Richmond Fed Manufacturing Survey Again Improves In April 2017

Of the four regional Federal Reserve surveys released to date, all are in expansion.

Analyst Opinion of Richmond Manufacturing

For the fourth month, the regional Fed surveys seem to be saying uniformly that growth is expanding. The Richmond Fed subcategories were strong - especially new orders.

Market expectations from Bloomberg/Econoday was 15.0 to 20.0 (consensus 16.0). The actual survey value was +20 [note that values above zero represent expansion].

Manufacturers in the Fifth District were upbeat again in April, according to the latest survey by the Federal Reserve Bank of Richmond. The index for shipments rose and the index for new orders remained very strong. Even though the index for employment fell, the composite index for manufacturing remained high, with a reading of 20 in April compared to 22 in March. This was the first time since 1994 that the composite index remained at or above 20 for two consecutive months. The majority of firms continued to report longer workweeks and increased wages.

Looking six months ahead, manufacturing executives remained generally optimistic, although many of the indexes fell slightly from their March readings. The only two indexes that increased were expected capacity utilization and expected capital expenditures. Nonetheless, the expected shipments index had a strong reading of 42 in April and the expected new orders index was 46.

Survey respondents reported that growth in prices paid rose somewhat while growth in prices received moderated slightly.

Summary of all Federal Reserve Districts Manufacturing:

Richmond Fed (hyperlink to reports):

z richmond_man.PNG

Kansas Fed (hyperlink to reports):

z kansas_man.PNG

Dallas Fed (hyperlink to reports):

z dallas_man.PNG

Philly Fed (hyperlink to reports):

z philly fed1.PNG

New York Fed (hyperlink to reports):

z empire1.PNG

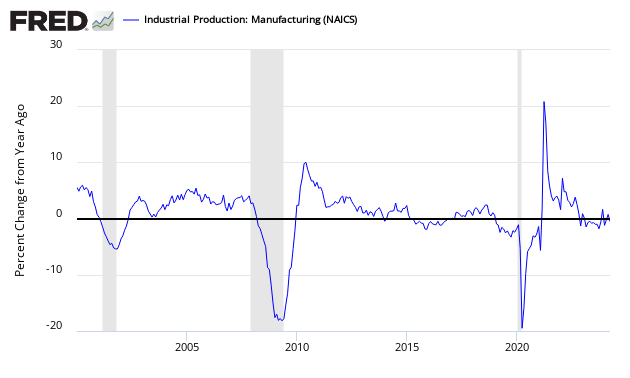

Federal Reserve Industrial Production - Actual Data (hyperlink to report):

Holding this and other survey's Econintersect follows accountable for their predictions, the following graph compares the hard data from Industrial Products manufacturing subindex (dark blue bar) and US Census manufacturing shipments (lighter blue bar) to the Richmond Fed survey (darkest bar).

In the above graphic, hard data is the long bars, and surveys are the short bars. The arrows on the left side are the key to growth or contraction.

Disclosure: None.