So They Say Shorting Volatility Is Like Playing With Dynamite...

I leave the country for one week, one week and return to discover that volatility has remained relatively low. But that’s not all I’ve returned to as the calls for an end to the short volatility trade and imminent disaster for such positioning have run rampant in my absence. As many already know, understand and accept, I’ve been shorting volatility now for a smidge over 5 years and doing so with astounding rates of return on invested capital (ROIC). As it were it will remain until further notice, Golden Capital Portfolio will maintain a short volatility strategy and as the fund has produced a 94.1% ROIC year-to-date. So let’s do it to it as they say and review these calls to an “end of the short volatility” trade. I think you’re going to like or dislike this very much, depending on what you’ve already read in my stead. I’m a poet and didn’t…nahhhhhhh!

First “up to bat”, again, as they say, is an article written by Eric Parnell and titled How To Protect Against A Rise In Volatility. Mr. Parnell asks a relatively simple question at the onset of his narrative while characterizing the short volatility trade as a “keg of dynamite, preparing to blow”.

What does the average investor need to do, if anything, to protect against the inevitable rise in volatility, and thus the unwinding of this short volatility trade, at some unknown point in the future?

The short volatility trade (Nasdaq:XIV) is like a keg of dynamite sitting at the heart of financial markets. Once it explodes, it is likely to come with meaningful collateral damage that could quickly spread across asset classes.

It’s a great question! But with a rather faulty premise that denies the reader/investor/trader the opportunity to best understand that most short volatility participants utilize designed instruments to participate. The question is also proposed with a predetermined outcome: The unwinding of this short volatility trade. Regardless of the direction in volatility since the genesis of short volatility instruments, the short participation rate has only, only increased. With that factual piece of information in hand, the outcome is not only predetermined by Mr. Parnell, but it’s absolutely incorrect with regards to history. And “a keg of dynamite sitting at the heart of financial markets”? Well Mr. Parnell, if fear-mongering was the goal within your narrative…

Mr. Parnell’s article is well-written and well intended, but so far as content, it fails to give the full scope of why the short volatility trade has worked so very well. The nature of volatility is the enemy of a long volatility strategy or any hedging strategy one can put forth. Everything an investor/trader needs to know is centered on the study and understanding of volatility. At the heart of volatility is the acceptance of desensitization from introduced stimuli. The more exposure to like stimuli, the greater the desensitization and hence the reduced volatility. In other words, what once produced outsized levels of fear and volatility, upon previous exposure to such stimuli, will not have the ability to produce like levels of fear and volatility when exposed to the same stimuli in the future. This is desensitization and something you likely won’t see articulated by others in the media. Why? Well because it takes effort and a dedication for considering a deeper understanding as to why something works the way it does. Mr. Parnell’s article doesn’t offer any understanding of volatility itself, even when offering several charts of when volatility spiked and subsequently falls. Through all of these magnificent volatility spike examples articulated by Mr. Parnell, the short volatility trade still grew larger, not once “blowing up” or “unwinding” in perpetuity. The short trade only grew larger. Look at the following example offered by Mr. Parnell as follows:

Consider the last time we saw even a momentary extreme spike in volatility from below 11 to above 53 back in August 2015. While U.S. stocks dropped by more than -10% along with this spike in volatility, long-term U.S. Treasuries gained by a bit less than +10%. And as the stock market thrashed back and forth and volatility remained elevated in the months that followed, U.S. Treasuries continued on their upward trajectory.

