Small Cap Best & Worst Report - October 9, 2014

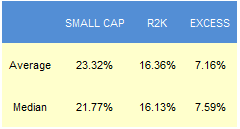

Since 2010, the average return for our weekly best scoring small caps has outpaced the R2K by a median 759 bps over the following year. The best performers from one year ago are HA up 79%, ARII up 69%, and SYNA up 56%.

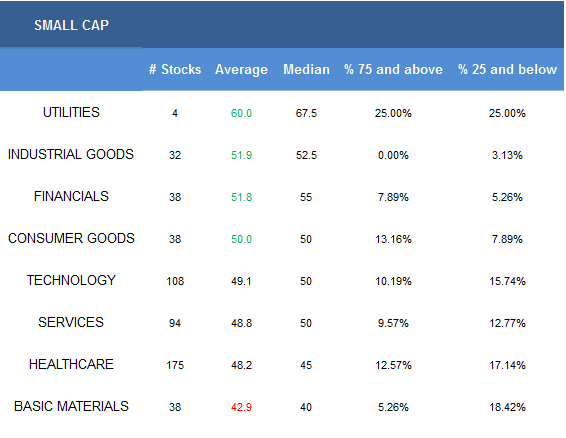

- The best small cap sector is utilities.

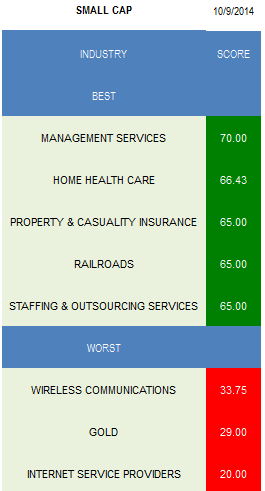

- The top small cap industry is management services.

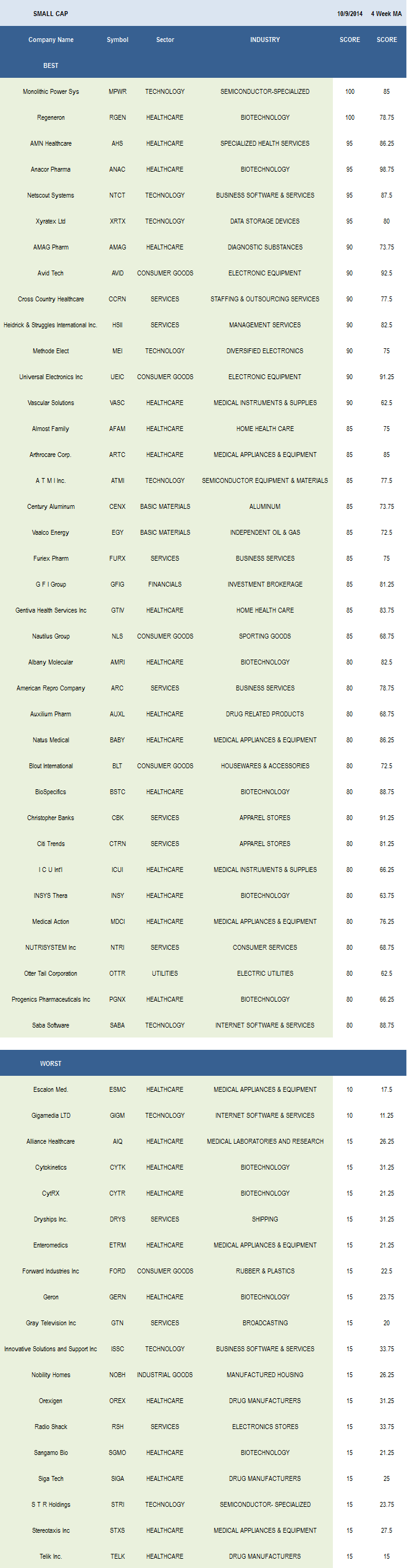

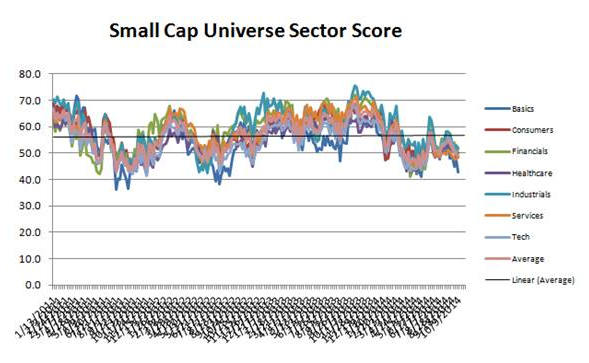

The average small cap score across our universe is 48.80, below the four week moving average score of 49.85. The average small cap is trading -29.98% below its 52 week high, -6.45% below its 200 dma, and has 11.04 days to cover held short. NOTE: Short interest is getting coincident with levels where small caps have rallied.

