Smaller Final US Corn And Bean Crops, But Argentina Now Focus

Market Analysis

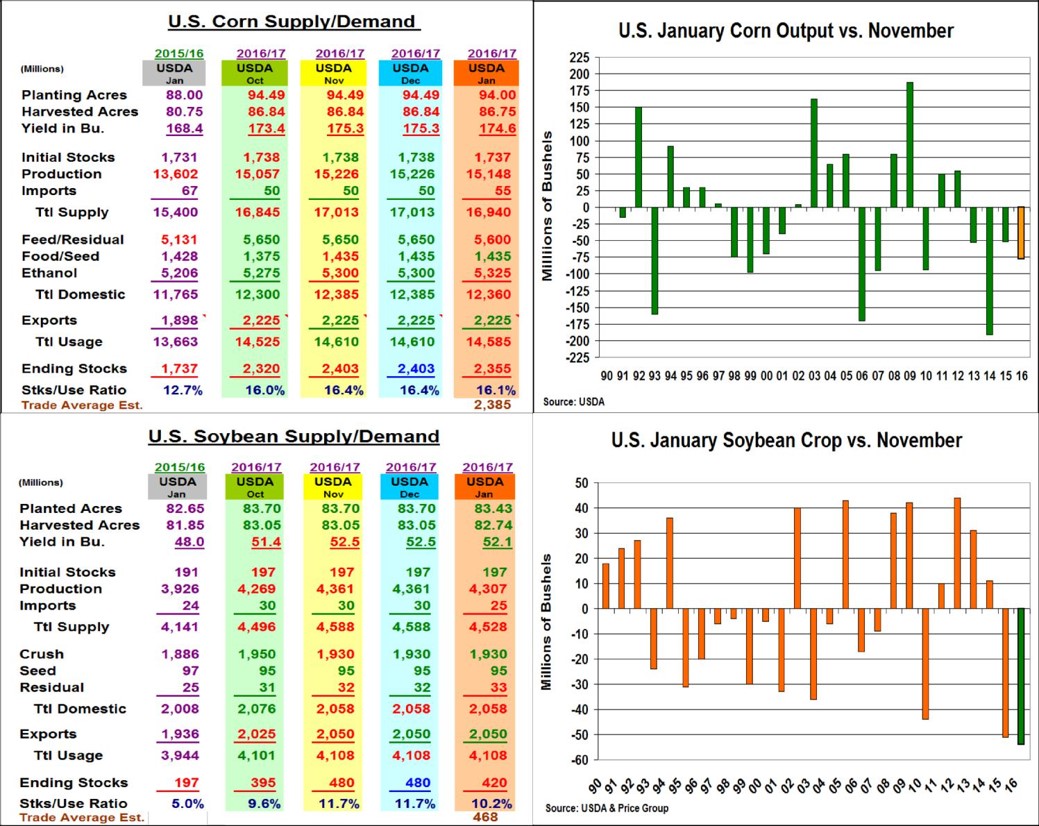

The USDA’s January reports provided some surprises again this year. Instead of a modest rise in soybean out-put and slight decline in corn’s final 2016/17 update, both major crops output decline from their November & trade expectations late last week. Also, US wheat producers reported a less- than-expected winter wheat seedings for the 28th out the last 29 years at 32.38 million acre. We’ll cover this important change in separate report.

This year’s corn crop dropped by 77.5 million to 15.15 billion bu., which was also 48 million below the trade av-erage estimate. The USDA’s latest poll revealed a 3.4 bu decline in the ECB’s regional yield to 179.8 bu. However, the WCB state of IA, MN, ND & SD record yields pushed this region’s yield up by 2.2 bu to 183.8 per acre. The SE & E. Coast were hurt by a drought and a hurricane while the Mid-South & SW were a mixed leaving the US yield off 0.7 bu. to 174.6 bu. 2016/17’s yield is still 3.6 bu higher than 2014’s 171 bu. record. These smaller sup-plies led to a lower 2016/15 ending stocks of 2.355 billion when the USDA upped its ethanol demand by 25 million after a record fall quarter in output. However, corn’s rec-ord December 1 stocks of 12.384 billion bu. and 84 mil-lion higher-than-expected prompted the USDA to shave its feed demand by 50 million. Corn’s biggest demand surprise was no change in exports despite this year’s sales pace being the highest since 2007/08 crop year.

The USDA’s soybean crop was a bigger surprise when it dropped 54 million from November & 67 million from trade expectation. Decreases in ECB & SE yields weren’t compensated by larger WCB yields prompting a 0.4 de-cline in the US yield to 52.1 bu. vs. 52.7 expectations. This smaller crop also shaved Dec 1 stocks by 40 million, but the biggest surprise was no change in the US exports despite a 87% sales pace with nearly 8 month left in the crop year. Beans ending stocks were cut to 420 million.

(Click on image to enlarge)

What’s Ahead

The soybean and wheat markets firmed after their unexpected smaller stocks and seedings levels last week, but the trade’s eyes will now be focused on Argentina’s latest batch of heavy rains. The com-bination of flooded out and unplanted soybean & corn areas will impact US exports going forward, but swings to $10.70-$10.80 in March and $10.40-$10.50 in November should be rewarded with sales.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more