The problem with Mr. Parnell’s “short volatility trade blowing up” thesis is apparent not only in the chart above, as one can see the dramatic drop in volatility post the dramatic spike, but in the table below:

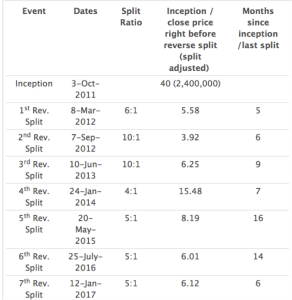

UVXY Reverse Split History

The table above accounts for the 7 reverse splits from a short volatility ETF. ProShares Trust Ultra VIX Short-Term Futures ETF (UVXY) is a designed, double-leveraged, short volatility ETF. Using Mr. Parnell’s August 2015 example of the short volatility trade blowing up we come to find that UVXY performed a reverse split only 8 months later and achieved all-time trading lows less than 6 months after the August spike in volatility. This massive volatility spike lasted a matter of weeks before dissipating. Having personally shorted UVXY into, through and post the spike in volatility during the exampled time period I can attest to profits of participating in such a manner. Is it an uncomfortable experience to participate in this manner and during such volatility spikes? Certainly! But the most important question as it pertains to Mr. Parnell’s narrative is whether or not it is the most profitable way to participate.

Mr. Parnell offers using Treasuries to hedge against the unwinding of the volatility trade. Unfortunately, this strategy denies the nature of volatility and the undeniable greater profitability that can be captured by shorting specific VIX-leveraged ETPs during volatility spikes. There’s no denying, on my part, that shorting VIX-leveraged ETPs is not for every trader or investor. It takes understanding, skill and yes an “iron stomach” at times. Having said that, you will be hard-pressed to find a more profitable investment strategy. The hedging strategy offered by Mr. Parnell in How To Protect Against A Rise In Volatility would have definitively been a lesser strategy when compared to shorting volatility spikes, as evidenced in the historic VIX-leveraged ETP charts. UVXY, regardless of the many major spikes in volatility that have occurred and exampled by Mr. Parnell, has generated an ROIC of over 90% annually.

Speaking of fear mongering, let the leaders lead, as we’ll now review an article published on Zero Hedge by the infamous Tyler Durden. On June 13th, the noted columnist regurgitates notes from J.P. Morgan’s (JPM) quant specialist Marko Kolanovic in an article titled JPM Head Quant Warns Of "Catastrophic Losses" For Short Vol Strategies. Specialist or not, Mr. Kolanovic unknowingly defines the very reason his research notes are found in error of forecasting outcomes. Take a gander:

Marko says that low volatility is not a new normal or fundamentally justified – it is result of macro decorrelation and massive supply of volatility through yield generation products and strategies. He concludes his quick rundown of changes in market structure by noting that "Big Data" strategies are increasingly challenging traditional fundamental investing and will be a catalyst for changes in the years to come.

I agree that low volatility is not a new normal, but disagree that it is or isn’t fundamentally justified. Make sense? Let me explain. Firstly, volatility is understood to exhibit levels of fear and complacency. It does this through the introduction of stimuli and traders’ reaction to the stimuli. The more stimuli experienced by the trader, the lesser degree of fear that will be expressed by the trader. There’s nothing new about this so far as understanding fear and volatility, nothing at all. Mr. Kolanovic doesn’t recognize this in his offering, consciously; he actually recognizes it accidentally and through my articulations. Most of the time, the macro-environment carries the greatest of fear-laden stimuli. With the increase of macro fears that have littered the global marketplace for several years now, it is no wonder whatsoever that the investor/trader has become decorrelated to the macro fears. Once again, and from a “specialist”, we have clear evidence of desensitization to fear at work accept the specialist calls it decorrelation. Like Mr. Parnell, Mr. Kolanovic doesn’t offer any understanding as to the nature of volatility and like Mr. Parnell, he is forced to try and understand the short volatility trade through a lens he specializes with, quants. Yes, Kolanovic has decided that quants are responsible, in part, to the low levels of volatility being expressed over an elongated period of time.

The low levels of volatility puzzle many investors, and an increased number of ‘volatility tourists’ trade and research volatility. It was certainly very good to be short volatility recently, and narratives justifying this as a ‘new normal’ abound. One such explanation is that the macro environment is very benign. Let’s consider that statement. In the last 20 years the VIX closed lower than 10 on a total of 11 days, and 7 of those days were in the past month. Think about that – over the past 2 decades, was the last month the most benign macro environment? (e.g. last week: Comey testimony, UK elections, ECB, geopolitical uncertainty, Qatar, FANG flash crash, etc.).

