Say No To Currency Contagion

Once again the deteriorating relationship between the United States and Turkey is leading the news. The Lira is sliding again and it does seem to be bringing some of the other emerging market currencies with it.

As we've been saying throughout the week, it's very possible that the declines in the crypto market earlier this week are due to a stronger US Dollar more than anything else.

As I've said before, in order to understand what's happening in crypto, we must look at what's happening in the rest of the economy as well. In this case, the US Dollar strength isn't coming from Turkey, that's just the catalyst.

The Greenback has been gaining ground since early April on the promise of higher interest rates in a strong economy. So far today, it doesn't seem that the Lira's slide is affecting the other major currencies though, nor has it touched crypto for the time being.

Today's Highlights

- Currency Contagion

- Looking at Metals

- ETC Backwards

Traditional Markets

Now that we've established the underlying theme and why the Dollar's been surging, it seems that the situation has largely been contained. At the beginning of the week, the strong Dollar was taking out everything in its path. Today, the declines seem to be limited to the emerging markets.

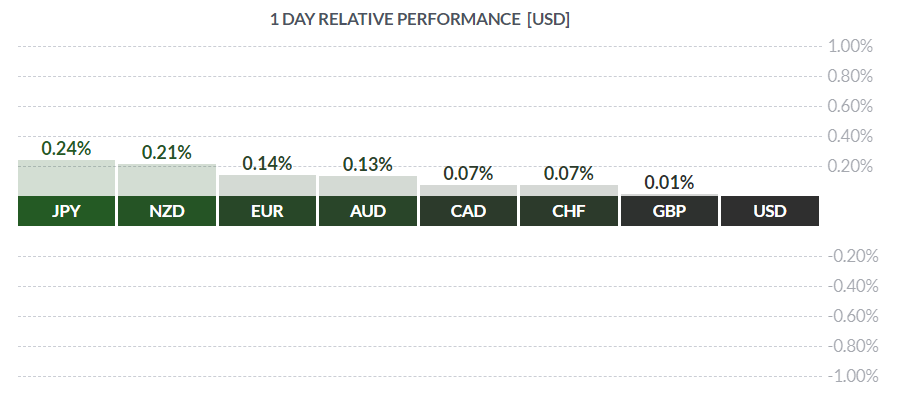

In fact, of the major currencies, the USD is the worst performer today.

(Click on image to enlarge)

So even though the Dollar is rising against the Lira, Peso, and Rand...

... it doesn't seem to be spilling over into other markets today.

Looking at Metals

Now that we've seen one of the biggest declines in the metals markets in recent history, it's time to examine the long-term charts again.

Frankly, the weakness in metals still doesn't make much sense to me. As we saw the Dollar strength earlier in the week, it did decline further but the declines seem disproportionate to the gains of the Buck.

Actually, what we're seeing since 2011 is a precious metals market that's been trending down.

(Click on image to enlarge)

The question is, has that dynamic come to a head?

The fun thing about the way down is that eventually, you run into a lower barrier at the production cost. Meaning, if the price to mine a metal is higher than the price to sell it, miners will stop mining, which generally tends to drive up the price.

A quick look at the mining costs of all three of the above does seem to indicate that those prices are quite close or even already passed.

A Crypto of its own

It's good to see the rebound taking hold in the crypto markets despite the emerging currencies continuing to sell-off today. This is a positive indication that crypto is less sensitive to the moves of the Dollar but under extreme circumstances still is susceptible.

One thing that seems to be sticking out like a sore thumb is Ethereum Classic. In this graph, we can see that ETC (white line) has been acting out since mid-June and simply hasn't been following the rest of the market.

(Click on image to enlarge)

This type of go-it-alone price action is typical when prices are moving up, but we almost never see it when prices are declining.

One of the reasons might be due to the listing of ETC on Coinbase. A new door to this crypto could mean new money flowing in. This could be worth keeping an eye on in the next few days. I'm eager to see how long it will take to fall back in line with the other cryptos or if it increases in market share following the listing.

Disclaimer: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of ...

more

Interesting. Contained to subprime currencies. Lol.