Small Cap Best & Worst - Turkey Day Edition

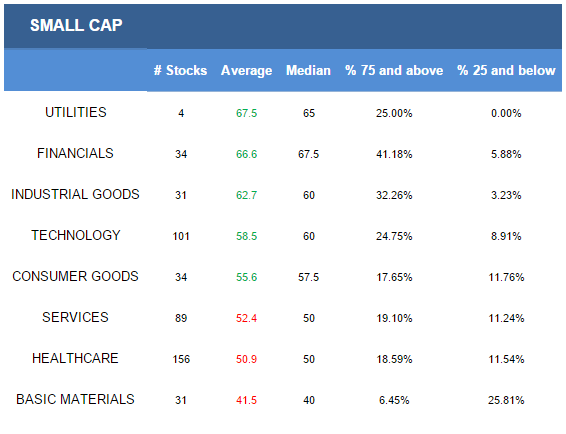

· Utilities (small sample size) & financials are best across small cap.

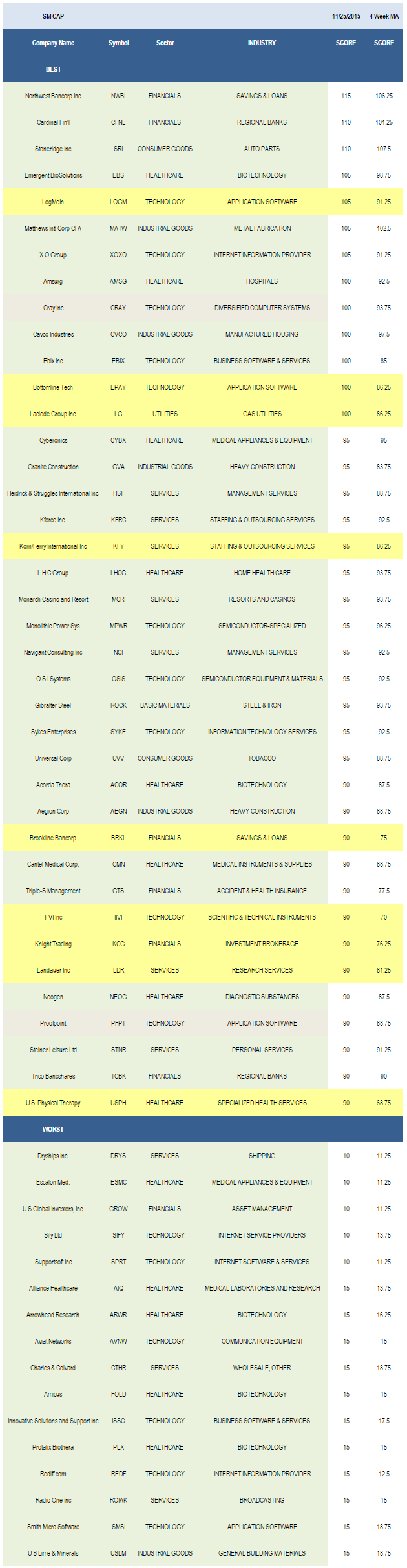

· The strongest scoring small cap industry is savings & loans.

The average small cap stock score is 54.50 and that's above the four week average score of 52.68. The average small cap stock in our universe is trading -31.11% below its 52 week high, -6.13% below its 200 dma, and has 8.24 days to cover held short.

Utilities, financials, and industrials score highest. Technology and consumer goods also score above average. Services, healthcare, and basics score below average and are industry and stock specific under weights.

.jpg)

Savings & loans (NWBI, BRKL, BANR, DCOM, PROV, COLB, OCFC), heavy construction (GVA, AEGN, MTRX), regional banks (CFNL, TCBK, LKFN, BBCN, MBWM), staffing (KFY, KFRC, CCRN), and application software (LOGM, EPAY, PRFT, QLYS) offer the most upside in small cap.

.png)

Across small cap basic materials, there are no above average scoring baskets. Processed & packaged goods (DMND, BDBD) and auto parts (SRI, SMP) are best in consumer goods. The top financials industries are S&Ls, regional banks, and investment brokers (KCG, GFIG). Home healthcare (LHCG, CHE, AMED) and medical instruments (CMN, MGCD, LMNX, VASC, ICUI) are strong in healthcare. The top industrials baskets include heavy construction, aerospace/defense (AVAV, LMIA), and industrial electrical (ULBI, DAKT). In services, buy staffing, management services (NCI, HSII), and resorts & casinos (MCRI, BYD). Application software, business software (EBIX, PRFT , CSGS, TSYS), and specialized semi (MPWR) should be overweight in technology.

.png)

Disclosure: None.

Thanks for your question. Our small cap ranking includes companies with market caps at inclusion that were below 2 billion and includes ADRs, such as the ones you mention. It is a small cap, rather than a U.S. domestic, report. Our ADR report is issued every Monday. Our large cap report is issued on Tuesday. Our mid cap report on Wednesday. And our small cap report is issued on Thursday. The report is generated from a portfolio of more than 1,700 equities and includes virtually all the institutional quality names portfolio managers tend to traffic in. Additional insight into the methodology is available at www.ebcapitalmarkets.com, including a podcast overview.

for the record SIFY, BYD and DRYS are non-US companies, SIFY is Indian, BYD Chinese and DRYS offshore Greek so they are not in the right portfolio. I assume it is because you need examples for the categories you have created but I am not sure about the whole process

while I don't know anything as much about US small cap stocks as I do about ADRs, again I am puzzled by how you select your examples and am worried about biases introduced by the use of single shares to cover different sectors within your major sectors. The single share may just happen to have woes or wonders which are unique to it, rather than to the sector. So there is selection bias at work here too.