Smoking Hot Opportunity In Imperial Tobacco Group

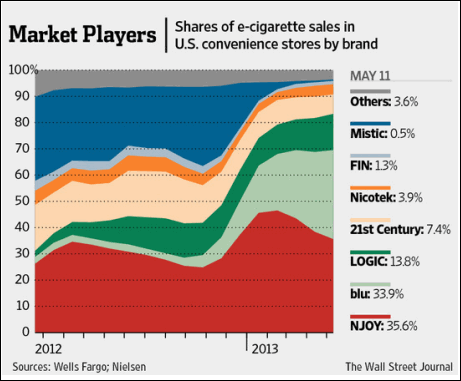

In the case of Imperial Tobacco (OTCQX:ITYBY), it also offers two of my favorite types of opportunities - the opportunity to pick up bargain assets in antitrust divestitures and the opportunity to be the first on the ground in a newly opening market. I like getting one or the other and love getting them both in a single equity.

Imperial will get more brands than they bargained for

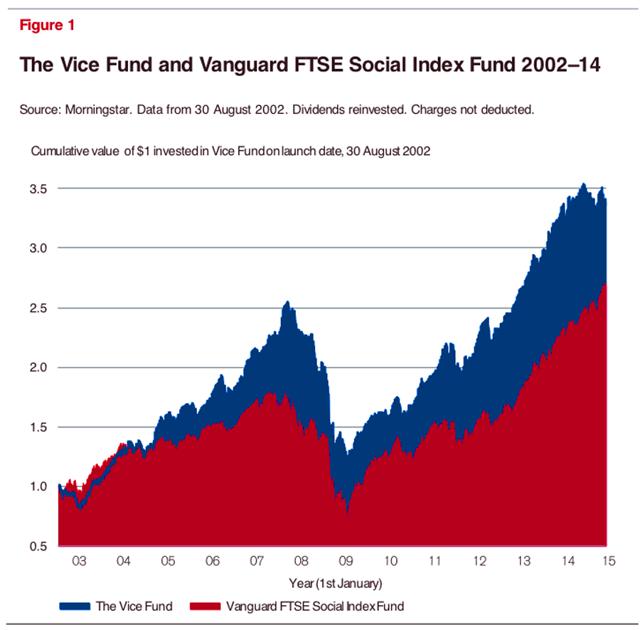

On July 15, 2014, Reynolds (NYSE:RAI) and Lorillard (NYSE:LO) announced a long anticipated combination of their two companies. The deal involves substantial antitrust risk and their solution to that risk involves a substantial divestiture to Imperial:

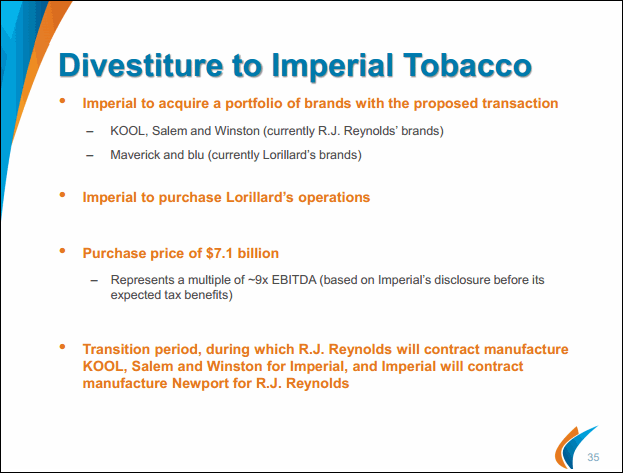

Securing Federal Trade Commission/FTC approval will be a challenge that might involve additional divestitures to Imperial. This can be an extremely advantageous position for the divestiture buyer because the buyer has the power to delay or disrupt the larger transaction. M&A partners will typically be willing to part with divestiture packages at substantial discounts to their fundamental value in order to expedite their deal. In some deals that I have been involved in, divestitures were practically given away in order to quickly appease antitrust authorities. Specifically, it is reasonably likely that the FTC will demand the divestiture of Doral in addition to Winston, Kool, and Salem. If Imperial holds firm in pricing negotiations, they should be able to buy a brand with a 2% market share for next to nothing. That take their market share from its current 4.5% and 9.2% with the currently agreed upon divestiture package to a total of 11.2% of the U.S. market.

