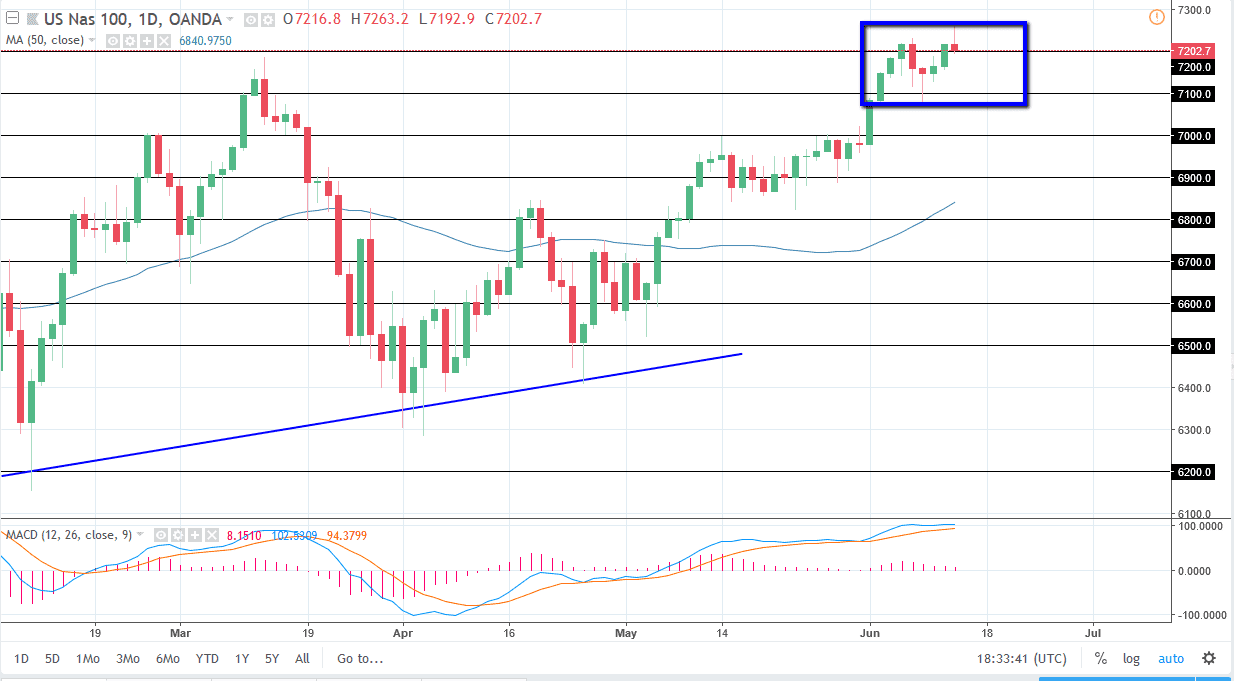

Nasdaq 100

The Nasdaq 100 took off to the upside during the trading session on Wednesday but gave back quite a bit of the gains after the FOMC statement. By forming a shooting star that we have, I think we will pull back, but I believe it’s only a matter of time before the buyers get involved and push this market to the upside. If we can break above the top of the range for the day on Wednesday, that is a very bullish sign and it should send the Nasdaq 100 higher. I believe that this market is going to continue to build up enough momentum by pulling back to attract value hunters to break out to the upside. The 7300 level above is the initial target, followed by the 7500 level. I believe that the absolute “floor” in the market is at the 7000 level.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more