Semi Equipment Company AMAT: Record Earnings

While some might want us to focus solely on the big layoff at Cisco, why don’t we stay with what is actually happening. What is actually happening is that there are pockets of weakness and pockets of strength, throughout the economy. Cisco for example, cites the Brexit disturbance for some of its issues. It is more of a lagging, consumer-direct oriented company after all.

Applied Materials on the other hand, gave us the heads up on bullish things months ago…

AMAT Chirps, B2B Ramps, Yellen Hawks and Gold’s Fundamentals Erode

Lest gold bugs panic about that title, gold eroding vs. positively correlated assets and markets can be part of an inflationary plan.

Back on message, AMAT is booming and the Semi Equipment sector has been a place to be; a leader, a Canary in the Coal Mine, just as we labeled it months ago. Key Semi Equip. company AMAT has now reported record earnings on strong demand from Smartphone chip makers.

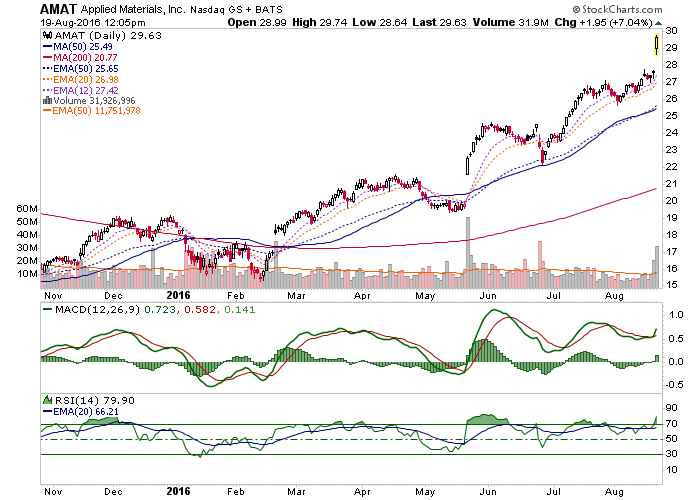

The stock reacts thusly…

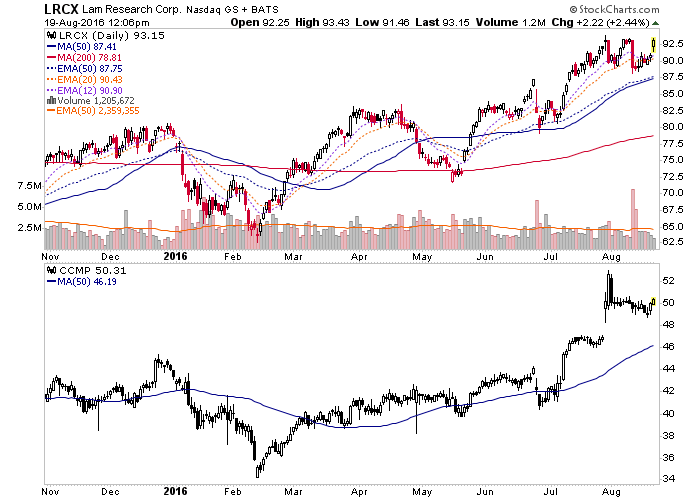

I already took a good profit on AMAT and did not buy it back. Instead, I bought back LRCX after it got conked down on threats to its merger with KLA Tencor, and have held CCMP, which is not an equipment company, but supports the Semi manufacturing equipment industry with materials and compounds used in the process.

There are some aspects to this report that are AMAT specific, like its specialty in OLED and strategic initiatives by Apple that DD doers may want to look into. But this does bode well for the industry. At the least, we remain on plan and live to fight another day.

“OLED display creates an incredible opportunity for us,” Dickerson said, as reported by Bloomberg. “This is going to be sustainable growth. This is not a peak.”

Disclosure: Subscribe to more