Some Light At The End Of The Tunnel For Target And J.C. Penney

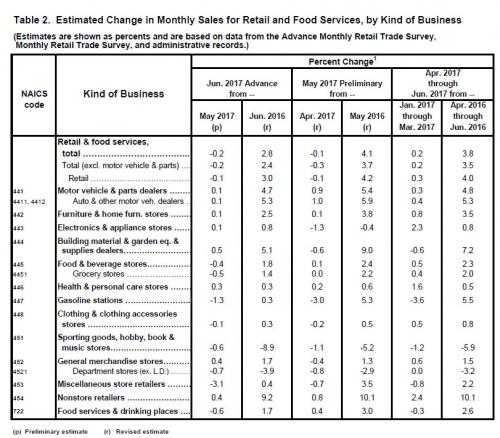

Retail sales have been a disappointment now for three consecutive months and as such this may lead to downward revisions for Q2 GDP estimates. While that remains to be seen, something simply isn’t resonating well with the consumer. Maybe it’s uncertainty surrounding the future of healthcare, maybe it’s simply the every rising costs of healthcare premiums that are syphoning off retail sales, only time will tell. One thing is for certain though, absent April’s surge in retail sales and for much of 2017, retail sales have been slightly lower. And not all retail sales categories are created equally. The table below comes to us from the Census Bureau and recognizes that retail sales fell in the month of June by .2% against an expectation for an increase of .2 percent. This comes on the heels of May retail sales, which also fell .1 percent.

The usual culprits showing the largest retail sales declines were grocery stores, miscellaneous stores and department stores. And it’s in that regard that we further discuss and analyze the department store names. Most department store stocks such as J.C. Penny (JCP), Target (TGT), Kohl’s (KSS ), Macy’s (M) and even Wal-Mart (WMT) have all had a rough go of it in 2017.

Every year I offer a full-scale retail industry report. In 2016 this report was some 35 pages of content on the retail industry, consumption trends, and specific retail brand forecasts. Last year’s report was purchased by roughly 400 funds and portfolio managers. Famed asset manager Alan Valdez on Yahoo Finance shared the sentiment and warnings within the report publicly in October of 2016. The basic tenor of the report warned of a pending calamity in the retail industry that would find significant store consolidation and lesser same-store-sales. Some of my more targeted individual brand warnings were heralded for J.C. Penney, Target, Macy’s and Bed Bath & Beyond.

What the team at focusedstocktrader.com and I are concerned about is the downward trend in retail sales. My colleague Seth Golden notes in his institutional report that, besides the April 1.2% outlier, sales have been anything but inspiring.

September retail sales came in at a lackluster -0.3% month-to-month. And look no further than today’s guidance from Wal-Mart (WMT), projecting a lackluster profit outlook into 2018. Even more troubling is the amount of big box stores closing hundreds of locations: Macy’s (M), Kmart, Sears (SHLD), and Wal-Mart. Yes, people are using online shopping more and more, but the closing of so many stores tells us the consumer is starting to have a more difficult time—and maybe the jobs number Wall Street looks at is not showing us the real picture of Main Street.”

Wal-Mart reported the best Q1 2017 results of the bunch for which the stock surged immediately after reporting, but has since given up most every bit of those gains. Target beat expectations during Q1, but even so the commentary from management surrounding the quarter’s results was subdued and cautious. Guidance wasn’t revised higher, even though I believed it should have been. More importantly and somewhat hidden in Target’s Q1 results was a dramatic 5% reduction in inventory. This helped the retailer greatly with regards to expenses and beating bottom line expectations. Investors aren’t as easily fooled as they may have been in the past. J.C. Penney had similar results as the firm beat bottom line expectations mightily. However, the bottom line beat was mainly attached to asset sales that can’t be duplicated and actually set a high bar for the company to jump over in the following year. More importantly, J.C. Penney’s same-store-sales fell much more than expected, by 3.5% YOY. This result damaged the total investor sentiment regarding J.C. Penney’s Q1 results. Moreover, the SSS decline was the largest in more than 10 quarters.

