Shorting Volatility Affords Multiple Opportunities

The last few weeks have been quite turbulent for volatility traders with swings in the VIX of greater than 20% on several occasions. The roller-coaster ride in volatility indicated in the chart below identifies, however, real opportunity and not just implied opportunity. Timing volatility from the long side would prove to be difficult, but adding short positions into volatility spikes has proven more advantageous and with great capital gains.

Having reduced my short exposure to volatility ahead of those rip-roaring spikes in the VIX, I was fortunate enough to recapture my short positions significantly higher than where I had covered. And it’s with great appreciation for the VIX and volatility that I am found to have benefited from the most recent decline in the VIX by way of shorting VIX-leveraged ETPs such as ProShares Ultra VIX Short-Term Futures ETF (UVXY), VelocityShares Daily 2x VIX Short-Term ETN (TVIX) and iPath S&P 500 VIX Short-Term Futures ETN (VXX). Over the last 5 years plus I have been shorting these products on most any spike in the VIX that expresses a spike in these ETPs. For those who don’t have the stomach to short double leveraged products the inverse ETPs like VelocityShares Daily Inverse VIX Short-Term ETN (XIV) and ProShares Short VIX Short-Term Futures ETF (SVXY) might be a good fit for shorting volatility, as they are “long products.”

I’ll admit, the stochastics for the major averages are not looking favorable at the moment and largely adding to the movement in the VIX. The S&P 500 has pulled back roughly 3% from its all-time high. Fits and starts have plagued the index from recapturing its momentum due to rising fears surrounding the North Korean threat and general lacking of volume in the markets during the August- September period. August 23rd proved to be the lowest trading volume of the year for the equity markets. Total composite volume for U.S. stocks finished at 5 billion shares on August 23rd according to Dow Jones data. The average daily volume for August is 5.98 billion shares and for the year it's 6.54 billion shares. Where there is light trading volume there tends to be a greater propensity for markets to express volatility.

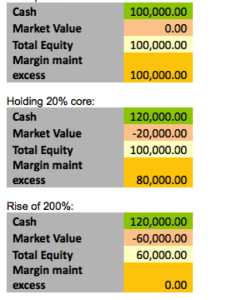

I’ve encouraged many of my followers, friends and associates partaking in a VIX-leveraged ETP strategy to employ great liquidity during the August-September period. For those of you who recall the August 2015 massive VIX spike that found shares of UVXY having appreciated upwards of 200+ percent you certainly understand as to why I expressed this measure of risk management. With a baseline of 200% liquidity in a trader/investor brokerage account your margin of error for shorting VIX-ETPs is well established. The following graphic (care of Guillermo Gomez) identifies my 20% core VIX-ETP short strategy in use for an independent trader’s brokerage account of $100,000 and a margin requirement of 100 percent.

In the event that an August 2015-like event came to pass the market values indicated would find the trader’s brokerage account at its limit before achieving a maintenance call. To be perfectly clear, the graphic doesn’t assume any additional trading positions or a uniform, 1-day VIX/ETP move of 200 percent. The graphic only assumes/depicts a core VIX-ETP short position value. For the most part, if traders/investors utilize a 20% core short VIX-ETP holding strategy annually, they do quite well. “But that’s only 20% Seth? Doesn’t it seem like a waste to only use that strategy or that little capital?” That’s a reasonable question.

Maintaining a 20% core UVXY or TVIX position annually and doing little else with one’s trading/investing capital may seem limiting, but the reality is quite the opposite. The decay on the two VIX-leveraged ETPs annually has been greater than 90 percent. For arguments sake and simplifying the numerical values let’s just say a trader/investor can double their capital invested annually by shorting these products. So if we take the model above on a $100k account with a 20% ($20K) short investment the trader/investor would have generated a 40% ($40K) return on their brokerage capital account for the year. Such a performance would have outperformed the benchmark S&P 500 rate of return for the year. That’s where you want to be as a trader/investor, beating the benchmark. And for those who follow my activity on Twitter and StockTwits, they come to understand that maintaining a 20% core position while scalping profits from intraday trading adds another layer of double-digit capital returns. Lastly, come the 4th quarter of 2017 and what has traditionally been a period of complacency with the S&P rallying through the holiday season, who’s to say a 20% core strategy can’t expand by 10% with measured risk? Mo money, mo money, mo money.

The last couple of weeks have found greater volatility and with that greater volatility the VIX-ETP short participation has only increased, creating a scarcity of shares to borrow short. I can attest that many of the brokerage houses have and currently lack shares to borrow. Shares of UVXY have scarcely been available to borrow even on Scottrade for which I’ve been forced to have their brokers find shares outside of the firm, successfully on two occasions. Shares of TVIX have also been in limited supply to borrow while shares of VXX have been readily available to borrow. VXX is not double-leveraged and therefore doesn’t offer the same share price decay as the formerly mentioned ETPs and as such is utilized to a lesser degree by volatility traders. Having said that, VXX is still a worthy short instrument when others are in limited supply. The short volatility boat is crowded my friends.

A crowded trade, however, doesn’t necessarily mean a contrarian play is optimal or that the trade is crowded for lack of reason. In fact, a crowded trade becomes crowded because it has worked, it is reasonable and can be correlated to fundamentals. The fundamentals behind shorting VIX-leveraged ETPs and/or volatility have been and remain quite strong. The fundamental reasons for shorting VIX-leveraged ETPs and/or volatility are in no particular order, but offered as follows:

- Consecutive quarters of double-digit S&P earnings growth

- Underpinnings of the economy remain strong even during an elongated expansion period

- Consumer spending and retail sales continue to grow with 2/3rds of the U.S. economic activity consisting of consumer consumption

- Relatively low energy costs contribute to economic activity

- Bond yields continue to underperform, forcing investors to seek out higher rates of return

- FOMC remains accommodative

- Global central banks remain accommodative

While one can easily add to the bullet points above it is the corporate earnings growth that I, and many investors, remain highly focused upon. It is this earnings growth that creates confidence among the investor community thus creating elongated periods of complacency in the equity markets. The end product of this complacency being relatively low volatility.

Of course some of the aforementioned bullet points can be eliminated in the future if not all for which volatility would naturally increase and equity markets would depreciate in value. What if central banks become less accommodative or are extricated from market intervention? Won’t bond yields soar, inflation set in? Won’t that increase volatility? Yes, yes and yes. But here is ideally and fundamentally what VIX-leveraged ETP shorts would better need to consider in such an environment: What’s my liquidity level and how do I mitigate my short strategy through such a time period whereby yields rise and equity prices fall? Print it out, post it on your PC or laptop cover, tattoo it on your arm if you so choose, but that is the “greatest consideration”.

There’s no such thing as longstanding or long-lasting bond yield inflation. Pull up your chart on the 10-year yield and try your darndest to call me a liar. If it weren’t for the 80’s, one wouldn’t have to think twice about my assertion. In a credit-based economy whereby the good faith and credit-lending standard is backed by the U.S. government and leveraged by bonds/debt, the laws that govern economics can only find bond yields going in one direction long-term…down, down, down! But regardless of the long-term trajectory for bond yields, as it pertains to our “greatest consideration”, those momentary periods whereby bond yields do inflate could cause lower equity multiples and greater volatility in the markets as a whole. Fortunately though, greater volatility will ultimately plateau in short order for which it will subsequently decline and find a basis for equilibrium. The gap in volatility from the prior period of complacency to the upper peak and back down to a resting point (albeit higher than previously) is the risk mitigation volatility shorts need to acknowledge. Volatility, regardless of the stimuli introduced to the markets does not have the ability to trend higher for elongated periods of time. Simply put, as I often say and as the history of the VIX evidences, increasing levels of volatility exist for extremely short bursts. The VIX is a 100-meter Olympic champion, but it is no Marathon Olympic champion or even participant. If it were a marathon runner nobody would put money into the equity market for its expression of great volatility.

So what does a volatility short trader/investor do when the bull market fades, central banks remove accommodative measures, corporate earnings contract and volatility rises to a new resting point? As mentioned in the past, a good volatility trader also has a strong acumen for economics and understanding the cyclicality of the economic cycle. Many of my followers have read many of my articles over the years that include the subject matter surrounding retailing and individual retailers such as Target (TGT), Wal-Mart (WMT), J.C. Penney (JCP), Macy’s (M) and Bed Bath & Beyond (BBBY just to name a few. If you understand how retail and the consumer work, you’ve covered 2/3rds of the economic conditions and trends in the U.S. economy. So I guess what I’m trying to offer with the tangent is that volatility investing and trading will lighten in future years but not limit mine or my followers’ potential to outperform the benchmark average. If newcomers to my volatility strategy and disseminations have found the accuracy for which I’ve participated with VIX-leveraged ETPs informative and beneficial then allow yourselves the time to read my past and ongoing retail focused articles. One of my first retail articles centered on Target. The title, how fitting as we are some 5 years since this article forecasted the woes to come, Target And The Big Retail Bust found with it great criticisms when published in 2012. I encourage readers to give it gander and pay special attention to the comments at the bottom of the article. Covering the Bed Bath & Beyond stories for the better part of a decade I couldn’t have warned investors any more prominently than with an authored work titled Bed Bath & Beyond: Stay Away On April 8th when that article was published, the share price was just under $50 per share. Today, the BBBY share price rests just below $29 a share.

