Rocket Scientists In The House

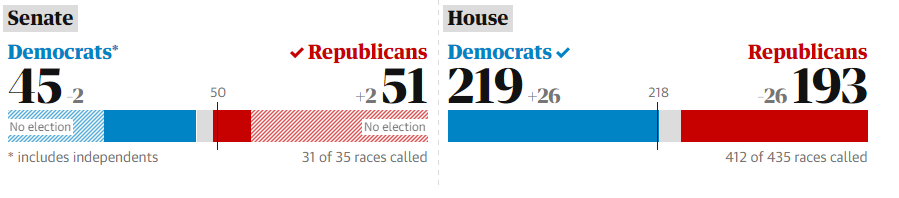

Preliminary results are in and it seems like the Democrats have managed to take control over the US House of Representatives while the Republicans maintained control over the Senate.

This is a mild upset for President Donald J Trump who previously controlled both houses of Congress. The Democrats aren't entirely thrilled either as they were hoping to exert a greater level of control over the President.

The stock markets seem to be happy with these results though and we're seeing gains in most major indices this morning.

Today's Highlights

- Stock Relief

- New Feature

- Crypto Rally Continues

Traditional Markets

Speaking this morning, the new CEO of Goldman Sachs David Solomon says that from a market perspective, the election will probably not have a big impact on policy or action from the US government over the next two years.

Solomon further elaborates that the biggest risk to markets is an overheating economy during the Fed's tightening of monetary policy especially since "we're certainly later in the cycle, so we're closer to the end of the cycle than we are to the beginning, it doesn't take a rocket scientist to figure that out."

Wait... let's rewind.Solomon is saying that even though the US economy is strong, and the bullish cycle might be over soon, the biggest danger is that the economy gets stronger.

Cut to... a graph of the Dow Jones over the last 20 years.

(Click on image to enlarge)

Crypto Rally Continued

Crypto prices continue to edge up this morning and bitcoin is now trading above $6,500 once again.

The gains are being led by Bitcoin Cash ahead of the hard fork next week. It's kind of funny to see that after all this sideways movement, a possible break out could come from a disagreement in the BCH community of all places.

In any case, the fire doesn't usually care where the spark came from. Upward momentum has a way of snowballing in financial markets no matter what the drivers of that momentum may have originally been.

In any case, the kindling has been building for weeks now, especially with the new Bakkt service and Fidelity joining the space. So there's certainly an excellent fundamental case for a strong rally.

The technicals, on the other hand, have only changed slightly. We've had our eye on Bitcoin's 200 day moving average for months now. As we can see, the line has come down a bit and the price has moved up a bit.

We're only $564 away from it now...

(Click on image to enlarge)

Disclaimer: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of ...

more