Retailers Wrap Up The Q1 Earnings Season

The earnings season is winding down with the typical parade of retail reports, and the results have mostly been good. Some standouts include Home Depot (HD), TJX Companies (TJX) and Target (TGT). The biggest disappointment, of course, being Wal-Mart (WMT). Headwinds such as the stronger dollar, West Coast port strikes and wage increases caused the retailer to miss both top and bottom-line expectations by a large margin.

Tonight we get results from Gap Inc (GPS) The struggling retailer has a new CEO that is hoping to turn things around. The Estimize community is looking for EPS of $0.58, 2 cents higher than the Street’s expectation. Revenues are anticipated to come in at $3.8B, surpassing the Wall Street consensus by $106M. Both the top and bottom-line estimates would put Gap roughly in-line with year-ago results. However, recent Q1 SSS results don’t bode well for the company, with the namesake Gap brand and Banana Republic posting declines of 10% and 8% for the quarter. Only their lower-end division, Old Navy, saw an increase of 3%. And it’s not only the fundamentals that are looking weak, the stock has fallen 8% since the beginning of the year.

Economic indicators also came in mixed this week. Housing Starts were strong on Tuesday morning, with a reading of 1.14M for April, growing 20% MoM, the biggest gain in 7 ½ years. Many took this as a sign that spring momentum in housing is here. However, this morning we received disappointing results for Existing Home Sales which fell 3.3% from March. The Philly Fed Business Outlook also showed that Mid-Atlantic manufacturing activity is slow, but stabilizing. Yesterday’s FOMC minutes indicated that the Fed believes weakness in macro conditions in the beginning of this year are only transitory, but it is unlikely there will be a rate hike in June.

How are we doing?

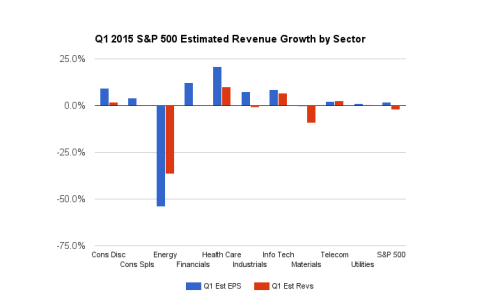

Expectations for S&P 500 earnings growth for the first quarter stand at 2.0%, a nice improvement from the -1.5% expected at the beginning of the season. On the flipside, revenues are anticipated to decline 2.3%.

Leaders

Earnings:

Health Care (20.9%). Notable industry: Biotechnology (41.3%).

Financials (12.4%). Notable industry: Capital Markets (18.4%)

Revenues:

Health Care (10.1%). Notable industry: Biotech (28.4%).

Information Technology (6.7%). Notable industry: Internet Software & Services (21.9%)

Laggards

Earnings:

Energy (-54.2%). Notable industry: Oil, Gas and Consumable Fuels (-65.1%)

Materials (-0.3%). Notable industry: Construction Materials (-85.7%)

Revenues:

Energy (-36.5%). Notable industry: Oil, Gas and Consumable Fuels (-39.4%).

Materials (-9.3%). Notable industry: Paper and Forest Products (-21.3%).

Beat/Miss/Match

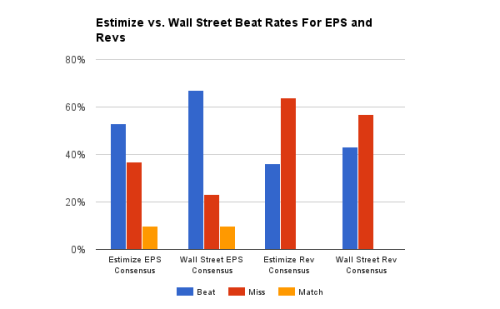

Earnings: With 479 S&P 500 companies reporting thus far, 53% have beaten the Estimize consensus, 37% have missed and 10% have met. This is compared to Wall Street estimates, of which 67% of companies have beat on the bottom-line, 23% have missed and 10% have met.

Revenue: 36% have beaten the Estimize consensus, while 64% have missed. For revenues, 43% of companies have beat the Wall Street estimate, while 57% have missed.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.