Smaller World Crop Lifts Wheat, But No Exports Stun Corn & Beans

Market Analysis

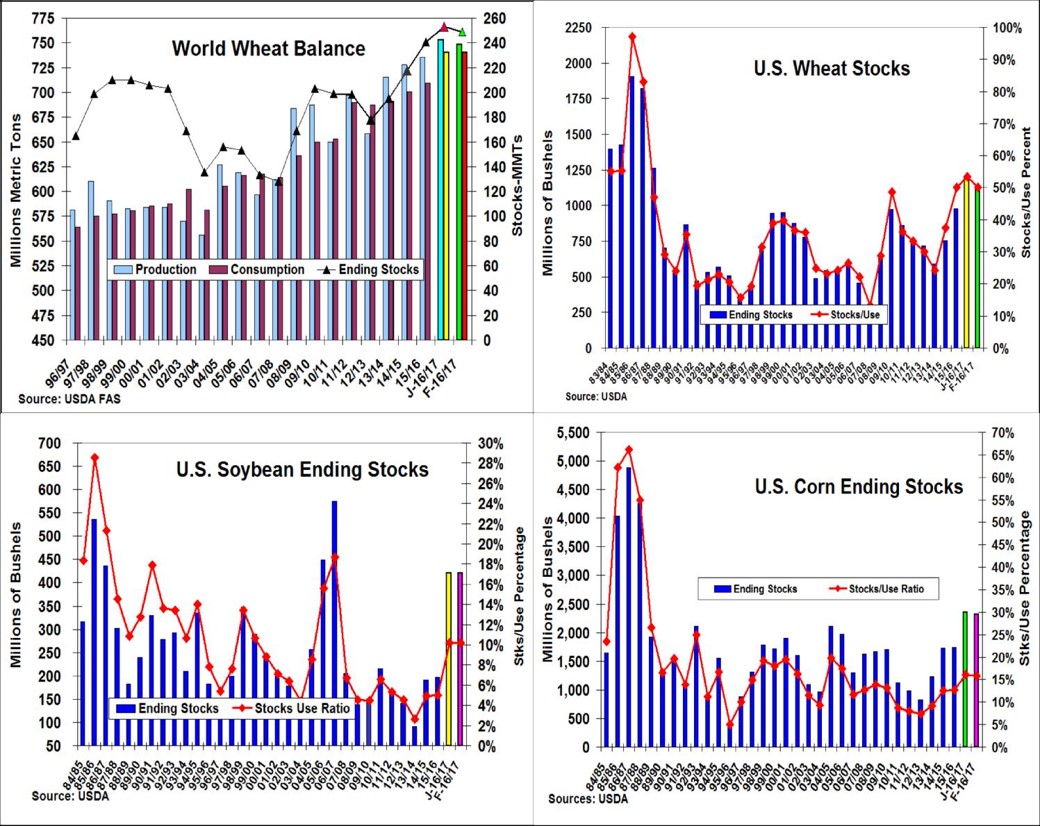

This month’s USDA world crop and supply/demand reports had revisions, but they weren’t where the trade was expecting them to be. Instead of increases across the three major crops overseas demand with higher export levels, February’s big change came in the government's world wheat crop forecast. A 4.4 mmt decrease in the world’s 2016/17 production because of erratic growing season weather in Kazakhstan (1.5 mmt) and tighter internal supplies in India (3.0 mmt) were the major changes in the USDA’s February revisions.

These reduced supplies and the current highest wheat sales on the books vs. the USDA’s forecast (88.2%) in the last 10 years (07/08’s 91.5%) prompted the government to increase its exports by 50 million bu. to 1.025 billion this month. This jump in demand shaved wheat’s ending stocks outlook by 47 million bu. to 1.139 billion bu. which was a larger drop than expected even with a 3 million decrease in food demand because of a flour milling report out earlier this month.

(Click on image to enlarge)

Our concerns about the USDA possibly waiting to see if this year’s foreign shipments might pick-up vs. the cur-rent bookings and their willingness to wait and see how S. America’s corn and soybeans crops finish up did seem to prompt the USDA the leave their export outlooks unchanged this month. In soybeans, this led to no change in this oilseed’s ending stocks vs. a whisper talk of 20-40 million higher exports to reduce this crop’s ending stocks under 400 million. This remains possible, but this change seems to be delayed until later this spring.

In corn, the current record biofuel output pace did prompt the USDA to up its ethanol demand, but only by 25 million bu. vs. our 50 million forecast. They did also increase corn’s food demand by 10 million so this feed grains’ ending stocks did fall by 35 million bu. to 2.320 billion, but 2017’s carryover remains highest in 30 years.

What’s Ahead

Given the current strong bookings, corn and soybeans were disappointed by this week’s lack of change. These increases could still occur depending upon S. America’s crop development over the next 4-6 weeks. However, given the current soybean/corn price relationship, we still suggest moving old-crop bean sales to 90%, basis March’s $10.65-$10.80 levels and 20-25% of your new crop in $10.25-$10.40 range.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more