September 2017 FOMC Meeting And Gold

Yesterday, the Fed released its most recent monetary policy statement. How can it affect the financial markets?

In line with expectations, the Fed kept the federal funds rate target unchanged at between 1.00 and 1.25 percent:

“In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1 to 1-1/4 percent”.

As we predicted in yesterday’s preview, the statement was little changed, but the U.S. central bank acknowledged the subdued inflation, as it pointed out again that inflation was running below 2 percent this year. The Fed also added some remarks about the recent hurricanes, but just to ease any worries about their long-term economic impact:

“Storm-related disruptions and rebuilding will affect economic activity in the near term, but past experience suggests that the storms are unlikely to materially alter the course of the national economy over the medium term.”

As expected, the Fed announced the unwinding of its $4.5 trillion balance sheet. It did it in a very laconic way, since it wrote just one sentence about the normalization:

“In October, the Committee will initiate the balance sheet normalization program described in the June 2017 Addendum to the Committee's Policy Normalization Principles and Plans.”

Because the decision was widely anticipated, the announcement should not move the financial markets significantly. Indeed, there are no surprises here: ‘quantitative tightening’ will be very passive and gradual. And the Fed’s balance sheet will not return to pre-crisis levels.

When it comes to the Summary of Economic Projections, the FOMC members generally stuck to their forecasts from June. They increased the GDP growth rate forecast from 2.2 percent to 2.4 percent this year and from 1.9 to 2.0 in 2019. They also reduced slightly the forecast unemployment rate for 2018 and 2019, the expected overall inflation rate for 2019, and the core inflation rate for 2017 and 2018.

However, the expected path of interest rates hikes remained unaltered this year and 2018, but was reduced slightly for 2019 and beyond. Now, the Fed expects that there will be one more rate increase this year, and three rate hikes of 25 basis points in 2018 and two more in 2019 (one less than in June’s projections).

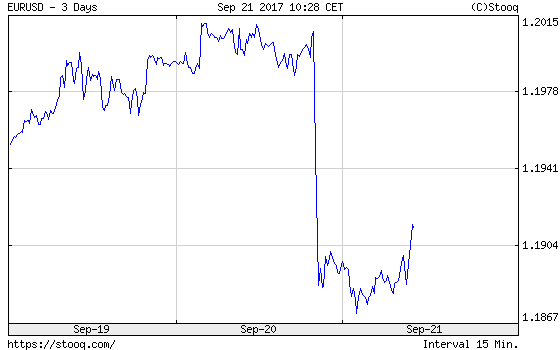

On balance, these changes should be interpreted as hawkish, since the investors’ expectations were much more dovish. The market odds of a Fed hike in December were less than 60 percent, and investors did not expect another rate hike at least until August 2018. Now, the markets will have to adjust their expectations. As the market odds of a Fed hike in December rose to more than 70 percent, both the EUR/USD exchange rate and the price of the yellow metal plunged initially after the announcement, as one can see in the charts below.

Chart 1: EUR/USD exchange rate over the three last days.

(Click on image to enlarge)

Chart 2: Gold prices over the three last days.

(Click on image to enlarge)

To sum up, the Fed did not change its interest rates, but announced the unwinding of its large balance sheet. But they key piece of news is that the U.S. central bank stuck to its previous plans despite subdued inflation and the landfalls of hurricanes, just as we predicted in our yesterday’s preview. The statement was, thus, interpreted as hawkish, in line with our expectations. As the Fed stayed on track to normalize its monetary policy, the U.S. dollar appreciated initially against the euro, while the price of gold plunged. Now, what’s next? We believe that there is room for further adjustments in the market expectations of the future path of interest rates – and this is not good news for gold. Anyway, in the upcoming editions of the Gold News Monitor, we will cover Yellen’s press conference and its consequences for the gold market.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly more