SMAs - A Better Way For Long-Term Investors

I am part of what may be a frontier in investment products - SMAs or Separately Managed Accounts. These have been around for decades, but are now finding favor as a smart alternative. SMAs, have grown by 84% since 2010, according to a report by Morgan Stanley titled "What's Behind the Surge in Separately Managed Accounts?"

Per Investopedia:

The investment management world is divided into retail and institutional investors. Products designed for middle-income individual investors, such as the retail classes of mutual funds, have modest initial investment requirements. Managed strategies for institutions have imposing minimum investment requirements of $25 million or more. Between these ends of the spectrum, however, is the growing universe of separately managed accounts (SMAs) targeted toward wealthy (but not necessarily ultra-wealthy) individual investors. Whether you refer to them as "individually managed accounts" or "separately managed accounts," managed accounts have gone mainstream.

It is basically a personal brokerage account, yours to do with as you wish, run by one or more fund managers of your choice. And you can customize this "fund" in various ways to be your personal mutual fund. They can be a Roth or any tax advantaged type you want. SMAs are a smart alternative to mutual funds, where you must pay taxes on your gain every year. But with an SMA, you can make your account tax free where you can let all the gain compound year after year and not have to fuss with it at tax time. They must be run per SEC safety rules for diversification and investment type, long stocks only.

Another tax advantage with an SMA is the fact that when you buy shares of a mutual fund, you are penalized for the tax accrued by any gain on the fund going clear back to the first of the year, even though you didn't own those shares then. The fund gives just one tax statement for all holders each year. You can only fix that problem by purchasing fund shares on January 1st. However, with an SMA that is taxable, you are liable only for gain on the new purchases in your account, like any brokerage account.

SMAs have grown US Assets from 396 Billion in 2000 to over a $trillion now. That's about 6% of the mutual fund/SMA pie and growing fast. Where did SMAs come from? Per the Wikipedia account::

SMAs were developed in the 1970s to accommodate accounts and clients who needed to meet specific objectives that did not fit within the constrictions of a mutual fund investment. It is the freedom of choice of professional managers, portfolio customization, objective investment advice for a set fee, diversification (or concentration should the client choose), tax efficiency and general flexibility that have made SMAs popular among informed investors.

SMAs are basically different as reflected by the kind of statement you receive from them. Per Investopedia:

the statements will look different. For the mutual fund client, the position will show up as a single-line entry bearing the mutual fund ticker – most likely a five-letter acronym ending in "X." The value will be the net asset value at the close of business on the statement's effective date. The SMA investor's statement, however, will list each of the equity positions and values separately, and the total value of the account will be the aggregate value of each of the positions.

SMAs are a not only an alternative to the safety of mutual funds, but to higher risk hedge funds as well. Investopedia has a piece (Hedge Funds' Higher Returns Come At A Price) describing some of the problems with hedge fund products:

"Although hedge funds are subject to anti-fraud standards and require audits, you should not assume that managers are more forthcoming than they need to be. This lack of transparency can make it hard for investors to distinguish risky funds from tame ones."

This is another big advantage of SMAs. You are not writing a monster check to be entrusted to a hedge fund manager with lockups, possible theft, and other uncomfortable conditions. Your money is entirely separate and yours to do with as you please, like in any brokerage account.

"The hedge fund manager must have a pre-existing relationship with a potential investor. It is also acceptable to be introduced by a qualified intermediary, which may be the hedge fund's prime broker. Potential investors must also meet income or net-worth requirements. Those that meet these requirements are called "accredited investors"

You have to be very rich, in other words, and know somebody.

"all of the advantages of hedge funds can become a nightmare if the fund is highly leveraged and the market moves in a direction opposite of the manager's opinion. The higher opportunity is why hedge funds have proliferated over the last 15 years, and the higher risk is why we sometimes hear about the more spectacular hedge fund blow-ups."