Department stores are and will likely continue to struggle for years to come. The seismic shift in retail online demand is unlikely to reverse course. Even with these traditional department store brands spending billions for omni-channel, retail sales platforms, the return on investment is slow to come. It may take many more years and further retail brick and mortar consolidation before an equilibrium can be found for some of these department store brands. What is more likely to occur for the likes of J.C. Penney, Target, Kohl’s, Macy’s Wal-Mart and the like are periods of stabilization followed by periods of declines.Simply put, one bad year will lead to better results in the following year provided by low expectations and low metric results in the previous year. Some of that forecast is already being realized here in late 2017.

Target updated their Q2 guidance recently. The following comes directly from the retailer’s press release:

As a result of improved traffic and sales trends through the first two months of the quarter, Target is now expecting to report a modest increase in its second quarter comparable sales. In addition, the Company now expects to report second quarter GAAP and Adjusted EPS above the high end of its previous guidance range of $0.95 to $1.15. Both GAAP and Adjusted EPS are expected to reflect a 5 to 9 cent benefit driven by the net tax effect of the Company’s global sourcing operations. In addition, GAAP EPS is expected to reflect 2 to 3 cents of pressure related to the unfavorable resolution of tax matters. Target plans to report its second quarter 2017 financial results on Wednesday, August 16.

Following better-than-expected results in the first quarter, we’ve seen additional, broad-based improvement in traffic and category sales trends in the second quarter, despite continued challenges in the competitive environment” said Brian Cornell, chairman and CEO of Target.

On the surface, this update to Q2 2017 guidance from the retailer sounds great and looks even better on paper. Having said that, I will repeat what I said after the company beat Q1 expectations, “I believe Target is sandbagging guidance”. Target’s Q1 performance simply wasn’t as bad as the EPS and SSS declines would have one believe. Couple that with dedication to expense control and a multitude of sales initiatives and I was able to recognize ability for management to raise guidance, although they certainly didn’t do so. Hence, sandbagging guidance and giving the company a reasonable opportunity to beat Q2 guidance and analysts’ expectations…again.

In an audio, YouTube interview with David Moadel on May 26th, I alerted my readers and followers with this exact verbiage, “I believe Target is sandbagging guidance. Thirteen minutes into the interview I discuss this with great clarity.

Target has outlined a few more initiatives since their Q1 2017 earnings release. One initiative centers on the launching of 12 private label brands. This got much attention in the media and since their latest children’s brand, Cat & Jack has gotten off to a phenomenal start. And I’ll gladly admit, as soon as my daughter is of size to wear Cat & Jack, she’ll be wearing Cat & Jack. The prices, assortment and general fashion forward collection is a smart choice for many a family and mine. But fashion is a given and where the low-lying fruit may be had already for Target. The retailer has attempted this very strategy now for many years and across many categories. They’ve had many, many partnerships with many, many brand ambassadors and celebrities. None of which have led to sustainable growth…. in any category; you name the category. So as I always warn investors with these “initiatives and offerings from management to turn the ship around”, know the value of these activities and operations.

Finally, as it pertains to Target and before we move on to J.C. Penney more specifically, Target is not an investment and it has been uninvestable for a good deal of time. While I can appreciate that this sounds outlandish or salacious, the chart is quite definitive in its depiction of TGT shares and how investors have fared.

As identified in the TGT chart above and since 2012, the share price is lower today than it was in 2012. Such an understanding identifies structural issues with the business model and its difficulties with adjusting to consumption trends. But the dividend right? Yes, even when accounting for the dividend, here comes the worst consideration of all: How much has the S&P 500 returned on average since 2012? It’s the question that many dividend investors have to ignore because most obviously they would have egregiously underperformed the benchmark average with TGT shares. Target can be and has been a great trading vehicle, but by no means is it a good investment. Proof is in the chart that is unless you desire to underperform the overall market.