I simply can’t do a better job than Mr. Kolanovic when it comes to defining desensitization. He’s literally making the case for me/it without knowing he’s making the case and in doing so evidencing his ignorance of the subject matter…to some degree. Kolanovic offers a number of macro factors at the end of the above quote that should stoke fear and express volatility in the markets. But those factors simply haven’t stoked volatility. One thing to recognize within Kolanovic’s macro factors is that not a single one of those noted affects the earnings picture. Earnings are expected to grow regardless of positioned quants. As such Comey, the U.K. elections and a FANG flash crash can all occur without driving an increase in volatility…me thinks, or as evidenced most obviously. But wait, Kolanovic offers more and conclusively as he contradicts the former offering and again unknowingly.

Kolanovic's volatility conclusion: "we think current low levels of volatility is not a new normal and will not last very long given the amount of leverage, rising rates, and the approaching reduction of central bank balance sheets.

So since Comey, U.K. elections and FANG flash crash didn’t work, here are some more macro factors to consider, which Kolanovic already noted have driven a decorrelation between the macro factors and volatility. Some people shouldn’t get “back on the bike”, they really shouldn’t. Having said that, it’s a forgone conclusion that volatility will increase, but from what level and for how long remains to be seen. That’s always a key variable to participating with a short volatility strategy. There’s no other premise that works for arguing a point of catastrophic losses from short volatility strategies. Volatility can spike from 10-20, but if UVXY enters this period of increased volatility from a base of $8 a share, and that period only lasts 2 months, you may only get UVXY to trade up to $16 a share. How does that result in catastrophic losses from the massive amount of long-term short participants who have positions several reverses splits out? These shorts don’t cover because they have no need to cover. They simply short more. It’s actually evidenced in the ever-increasing short participation for VIX-leveraged ETPs. Those with lesser experience and longstanding profits from VIX-leveraged ETPs may cover, but that is of little consequence to the institutional participation, which is where the greatest participation comes from and continues to grow.

Once again, this is why it is of critical importance for short volatility investors to understand the nature of volatility. Eric Parnell is a bond investor always has been and likely always will be and as such offers his narrative according to his expertise. Marko Kolanovic is a quant specialist and as such offers his narrative and research notes that align with the understanding of markets and quants. I’m…well I’m a trade of all Jacks, (see what I did there) but fancy myself a specialist of volatility and how the human psyche produces volatility in the market place be it automated or manually. What I find somewhat amusing about the Kolanovic offering is the use of quants to prevail in discussing what most erroneously determine to be short-term market instruments in VIX-leveraged ETPs. Quants derive their greatest efficacy through long-term, predictive definitions and not short-term, variable or static characteristics. I’ve often said that VIX-leveraged ETPs, despite their S-1 verbiage that suggests they are day-trading instruments, are long-term instruments. But many investors still insist, absolutely insist that these instruments shouldn’t be held overnight long or short. Well, you can’t have it both ways. Kolanovic can’t argue that quants are pushing down volatility given the nature of what creates an effective quaint and in the same argument state that quants are effective for the argued short-term instruments that are largely used to short volatility. The contradiction that nobody should be found expressing.

Disclosure: I am short UVXY since 2012. I am short VXX.

Nice article...would be interested to know if you have given consideration to a point where fear reaches a point of no longer desensitizing but to horror (supernormal event) as described in pages 9 of "Volatility and the allegory of the prisoner's dilemma", written by a volatility trader from Artemis Capital - http://www.artemiscm.com/welcome#home

Thank you for the comment and the introduction to the title. Kindly let me digest the content and offer a response later in the week. Thank you for reading and considering my article Japela!