Sector Strength - Monday, March 13

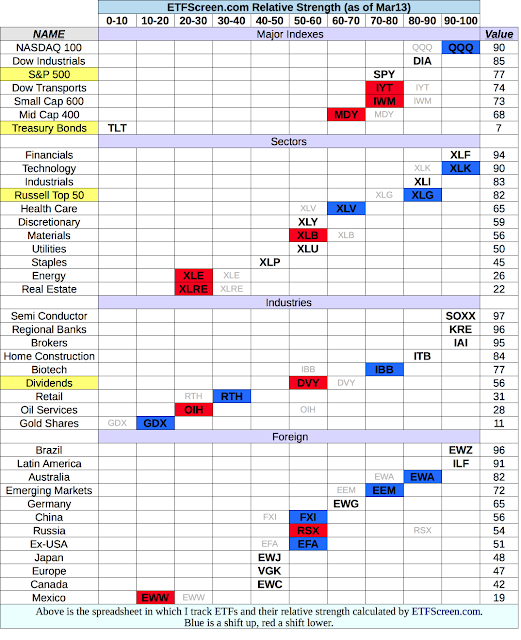

What is this spreadsheet telling us?

Among the major indexes, the large cap SPY has gained ground on the small caps, and that is often a sign of a weakening medium-term trend. It was just a couple weeks ago that IWM was the leader. Plus, these indexes are all skewed far right, and that usually indicates that the best time to buy has passed based on a risk-reward basis.

The Sectors show the inflation-sensitive Energy and Materials shifting left, while the rate-sensitive financials are in the top spot. Plus, the mega-cap XLG is gaining strength meaning that investors are focusing on the slower growing companies with very strong balance sheets.

Regarding the industries, as long as the Semiconductors are the leaders, you have to like the chances that the stock market is headed higher. Strength and leadership by this group usually means good things for stocks overall. Also, strength in Home Construction and Biotech also favors the broader stock market.

The Foreign stocks continue to show strength overall. I might let you draw your own conclusions with this group. I was expecting to see more weakness in the emerging market ETFs, but maybe it is too soon.

Bottom line: Stick with the outperforming ETFs, and cut back on the ETFs dropping in strength. At the moment, I think that means favoring large caps, financials, technology, home construction, biotech. Regarding the foreign ETFs, keep an eye out for shifts in leadership.

(Click on image to enlarge)

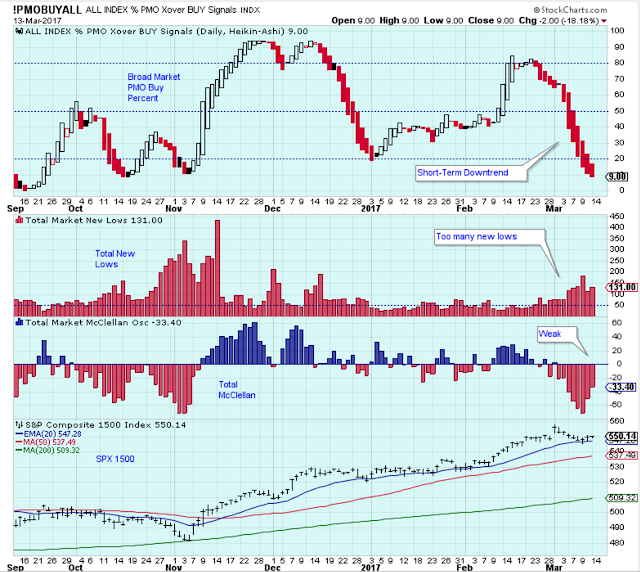

The Short-Term Trend

The short-term trend remains pointed lower, but with the PMO at this level, we are on watch for signs of the next short-term uptrend.

But who knows. The short-term trend has been difficult to trade over the last few months. So I am not counting on a rally. Instead, I am going to wait and just let the indicators and indexes tell me what to do.

(Click on image to enlarge)

The Leader List

The stock market can be so boring sometimes, like today. But tracking the leader list can make even the dullest day a bit more interesting.

INDY joined the leaders today. I am wondering if XLY and XLV will join the leaders soon.

(Click on image to enlarge)

A big election win for Indian Prime Minister Modi helped the India stock market, although it has been climbing for weeks. This is a nice 52-week breakout, but I am expecting that this gap will be closed after the excitement of the election wears off. That might be a better entry point.

Also important, the Rupee has been trending higher versus the USD since October. In my view, if you are tempted to own this ETF, I would also pay attention to the Rupee/USD pair. The currency heavily influences the price of this ETF.

(Click on image to enlarge)

The long-term outlook is positive.

The medium-term trend is up.

The short-term trend is down.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, ...

more