SBUX, XOM And PG May Be Turning A Corner

I like to see what the technical indicators say each day on some of the most popular stocks and post those results on my Stock Picks Blog.Today Starbucks (NASDAQ:SBUX), Exxon Mobil (NYSE:XOM) and Procter & Gamble (NYSE:PG) all still have Trend Spotter sell signals but those signals are beginning to weaken and just may turn to corner soon:

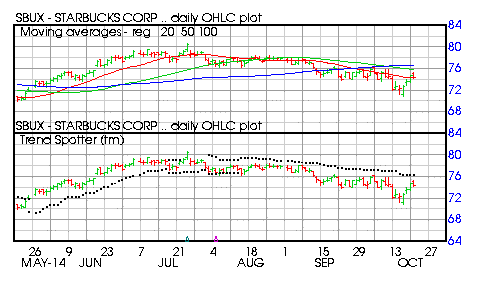

Barchart technical indicators:

- 32% technical sell signals

- Trend Spotter sell signal but weakening

- Above its 20 day moving average but still below its 50 and 100 day moving averages

- 9.88% below its recent high

- Relative Strength Index 50.04%

- Barchart computes a technical support level at 72.28

- Recently traded at 74.31 which is below its 50 day moving average of 75.83

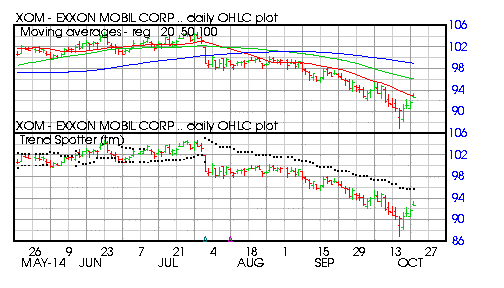

Barchart technical indicators:

- 48% technical sell signals

- Trend Spotter sell signal but weakening

- Below its 20, 50 and 100 day moving averages

- 11.58% off its recent high

- Relative Strength Index 45.61%

- Barchart computes a technical support level at 90.17

- Recently traded at 92.65 which is below its 50 day moving average of 96.08

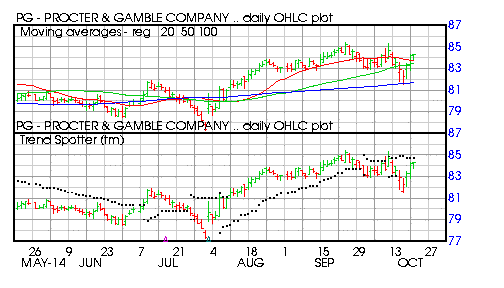

Barchart technical indicators:

- 48% Barchart technical buy signal

- Trend Spotter sell signal but weakening

- Above its 20, 50 and 100 day moving averages

- Only 1.95% below its recent high

- Relative Strength Index 53.95%

- Barchart computes a technical support level at 82.28

- Recently traded at 84.32 which is above its 50 day moving average of 83.46

Disclosure: None

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!