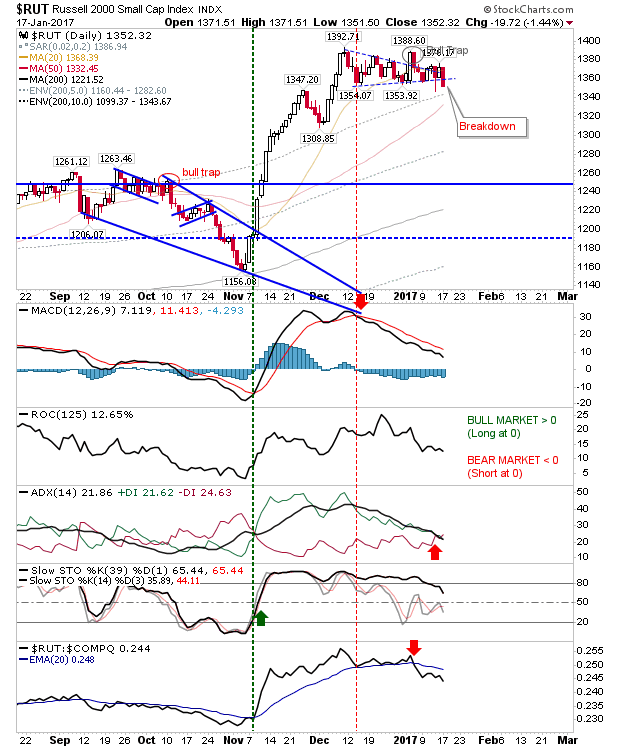

Russell 2000 Breaks Lower

In the end, it was Theresa May and not Trump which saw the Russell 2000 cut through support and confirm the earlier 'bull trap'. This change coincided with a 'sell' trigger in +DI/-DI. Only stochastics are hanging on to its 'buy' signal.

(Click on image to enlarge)

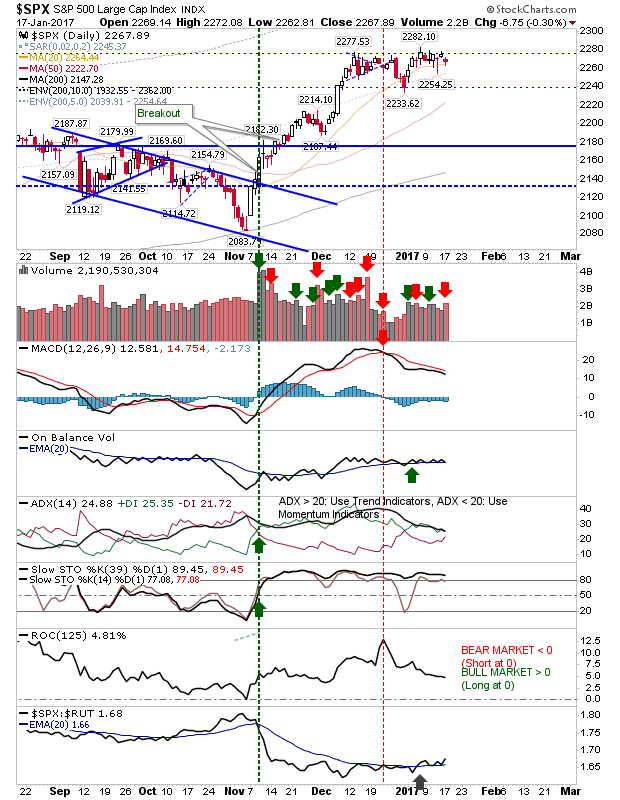

The S&P experienced heavier volume distribution, but there wasn't a big percentage loss, nor was there a break from the consolidation range.

(Click on image to enlarge)

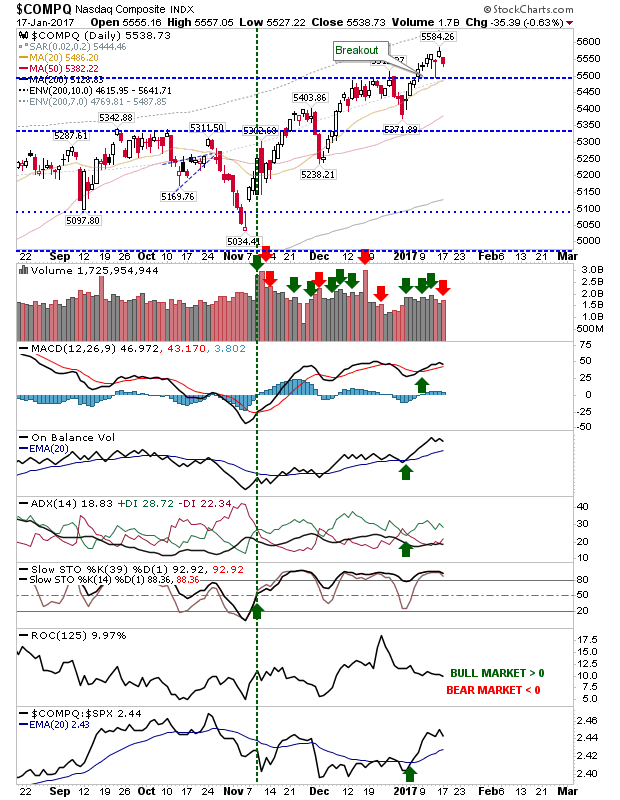

It was a similar story for the Nasdaq. It took a greater relative loss than the S&P, but it didn't challenge support from the breakout. However, look for such a test tomorrow. All supporting technicals remain in the green.

(Click on image to enlarge)

With the bank holiday weekend over, traders can again look to push the Trump/May agenda. Shorts can remain tied to the Russell 2000 - shorting rallies as they emerge. Longs should to Large Cap indices and the short covering which is likely to follow once trading range resistance is breached.

Disclosure: None.