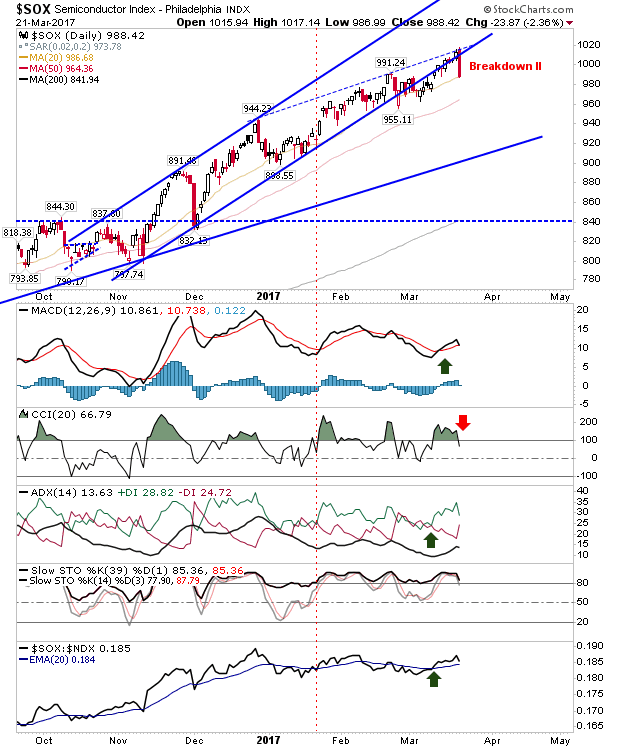

Seniconductor Shorts Gifted Their Positions

For those who took advantage of the resistance test in the Semiconductor Index; there was a picture perfect test of the hashed blue line resistance and secondary break of former rising channel support. The Semiconductor Index finished bang on the 20-day MA so there may be a little (big?) bounce tomorrow. If buyers can't defend the 20-day MA then the 50-day MA is next.

The S&P did not experience the biggest loss, but it did undercut the recent swing low. In fact, the relative performance of the index against the Russell 2000 kicked on in the S&P's favour, but it may not be enough. The next logical test is the 50-day MA at 2,326. Today was also marked by significant distribution and a 'sell' trigger in

It was a similar story for the Nasdaq as it undercut the swing low. Volume climbed in distribution (as it was for other indices) with a new 'sell' trigger in +DI/-DI. The only hang-on for bulls is bullish stochastics. The 50-day MA at 5,736 is looking like a good place for buyers to return to the index.

The Russell 2000 was the weakest index coming into today, but today it gave up close to 3% as sellers swarmed the index after having long said goodbye to its 20-day and 50-day MAs. The next question is whether it can defend 1,342; if it can't, then it's about looking at the 200-day MA.

For tomorrow, given the extent of 1-day losses over the last 6-months (not many), the likelihood of a rally is quite high. The indices hardest hit - the Russell 2000 and Semiconductor Index - are most likely to post the biggest gains. However, if there is not a positive reaction in the first half-hour of market action, then these same indices will be most likely take the biggest losses.

Disclosure: None.