I’ve written dozens upon dozens of articles for retail-centric investors, mostly warning of the seismic shift in the retail consumption environment. In tandem with my volatility investing strategy I’ve been able to take advantage of my knowledge concerning the retailers named to identify swing-trading opportunities in these retail stocks over the last several years and as of last week. Most of my swing trades are offered through my StockTwits and Twitter feed in the same manner as my volatility trades. My independent annual investment returns prior to the commencement of VIX-leveraged ETP trading/investing was around 35% and still beating the benchmark average year after year after year. Volatility isn’t everything, but it makes for great outperformance. In short, your opportunity today as a volatility short is to seek out another area of expertise for which you can continue to outperform during times when the short volatility trade might yield a lesser ROIC. Let’s face it; the VIX-leveraged ETP short strategy has gifted investors with the time to grow a secondary basis of knowledge through already captured capital gains. Keep in mind be it a bear or bull market, that is not the determining factor guiding VIX-leveraged ETPs. Markets can fall in an orderly fashion whereby volatility doesn’t necessarily rise substantially or for great periods of time, but gradually and forcing for investors to still forecast low levels of implied volatility through VIX Futures. Greater than 60% of the time when the S&P 500 has been negative on the trading day, UVXY shares have also decayed in price. Additionally having said all of that, if a bear market should find the ROIC of VIX-leveraged ETP shorts curtailed for half of its ROIC during a bull market cycle…I’ll still take that ROIC. Bear markets have short life cycles whereas bull markets last far longer and as such I would be of the opinion that when the time comes the short volatility trade will increase yet again. But we’re not there yet folks, not quite there.

I’ve been an investor for many years now. In the past I held a partnership in Capital Ladder Advisory Group before certain of its assets were acquired. Our research was widely purchased amongst the hedge fund community. I’ve held and hold relationships with such hedge funds to this date.

While the coming week/s will likely prove to continue to be choppy in my opinion, the trading environment will also likely prove to remain strong. Short volatility scalping will be my focus and especially if contango progressively increases. As of the close of last week, contango rose above 7 percent. This represents a high cost for long-term holders of UVXY, TVIX and VXX. Should contango rise to 10% I will likely expand my short position for longer trading time frames i.e. a few days to a week. I don’t anticipate making any additional changes to my core VIX-leveraged ETP holdings in the near-term. Having said that I know I must pay close attention to the pending Muller/Trump administration investigations. There has been little discussion or details surrounding the progression of the investigation, which could lead to a very unexpected announcement in the coming months. So where I would typically be expanding my core short position to 30% at this time of year, I’m forced to respect the political landscape at-hand or that lay ahead.

Key Investor Takeaways

I hope traders and investors walk away from this article with at least 3 key understandings: 1.The short VIX-leveraged ETP strategy has already captured hefty capital gains YTD and gifted investors an opportunity to seek out another expertise and basis of knowledge for which to utilize in future investing years. 2. A bear market does not equate to underperforming capital gains using a short VIX-leveraged ETP strategy. 3. I can offer great resources for traders/investors.

And one last thing. I think the New York Times will have something to offer in the coming days regarding the short volatility trade and those who participate…me thinks it be so.

Disclosure: I am short UVXY, TVIX and VXX. All swing trades in BBBY and TGT have been closed.

Another great article! What a gift you are to your readers. We are blessed to have this opportunity to gain knowledge from such a knowledgeable mentor.

Great article. Thanks, Seth.

I am new to the short volatility party. Can you please share how to measure contango?

BTW, I did go to the VIXCentral page based on one of your Utube videos. I am in the process of reading your other articles.

Thanks.

So the way I view contango on a percentage basis regarding low-high contango is: Contango below 5 is low, no need to add positions LT but can scalp w/bit more risk. 5% contango edges near high contango and is what I refer to as the chop zone. above 5% contango is high contango where short risk is lesser and can perform daily scalps.10% & ^ is high contango whereby one can consider adding longer-term short positions. It's not a hard and fast formula but it has a good efficacy.

Thank you so much for the prompt reply.

Fantastic job Mr. Golden! I find it funny all the so called "experts" bashing how you have perfected this. Congratulations on finding something you are obviously so well skilled at and maximizing it to the fullest.

Yes, nice job.

Thank you Chad and Seth is just fine by me. Experts...had my fair share of run in with experts over the years for which my dedication to a field of study or market participation proved a pretty valid and profitable path. I hope those who have read my works over the last 5,6 years have learned and continue to learn that if they have the time and dedication they can achieve great investing success.

Not only educative, but very well written. Must be hard work. Seth, you have been educating and helping small investors who do not have free access to very successful trades. Great service! You deserve to baost. Salute!

I agree

Thank you for reading Vinay and for the compliments! I will have a website in the coming months that hopefully helps to more conveniently and daily engage investors and traders. Thank you again and I hope your trading has benefited from mine and other's articles on TalkMarkets.