September 2018 CFNAI Super Index Moving Average Declined

The economy's rate of growth slowed based on the Chicago Fed National Activity Index (CFNAI) 3 month moving (3MA) average - but economic growth remained above the historical trend rate of growth.

Analyst Opinion of the CFNAI This Month

The single month index which is not used for economic forecasting which unfortunately is what the CFNAI headlines. Economic predictions are based on the 3 month moving average. The single month index historically is very noisy and the 3 month moving average would be the way to view this index in any event.

There was upward revision to August's data.

The bottom line is the economy is doing better than average in times of economic expansion..

The three month moving average of the Chicago Fed National Activity Index (CFNAI) slowed from +0.27 (originally reported as +0.24 last month) to +0.21

PLEASE NOTE:

- This index IS NOT accurate in real time (see caveats below) - and it did miss the start of the 2007 recession.

- Expectations from Econoday was 0.11 to 0.22 (consensus +0.18) - the actual was +0.17 for the single month index which is not used for economic forecasting.

- This index is a rear view mirror of the economy.

z cfnai2.PNG

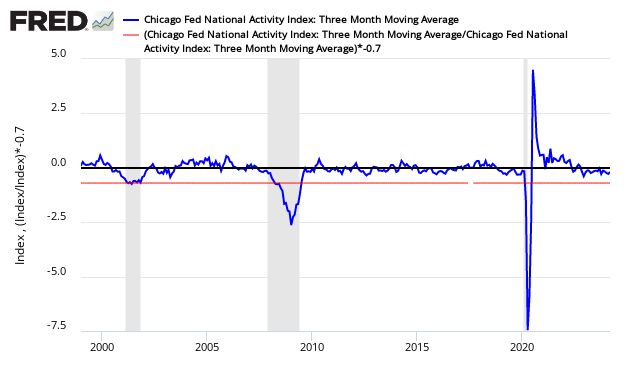

A value of zero for the index would indicate that the national economy is expanding at its historical trend rate of growth, and that a level below -0.7 would be indicating a recession was likely underway. Econintersect uses the three month trend because the index is very noisy (volatile).

CFNAI Three Month Moving Average (blue line) with Historical Recession Line (red line)

As the 3 month index is the trend line, the overall trend for the last few years is upward - but the short term trend is down As stated: this index only begins to show what is happening in the economy after many months of revision following the index's first release.

CFNAI Three Month Moving Average Showing Month-over-Month Change

The CFNAI is a weighted average of 85 indicators drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

CFNAI Components - Production and Income (orange line), Employment / Unemployment & Hours (green line), Personal Consumption & Housing (blue line), and Sales / Orders & Inventory (red line)

Low Personal Consumption has been a headwind on the index for the last three years. The other three elements of the CFNAI have taken turns dragging the index down. The Chicago Fed's explanation of the movement this month:

The Chicago Fed National Activity Index (CFNAI) decreased to +0.17 in September from +0.27 in August. Two of the four broad categories of indicators that make up the index decreased from August, but three of the four categories made positive contributions to the index in September. The index's three-month moving average, CFNAI-MA3, moved down to +0.21 in September from +0.27 in August. The CFNAI Diffusion Index, which is also a three-month moving average, was unchanged at +0.18 in September. Forty-six of the 85 individual indicators made positive contributions to the CFNAI in September, while 39 made negative contributions. Thirty-six indicators improved from August to September, while 49 indicators deteriorated. Of the indicators that improved, 11 made negative contributions.

The contribution from production-related indicators to the CFNAI moved down to +0.11 in September from +0.16 in August. Industrial production increased 0.3 percent in September after rising 0.4 percent in August. The sales, orders, and inventories category made a contribution of +0.05 to the CFNAI in September, down from +0.10 in August. The Institute for Supply Management's Manufacturing New Orders Index decreased to 61.8 in September from 65.1 in August. Employment-related indicators contributed +0.07 to the CFNAI in September, up slightly from +0.06 in August. The civilian unemployment rate decreased to 3.7 percent in September from 3.9 percent in August; however, nonfarm payrolls increased by 134,000 in September after rising by 270,000 in the previous month. The contribution of the personal consumption and housing category to the CFNAI edged up to -0.05 in September from -0.06 in August. On balance, consumption indicators improved slightly from August, pushing up the category's overall contribution in September. The CFNAI was constructed using data available as of October 18, 2018. At that time, September data for 51 of the 85 indicators had been published.

