Should Creditors Take Low Volatility On Face Value?

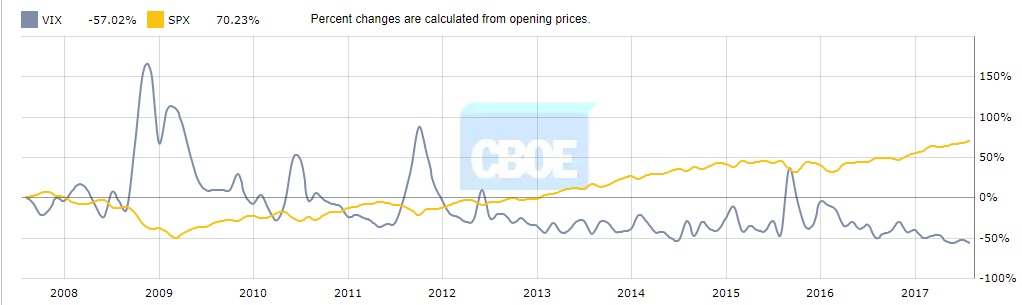

Low volatility is a good indicator of reduced lending risk. This is very evident when you look at the CBOE Volatility Index (VIX). During the global financial crises of 2008-2009, the Volatility Index peaked to historical highs to reflect the increased credit risk in the market and the risk of investing in capital assets overall.

Similar spikes can be seen in 2011-2012, which also marks the period when the Eurozone crisis was at peak levels thereby creating fears of a recurrence of the 2008/2009 crisis. The same happened in 2015, which was also characterized by the collapse of oil prices and the EUR/CHF forex flash crash.

However, a lot has changed since then with the CBOE Volatility Index now at the lowest levels in history. The current price per share of the CBOE Volatility Index is pegged at just under $10 and recently traded well below $9.50. Consequently, stock prices have been rallying to reflect the economic confidence levels depicted by the VIX, with the S&P 500 Index (SPX), the NASDAQ Composite and the Dow, all hitting historical highs.

And in response to the low volatility, creditors have increased their lending to businesses while consumer loans are yet to catch up. This could be partly because creditors are not completely convinced by the low volatility levels and are being extra cautious when lending to individuals. Consumers have also exhibited signs of restraint when it comes to borrowing while top credit repair agencies continue to caution against the unnecessary use of credit.

This is probably the reason why the U.S. consumer credit has been on a downward trend since the turn of the year. On the contrary, business lending increased during the first quarter of 2017 and is predicted to continue this trend in the foreseeable future. According to a report published by the WSJ, business lending by U.S. banks grew by 8.5% in the first three months of the calendar year and is now on track to overtake residential mortgages.

This clearly illustrates that while consumer credit has slowed in the last few months, banks have increased lending to commercial and industrial firms. The reason for this scenario is simple. Even if the current volatility levels were artificial, businesses will still benefit regardless. This is because of the dynamic nature of today’s financial markets, which seem to rely massively on the data as is presented by various economic indicators rather than the feeling and the atmosphere in the consumer markets.

For instance, the U.S. Federal Reserve has continued to hike interest rates even when the non-farm payrolls and the inflation rate have suggested otherwise. While the unemployment rate remains at multi-year lows, wages have failed to mirror the same trend leading economists to suggest that the quality of the new jobs being created every month is not at par with economic expectations.

Therefore, while the current levels of volatility might suggest that the level of investment risk has declined substantially, this may not be unconditionally true. Stock market investors seem to be excited by the current conditions given the way stocks have rallied over the last few months. But stock investors' counterparts in the lending market are a lot more cautious and won’t be hoodwinked into believing that there is nothing behind the veil.

Conclusion

In summary, the current volatility levels appear very attractive to lenders in the sense that the lower the market risk, the lower the credit risk. Theoretically, this means that default risk has declined, but the banks are not buying into this perception just yet. They have shown more confidence in lending to businesses than to individuals while credit advisers also seem to be wary of potentially, what could be a credit trap for borrowers, especially given the continued hiking of the U.S. Funds rate.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more