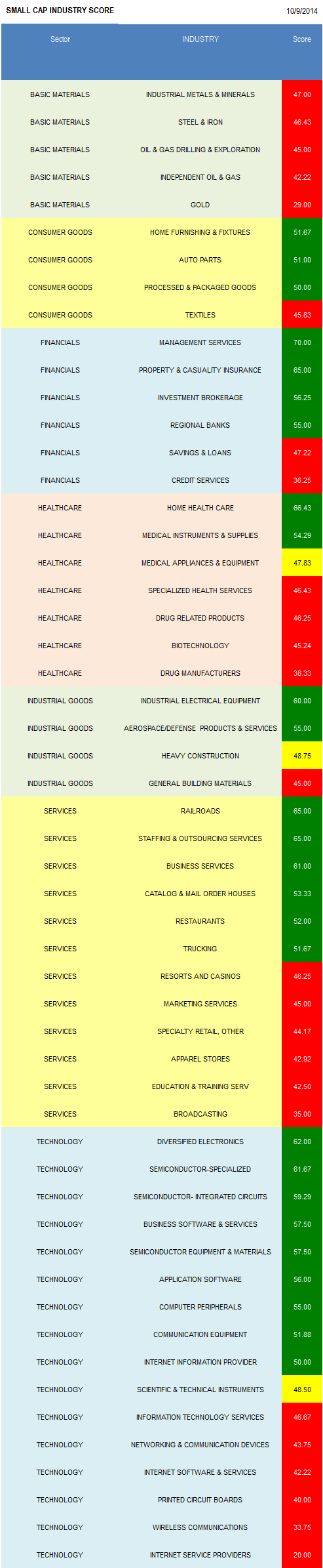

Utilities, industrials, financials, and consumer goods score above average. Technology, services, and healthcare score in line. basics score below average.

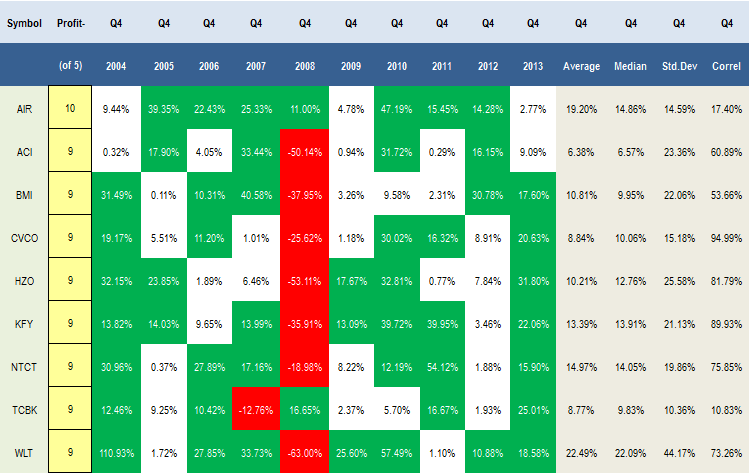

The following table shows those small caps with the best history of posting gains in the fourth quarter. All of these companies have gained in 9 or 10 of the past 10 Q4's.

The best scoring small cap industry is management services (HSII, CRAI). Home healthcare (GTIV, AFAM) is strong scoring. P&C insurers (STFC, MIG) offer upside on rate strength. Rail suppliers (GBX, RAIL) benefit from ongoing carload volume growth. Staffing stocks (CCRN, KFRC) benefit from seasonal hiring patterns and ongoing job growth.

No small cap basics baskets score above average this week -- trade up in market cap where possible. In consumer goods, buy home furnishing (ETH) and auto parts (SRI). P&C insurers, investment brokers (GFIG, KCG), and regional banks (CFNL, TCBK) are best in financials. Home healthcare and medical instruments (VASC, ICUI, LMNX) score above average in healthcare. Industrial electrical equipment (BGC, DAKT) and aerospace/defense (ORB) are top scoring across industrial goods. In services, buy rails, staffing, and business services (FURX, ARC, EXAM). The top technology groups are diversified electronics (MPWR), specialized semi (MPWR), and semi ICs (TQNT).

Disclosure: None.

Yes, $CYTK is a pos. If it gets over 4 again, I'm out.