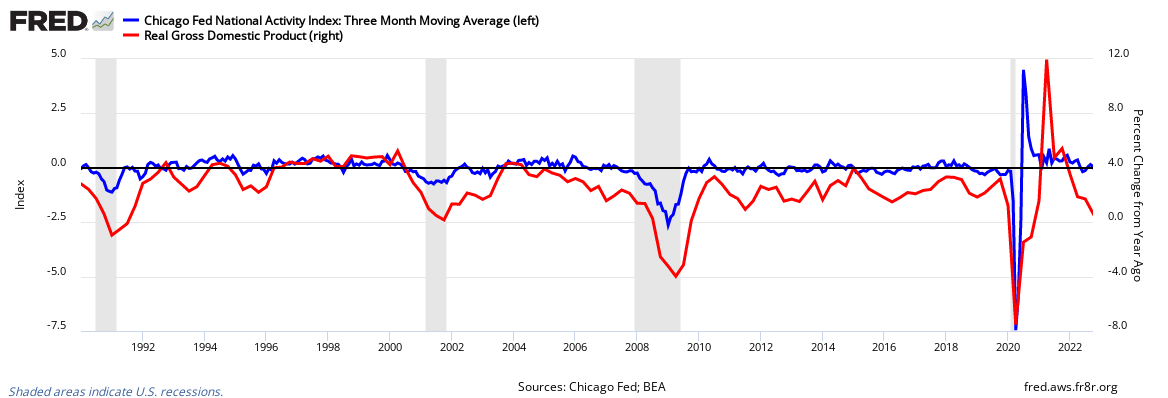

Econintersect considers the CFNAI one of the better single metrics to gauge the real economic activity for the U.S. - and puts the entire month's economic releases into their proper perspective, although it is almost a month after the fact. It correlates well and historically has lead GDP. Note that the CFNAI is updated monthly and within 30 days of period close. GDP is released quarterly so lags the CFNAI by up to three months.

As the CFNAI is a summary index, the data must be assumed correct to give it credibility. This assumption has been justified in the past because the index has proven to have a good correlation to the overall economy. When using this index, it is trend direction which is important - not necessarily the value when the index is above -0.7, the historical boundary between expansion and contraction.

Caveats on the Use of the Chicago Fed National Activity Index

The index is quite noisy, and the only way to view the data is to use the 3 month moving average. As this index is never set in concrete, each month a good portion (usually from January 2001 onwards) of the data is backwardly revised slightly. The most significant revision is in the data released in the last six months due to revisions of the 85 indices which are embodied into the CFNAI.

Even the 3 month moving average has over time significant backward revision. This is due both to changing methodology and backward revisions of this index's data sources. This point is important as the authors of this index have stated that -0.7 value is the separation between economic expansion and contraction. The graph below shows the difference between the original published index values and the values of the index as of August 2011.

This index seems to continuously creep - and when using this index in real time, Econintersect would assume the index values when first released could easily be off in a range +0.2 to -0.2 as the data in the future will be continuously revised. However, there are times when the uncertainty in real time can be much larger. For seven consecutive months in the Great Recession, backward revisions ranged from -0.7 to -0.9. In such times of severe economic stress the CFNAI has little real time accuracy, although it still definitely was showing that the economy was bad. It simply did not reflect exactly how bad in real time.

We can compare the CFNAI to ECRI's coincident index which is released monthly almost in real time. It is true that using ECRI's coincident index, the year-over-year rate of change is at recession levels - however, the CFNAI's rate of change provides a different conclusion.

In real time, ECRI's coincident indicator may be providing a better yardstick for the Wall Street economy. While in hindsight, CFNAI seems more intuitive - but is inaccurate in real time because of backward revision. GDP lives in its own world (as opposed to what economy is experienced by the population in their own lives) and has general correlation to most broad forecasts or coincident indexes as a selected view of the overall economy. However, I do not believe GDP has a good correlation to the Main Street economy.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more