Besides all the "blow ups" there are many hedge funds with big annualized returns over long periods that aren't so sensational with just the safer stock part of their work - away from the high risk leverage and derivative toys and commodities. Even high roller hedge fund king George Soros, who is recognized as having the best investment fund performance in the world with his hedge fund since inception in 1969 has had a relatively flat period with stocks in the time frame since 2000. You can see this at "George Soros' s Profile and Performance" at gurufocus.com. If somehow you could have placed money with him in just the lower risk stock part of his holdings, the total equities only portion would have grown by 220% since 2000.This is way out-performing the Dow, but way under-performing Warren Buffett.

Another big problem with hedge funds is that they come and go by the hundreds each year. For nearly every new hedge fund that opens, another is forced to liquidate after poor performance. This frantic rotation has averaged nearly 1000 funds opened and 1000 funds liquidated each year for the last 8 years. Given that there has been around 8000 hedge funds existing the last 8 years, that makes a 12% casualty rate every year. That's an average life span of 8 years. You never know if your fund is going to disappear after maybe 3 years of dazzle but 8 to 12 years of struggle.

Yet another problem with hedge funds is that they are very difficult to get a long-term performance handle on. Have you ever tried to pin down a hedge fund's since-inception performance. They are not required to publish this, so you are greeted with a maze of "it did this in 2007" and "it did that in 2014", and "it is thought" their annualized return is this, all of which is gibberish noise and means nothing to the careful shopper.

A disadvantage of SMAs is the typically high account minimums, usually $100,000 or higher, although some firms, such as Morgan Stanley, have minimums as low as $25000. For mutual funds. it is far lower, but, as Investopedia puts it: "Separately-managed accounts are ultimately designed to provide individual investors with the kind of personalized money management that was formerly reserved for institutions and corporate clients" and they want to make it worth their while.

Another disadvantage of SMAs is that, because they are so individually customized, they do not issue a prospectus. So some additional due diligence on the fund manager and his style is warranted. A helpful tip from Investopedia in this regard:

A good question to ask here is whether the composite complies with the Global Investment Performance Standards set by the CFA Institute and whether a competent third-party auditor has provided a letter affirming compliance with the standards.

The flexibility, tax advantage, and risk problem solving for the mid-tier wealth level of investors is why I think SMAs could be the wave of the future. Hedge funds are going out of favor as an alternative to mutual funds because they don't significantly out-perform them. Check out "The Buffett Challenge: Year Nine Update" at Investopia.As investors become more disenchanted with the usual mutual fund and hedge fund choices, SMAs may step into the void.

With the kind of SMA I'm involved in, your account is synced to one or more models you want with over 30 models to choose from, chosen from over 30,000 competing fund managers at Marketocracy. They have partnered with FOLIOfn Institutional to set up SMAs. Marketocracy has been around since 2000 and most of the funds chosen for SMA modeling have 15+ year track records.

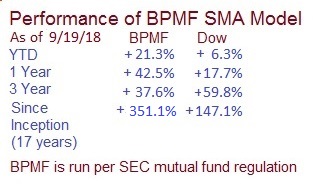

Studies have found that about two thirds of all stock funds don't survive over 15 years due mainly to poor performance. Of those that do, only 5% beat the Dow. The average fund has under-performed the market by 3.5% annually the last 20 years. That's a massive amount of compounded money lost in any financial plan if you don't hunt down the good managers.The FOLIOfn SMAs can do the hard work of finding the good long-term managers. I run one of these SMA models, BPMF (Bruce Pile's Mutual Fund):

Warren Buffett is thought of as the world's greatest long-term stock investor. Most of the SMA model funds' since-inception performance, including mine, closely match or greatly exceed Buffett's performance over the same time period - all top 1% stuff for all mutual and hedge funds for 15+ year performance.

With the FOLIOfn SMAs, you just need to go to mytrackrecord.com to survey all the since-inception charts of every manager you might want to choose, complete with all the slumps and warts. And you can choose more than one manager or style to model your account after to further reduce your risk. All of them have the GIPS (Global Investment Performance Standards) seal of approval.