So I promised you some J.C. Penney and now I’ll give you some J.C. Penney. If we put the car in reverse for a moment and harken back to 2016 we’ll recognize that JCP shares have been in my proverbial doghouse since that time. In a series of detailed analytical works I outlined why I believed JCP would underperform the market and not find itself appreciating. In the article titled J.C. Penney Shares Fall Back Into 'Show Me' Status, I explained my 12-month thesis and why I thought it prudent for investors to avoid shares. My sentiment through 2016 remained bearish and carried forth with publications at TalkMarkets.com and my first J.C. Penney article titled J.C. Penney Is Optimistic Despite Lowering Sales Expectations. Since then and through 2017 I’ve authored 5 or 6 more J.C. Penney articles that included many analytical insights as to why I would remain in opposition with regards to buying shares of JCP… until now. With this publication, I’m moving my rating on JCP shares in a positive direction from Avoid to Neutral. I believe if you currently own JCP shares, the share price will appreciate in the near-midterm.

J.C. Penney’s executive team has been on a year long mission to right size the business model, adapt to changing consumption trends, growing and diversifying its assortment and enticing shoppers with new in-store presentations and formats. While there are ample more operations in place to name, for the sake of brevity the named offer an all-encompassing effort to return to same-store-sales growth and sustainable profitability. From 2013-2015, the bar had been set very low for J.C. Penney. That low bar was since removed in 2016 where the retailer found itself struggling to grow same-store-sales outside of its immature online sales division. With some 88% of total sales driven through J.C. Penney stores, the company simply cannot offset same-store-sales declines with its double-digit growth in its online sales division.

In 2017 J.C. Penney will close roughly 138 storefronts for which they account for roughly 5% of total J.C. Penney sales. This effort should facilitate a curtailment and expenditures while elevating long-term profitability. The other beneficial affect from these store closures will likely be an artificial boost in same-store-sales results. It is one of the reasons, not the sole reason, that after a dismal Q1 2017 SSS decline of 3.5%, the retailer still maintained its -1-1% SSS forecast for the fiscal year. It’s a little ancillary benefit in 2017, much like having a 53rd week of sales in 2017 that was not available in 2016. There are a great deal of moving pieces when analyzing and forecasting retailers and retail sales.

Moreover, store closures tend to do more than just artificially boost top and bottom line prospects; they lead to more store closures, eventually and always. Macy’s, Sears Holdings (SHLD), Abercrombie & Fitch (ANF), HHgregg, Circuit City, Radio Shack, RUE21 and on and on and on; they’ve all started down the store closure path in the past and have found either bankruptcy or more store closures at the end of the path. It takes a very special set of circumstances to offset this historical situation regarding store closures. As such, it would not surprise me if J.C. Penney rationalizes another 40-60 store closings in the next 12-18 months.

In analyzing J.C. Penney’s current strategy for growing sales and profits, as an investor/trader, I force myself to forgo the profit picture in favor of the sales picture. Retailers, by and large, are valued on the basis of sales and not profits during an era where the likes of Amazon (AMZN) is capturing more and more market share with each passing year. Investors want to see sales and market share gains as the profit picture can generally be manipulated so long as those sales have some semblance of stable margins. It’s how Amazon has gotten away with being highly unprofitable for many a year and found their share price ever appreciating in value.

In 4 out of the last 5 quarters, J.C. Penney has found same-store-sales declining and none more than in Q1 2017. With a low bar having been set, seemingly, for 2017 the company recently announced a vast improvement from the most recently reported period. Alongside this announced sequential improvement in SSS, the retailer also disclosed the departure of its CFO Edward Record. Notes from the investor relations release are offered as follows:

J. C. Penney Company, Inc. (NYSE: JCP) today announced that Edward Record has informed the Company of his intention to step down from his position as executive vice president, chief financial officer effective July 11 to pursue other interests. Record will remain with the Company in an advisory capacity until Aug. 7 to assist with the transition while a search for his replacement is conducted. Additionally, Andrew Drexler, senior vice president, chief accounting officer and controller, will assume the position of Interim chief financial officer along with his current duties.

