South America's Soybean Crop Prospects Update -- Tuesday, November 22

Market Analysis

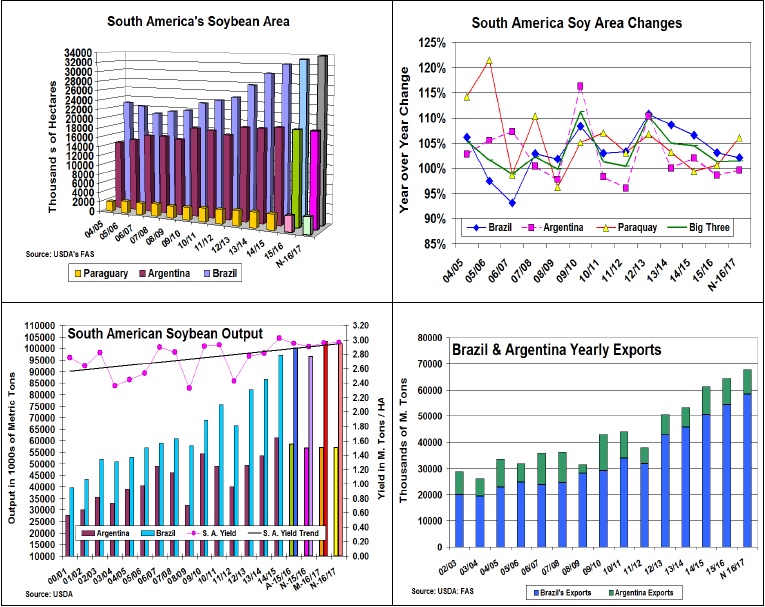

With this past fall’s spot futures price relationship between corn and soybeans prices staying in 2.85 to 2.95 to 1 ratio, the general expectations are for higher US soybean seedings and lower US corn plantings in next year’s 2017 planting period. This isn’t the case in the upcoming South American growing season. Argentina’s new government eliminated export quotas and tariffs for wheat and corn and Brazil’ sharply lower second crop corn output because of last year’s drought in the CenterWest region have attracted more grain seedings vs. oilseeds for upcoming year. After soybean seedings surged 9.6 million hectares from 2012 to 2014 crop years in the three major producing nations of Brazil, Argentina and Paraguay, heavy harvest rains cut Argentina’s area (-1.3%) reducing 2015/16’s overall harvested expansion to just 760,000 hectares. Last summer’s high grain prices in Brazil and Argentina also limited soy area expansion to 620,000 ha.

Interestingly, Paraguay’s 200,000 projected increase in seedings is the largest percentage gainer (6.1%) in the region for upcoming 2016/17 crop year. Last year’s late season Brazilian heat and Argentine flooding also impacted their yields, which cut their output by 1.7 mmt and 4.6 mmt, respectively. After some erratic early season weather (excessive rains delaying Argentina plantings and Brazilian dryness curtailed growth the north), seasonal rains in Mato Grasso and central Argentina drying out over the last 2 weeks suggests trend or better yields may still occur. This could boost the region output by 5.87 mmt to 168.2 mmt, a new record, if it continues through the growing season. These potentially larger crops are projected to boost the exports from this region by 3.35 mmt to 67.65 mmt from Brazil and Argentina combined.

What’s Ahead

With this fall’s record breaking export movement likely coming to an end because of the normal shutdown of the US Mississippi River barge transportation system, a slowdown in this demand is likely to occur as the lock and dams close during December. The market’s focus will also be switching South America suggesting producer should have 50-60% of your 2016 soybean output sold at this time.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more