Revenues Are Bottoming Out, So Buy IBM Now While Price Still Low

For the 12th straight quarter, International Business Machines Corp. saw its revenue drop compared to the year-earlier period. Total revenue from the quarter fell to $19.6 billion from $22.2 billion, while net income fell slightly to $2.33 billion from $2.38 billion. The consistently diminishing revenues have partially been a result of efforts by CEO Ginny Rometty to transform the business. The stock price has fallen 8.5% since she was appointed CEO, vastly underperforming in a time when the S&P 500 index has surged. The company has maintained for years that it would struggle while transforming the business, but actual results have still not occurred. This could change later this year, as the signs are finally there for IBM to start organically growing its revenue after the transformation. Low value assets have been sold off, revenue looks to have reached a bottom, and the company is investing in strategic imperatives to complete the fundamental transformation that has been years in the making.

Revenue Numbers Misleading

The falling revenue numbers have been the headline for IBM’s earnings reports for the last three years now, as they have been interpreted as a sign that the once dominant company is struggling to keep up with the evolving market place. As companies continue to move away from large mainframes, instead stitching together many cheaper computer servers to get supercomputer performance or moving to the cloud, IBM’s hardware business has been seen as dying or already dead. Some of this talk has merit, as the company did sell its server business to Lenovo.

Most of the hardware business that IBM has been selling off did not have good margins, providing little value to the company. While taking these assets off its books has damaged the company’s revenue numbers, they have actually helped the profit margins the company has made, making it a better value investment. And even though the company is transitioning away from hardware to other strategic investments, it does not mean that IBM does not get value from its hardware legacy. Its brand new System Z mainframe performed very well during the previous quarter, and the hardware business reported 30% year-over-year growth thanks to sales of these machines.

The decreasing revenues overall from this segment over the past three years will make the company stronger in the long run, as increased revenues from other segments that are growing rapidly will provide better profit margins. Along with the removal of assets that provided no value to the company from its books, IBM also took a hit from currency headwinds, as most companies have during the past couple of quarters. The company receives more than half of its revenue from overseas, and now expects a 7% impact from currency effects, more than it had previously expected.

Taking into account the business segments that have been taken off the books and the currency headwinds, revenue was actually flat from the year-earlier period. With the second quarter of the year expected to see an increase in mainframe hardware sales, it now appears possible that revenue might finally be bottoming out and could be set to start increasing within the next year. This will depend upon the ability of the strategic investments to grow at a faster pace than the traditional business retreats.

Strategic Imperatives Showing Promise

As IBM transitions away from hardware, it is organizing its future around cloud, the internet of things, and analytics. These business segments were up 30% when taking out currency effects, and up 20% even including those currency headwinds. These strategic investments will need to keep this pace of growth going forward for IBM to turn their revenue performance around. Revenue from the cloud business grew by 60% compared to the year before period, and is on pace to do $3.8 billion in business this year. This is still minor in comparison to its overall top line, but the growth prospects show that this business segment is making progress in the growing cloud market.

The analytics segment is up 12% compared to last year as well, where IBM has been a major player for years. The transition to this business is not as large of a shift based off what IBM is doing. Instead, it is placing a bigger emphasis on this field, as it has become increasingly popular among companies as they try to analyze data from mobile devices, big data, and cloud computing. IBM is continuing to emphasize the need to grow these businesses, as it is investing $4 billion this year on software and services delivered in the cloud. These businesses accounted for $25 billion, or 27% of annual revenue. IBM is hoping to increase the revenue from these businesses to $40 billion, which would be 40% of their annual revenue goal, by 2018.

Besides the planned investment into business segments that the company hopes it can grow quickly, IBM is also entering into partnerships with other firms to help get their businesses into consumers’ hands. Is has an ambitious partnership with Apple Inc., in which it is releasing apps for specific industries, such as airlines and retail, as well as a partnership with Twitter Inc., in which it will be able to analyze consumer’s tweets for firms of any size. The most interesting partnerships, though, are ones in healthcare with companies like Apple and Johnson and Johnson, along with several hospitals, as it attempts to become a major player in this field.

Experts agree that the linking together of all the massive computers that now hold medical information is the biggest opportunity presently available. IBM hopes to take advantage using its Watson artificial intelligence to make sense of the overwhelming amounts of medical data that is out there. Its partnership with Apple allows Watson based apps to collect info from consumers using HealthKit and ResearchKit. Similarly, a partnership with Medtronic will allow Watson to create an internet of things around the company’s medical gadgets. It will collect data for patients’ personal use and help doctors understand how well the devices are working.

IBM is not the only company that is attempting to take advantage of the opportunity in this field. Watson already has partnerships announced with the health insurer Anthem and medical centers including M.D. Anderson, Memorial Sloan-Kettering Cancer Center, and The Cleveland Clinic. Anecdotal reports so far have been positive, and IBM is convinced that the size and scale of Watson makes it capable of transforming the industry, allowing software to use data remotely while keeping it secure.

Algorithmic Analysis

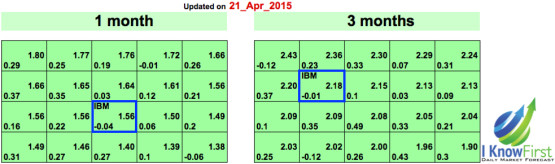

I Know First is a financial services firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions.

The signal represents the predicted movement direction or trend, and is not a percentage or specific target price. The signal strength indicates how much the current price deviates from what the system considers an equilibrium or “fair” price. The signal can have a positive (predicted increase) or negative (predicted decline) sign. The heat map is arranged according to the signal strength with strongest up signals at the top, while down signals are at the bottom. The table colors are indicative of the signal. Green corresponds to the positive signal and red indicates a negative signal. A deeper color means a stronger signal and a lighter color equals a weaker signal.

The predictability indicator measures the importance of the signal. The predictability is the historical correlation between the prediction and the actual market movement for that particular asset, which is recalculated daily. Theoretically the predictability ranges from minus one to plus one. The higher this number is the more predictable the particular asset is. If you compare predictability for different time ranges, you’ll find that the longer time ranges have higher predictability. This means that longer-range signals are more important and tend to be more accurate.

The figure above is a one-month and three-month forecast for IBM from April 21st, 2015. IBM has a weak bullish outlook in both forecasts. This fits well with the fundamental analysis for the company, as the stock price is likely to trend slightly higher until the company is able to start growing its revenue. This means that investors should go ahead and purchase the stock, as the stock price will soar much higher when revenue growth does occur, with the P/E ratio moving back to industry averages from its extremely low current level. With the impressive return to investors that IBM has historically provided to investors, it is worth purchasing now, as good times are ahead for this historic company.

Nicely done - I'm convinced.