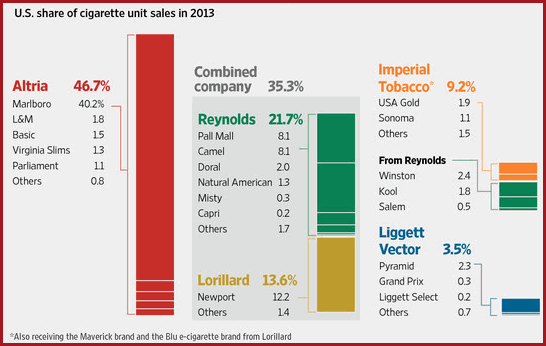

If the deal goes through, Imperial will also own over a third of the US e-cigarette market.

Imperial is in Cuba ahead of the lifting of the US embargo

Imperial is also a 50/50 JV partner with Cuba in Habanos S.A., which is the monopoly guarantor of Cuban cigars. Habanos estimates that it will sell between twenty-five and thirty percent of the U.S. premium cigars if President Obama lifts its embargo on Cuba.

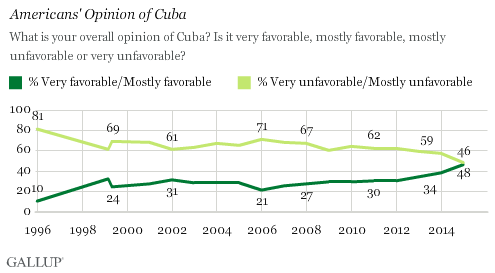

Since his reelection, Obama has exhibited a willingness to make bold moves by executive authority without relying on Congress. It is likely that he will do so again with regard to Cuba. Based on his prior statements, he favors lifting the embargo. Without the constraints associated with the need to run for reelection, he can largely do as he likes over the next few years. In the case of Cuba, public opinion has become increasingly favorable:

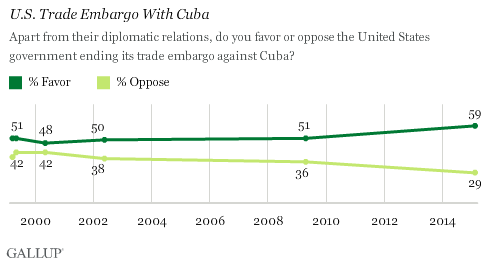

Most Americans would support lifting the embargo:

Backed by popular opinion, it is likely that Obama will end the embargo by instruction to his Treasury Department. This would expand upon the recent loosening of travel restrictions, which allow Americans to bring $100 of Cuban rum and cigars back to the US. Each of the six laws that form the basis of the US' Cuba embargo grants the president a lot of flexibility. He will probably move so far so fast, that by the time proposed legislation makes it to Congress, it will largely be a fait accompli.

Hedge

As a hedge, you might consider shorting the Herzfeld Caribbean Basin Fund (NASDAQ:CUBA) at over a 15% premium to its NAV. Its portfolio is conventional, price is high, and management is undeserving of a premium (in fairness, few are).

Conclusion

Between the growing divestiture package and the liberalizing trade opportunity, Imperial has a number of auspicious catalysts in 2015. They could have over ten percent of the US cigarette market, over a third of the e-cigarette market, and over fifteen percent of the US premium cigar market by the end of the year. When it comes to smoking, this could be a good year to be bad.

Disclosure: The author is long LO, ITYBY, ITYBF.

Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying ...

more