The timing of his departure coincides with a demonstrated sales performance improvement in the second quarter, and we continue to expect to report significantly improved top-line results this quarter versus the first quarter. We look forward to sharing more details on August 11.

All I concern myself with are the sales. The sentiment shared regarding a sequential sales improvement is a positive sign for J.C. Penney and its investors. But let’s make sure we understand the offering for its greatest efficacy. A sequential sales improvement is one thing, but the sales update did not suggest a year-over-year sales improvement. As such, I would still expect SSS results to have fallen, not including online sales, during the Q2 2017 period. Additionally, it should be understood that some of this sales improvement would come from the aforementioned benefit of store liquidation sales and subsequent closures. Furthermore, J.C. Penney will likely have achieved some sales lift from the rollout of appliance sales to some 500+ store locations that were not selling appliances in either the previous quarter or the previous years. Then, of course, piling on with the greater sales initiatives, is the additional Sephora locations both QoQ and YOY…not to mention Instyle Salon revamps. That’s a heck of a lot of sales initiatives thrown into any single quarter. So when management updated sales sentiment, this should be somewhat expected even as it doesn’t seem to be able to bridge the YOY sales gap. Logically this type of decline YOY, and when the retailer is selling goods that cost thousands of dollars like appliances, is a result of slower foot traffic.

Not bridging the sales gap YOY with all these initiatives is a going concern, but I’m willing to give the retailer some time to fully extrapolate the potential from these operations and before drawing long-term conclusions. Toys are another area J.C. Penney has only just broadly ventured into with a new, in-store and online toy assortment and presentation. This is very much a dollar/sq. ft. play by the retailer as the toy business is a highly unprofitable, unstable and contested business segment. But again, installing such a sales initiative today, can build sales for this fiscal year. Next year, however, this may prove to be an impediment to sales and profits. J.C. Penney doesn’t have the buying power or brand cache to compete well in the category and against the likes of Amazon, Target, Toy’s R Us and Wal-Mart. J.C. Penney will likely have a great deal of markdowns in this department after the holiday season. An example of why this is a poor long-term strategy is Hatchimals. J.C. Penney isn’t likely going to get whatever the hot toy of the season is in any great quantity, if at all. Vendors want to ensure the largest players and their biggest customers have ample supply to meet the holiday demand. J.C. Penney’s relative youth in the category and meager size when compared to its peers will likely find it without consideration by these vendors. In future years, J.C. Penney will find its toy initiative to be nothing more than a “filler” and something left behind. Having said that, one dollar/sq. ft. initiative that nobody is talking about due to its conspicuousness is the “candy wrap”. J.C. Penney is now offering an assorted variety of candy for sale at each register area to try and spur that last minute, add-on sale from its customers. Many big box retailers use this strategy. While foot traffic declines have hurt the candy wrap sales for the likes of Target and Wal-Mart, a commencement of the strategy akin to the toy strategy in the here and now can only help J.C. Penney sales.

The road ahead for J.C. Penney is more difficult than some would choose to believe or find welcome. They see the initiatives, the big dollar ticket items from appliances and furniture and spirited customers awaiting Sephora grand openings as evidence of a turnaround in the business. I can assure you that these are nothing more than the typical rolling out of initiatives that once meet scale find themselves wanting for real solutions to an unrelenting problem. That problem is the seismic shift toward online sales. Nothing J.C. Penney or Target are doing today largely addresses where consumption and retail sales are heading. There is no putting the genie back in the bottle with regards to the state of retail sales. And while e-commerce only accounts for some 9% of total retail sales, when brick & mortar sales have obviously peaked, every dollar lost to e-commerce sales proves incremental.

Despite the gives and takes offered in this analysis regarding retail sales and more specifically Target and J.C. Penney, I favor these two retailers as trading instruments. Neither is investable given the aforementioned variables, results, and impediments to their long-term growth. Near to mid-term trading opportunities very well could find both retailers’ share prices appreciating in value. It’s happened before and therefore it is likely to happen again for all the reasons mentioned. But understand that what will find share prices appreciating will also find them depreciating in the future.