Safety Trades Fade

Good morning, everyone, and welcome to the last day of what’s been a terrific month.

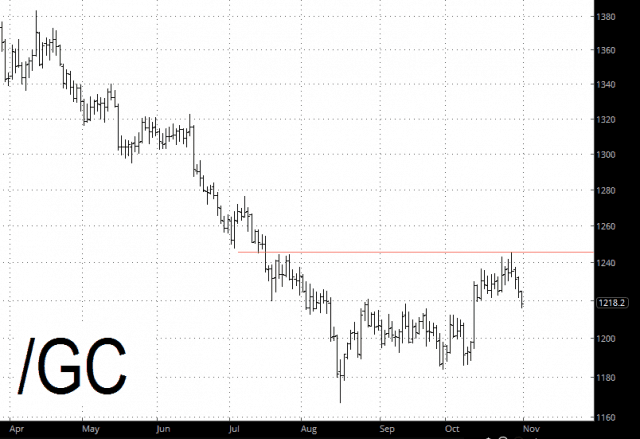

I’ve got puts on a couple of markets that were the “flight to quality” trades during the big selloff. One of them is gold, which is down nearly $9 this morning. Precious metals can’t seem to get off the mat, no matter what the other markets are doing.

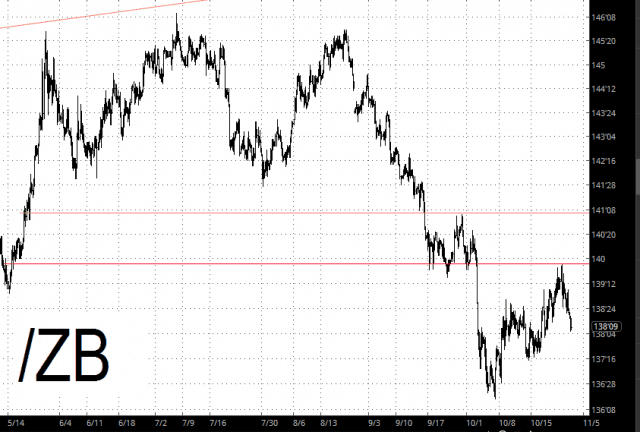

Far more interesting to me for a multitude of reasons are the bonds, which are down about half a percent as I’m typing this. The pattern is much more significant and well-formed.

I’m still in “semi-wait-and-see” mode. I’m closing out an absolutely dynamite month, and as of this moment I’m only “half-in” with 150% of my buying power committed to 54 short positions. Given the strength this morning, I imagine I’ll get stop out in a few places, but I want to see if things look like they’re stalling out intraday.

The Main Event, of course, is tomorrow’s AAPL announcement after the close. I think that’ll be psychologically important, just as FB was yesterday evening.