Return On Trust: The "State Of Trust" 2016

In the short-term “low trust” businesses can be very profitable. Corporate executives who “legally” cheat, steal, lie, avoiding paying taxes, and stay just on the “right side” of compliance may produce the profits that both their Board and shareholders crave, but these “business as usual” trust violations are not conducive to long-term business success. That long-term success is built by embracing trust as both a business “imperative” and long-term strategy. This translates to practicing “trust” on a daily basis by treating your customers and suppliers “right”, by having superior products, great service, high performing teams, low employee turnover, and a high degree of innovation.

Now in its seventh year, our proprietary FACTS® Framework measures the trust "worthiness" of America's largest public companies (over 2000). We define trustworthy as those companies with the strongest culture and core values, including good citizenship. The following are some of the “fast facts” drawn from our larger study.

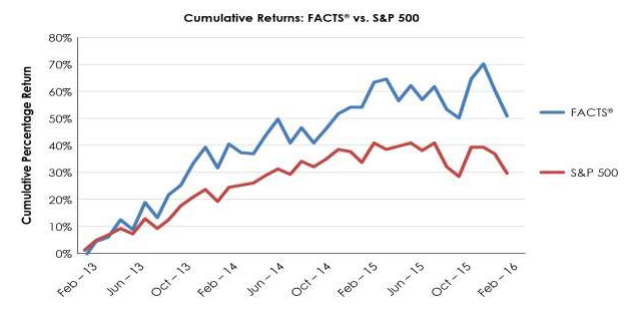

Chart #1

During the three-year period from February 2013-February 2016 America's most trustworthy public companies outperformed the S&P 500.

This was not a "test" but rather “real” money under management, followed by an independent audit verifying the returns. Trust works as a business strategy.

FACTS® Managed Accounts were independently audited from Feb.1, 2013-Jan.31, 2016. Prepared by FACTS Asset Management LLC

FACTS® is our model of identifying America’s Most Trustworthy Companies by applying FACTS strategy parameters. The composite results translate to 50.09% for FACTS® and 28.1% for the S&P 500 cumulative percentage return shown above, or 16.7% average annualized for FACTS® vs. 9.5% for the S&P 500 over the same period. The audited Composite Performance results shown above may not be indicative of future results. Full audit documents available upon request.

The composite performance records are based on all accounts managed using the FACTS strategy for a three year period, 2/1/13 to 1/31/16 and are not representative of the FACTS® Asset Management LLC program. Tax consequences are not reflected in the performance records. Past performance is not an indication of future return. There can be no guarantee that a new program will prove to be profitable in the future or that it will achieve performance results similar to those achieved in the past using the FACTS strategy parameters and you may lose money. The performance numbers reflect the reinvestment of dividends. The composite performance net of fees is calculated using a weighted average fee for the entire period because not all accounts were charged equal fees and some accounts were not charged fees. The S&P 500 is a widely recognized market value-weighted index of 500 stocks designed to mimic the overall U.S. equity market’s industry weightings, and does reflect the reinvestment of dividends.

Past results are not necessarily indicative of future results.

FACTS® Asset Management LLC is a New Jersey registered Registered Investment Advisor

Prepared by FACTS Asset Management LLC

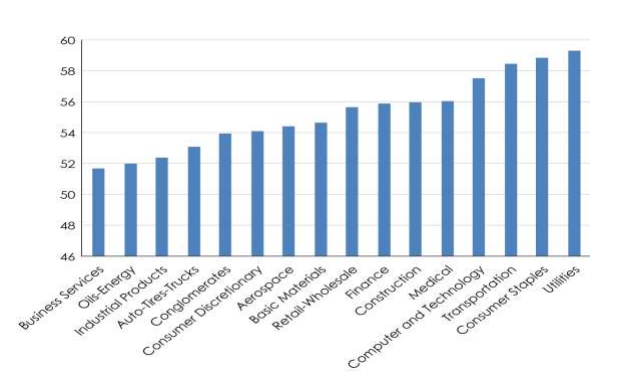

Chart #2

FACTS data can be sorted by sector and the following chart represents the sector rankings for the S&P 500 companies for 2015. Please keep in mind that the Framework uses a broad 16-sector model provided by Zacks Investment Research. Others like S&P and Morningstar sometimes place companies in different sectors. For example, Zacks financial sector, which you might expect to rank much lower than other sectors, includes banks, insurance companies, REITS and brokerage firms, to name just a few. And it's also important to remember that industry is NOT destiny.

The data can also rank companies within sectors, by market cap and headquarter state, to name just a few. We can also perform company comparisons.

Sector Rankings

Correlation Studies:

We continue to run a series of ongoing correlation studies with other organizations and these are a few of our findings:

- High correlation between our FACTS rankings and percentage of women on boards as reported by Catalyst.

- High correlation between our FACTS rankings and Governance & Accountability Institute’s companies that voluntarily report on sustainability.

- High correlation between our FACTS rankings, Ethisphere's Most Ethical Companies and CR's Best Corporate Citizens.

- Low correlation between our FACTS rankings, Great Places to Work and Forbes Annual Ratings of Most Trustworthy Public Companies (Forbes data providers employ a different “measure” of trust “worthiness” to compile their rankings.

These studies, confirmed by many others, show that the best companies want to get better and they dedicate the necessary resources for continuous improvement.

Our FACTS Framework and rankings are being licensed in a variety of formats within and outside the financial services industry.

FACTS® Managed Accounts were independently audited from Feb.1, 2013-Jan.31, 2016. Prepared by FACTS Asset Management LLC

more