Retail Sales Growth Improve In March 2018 - But Is A Weak Bounce

Retail sales were up according to US Census headline data. The unadjusted rolling averages rate of growth also improved.

Analyst Opinion of Retail Sales

Even though there is seen a significant improvement - it was a weak bounce back from the previous month's solf reports.

Things to consider when viewing this data:

- it is not inflation adjusted.

- the three month rolling averages of the unadjusted data significantly slowed

- still, our analysis says this months' year-over-year growth was about average for the growth seen in the last 12 months..

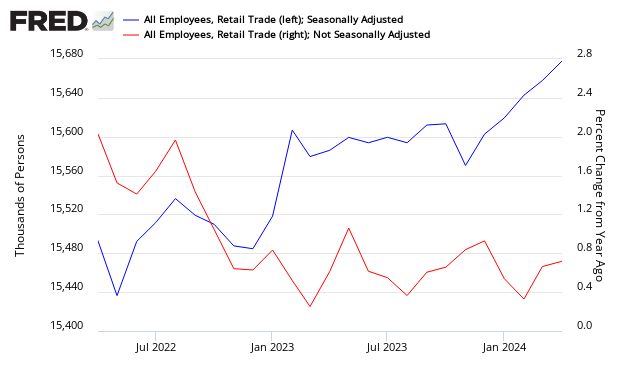

The relationship between year-over-year growth in inflation adjusted retail sales and retail employment do not correlate.

(Click on image to enlarge)

Backward data revisions were upward.

Econintersect Analysis:

- unadjusted sales rate of growth accelerated 1.1 % month-over-month, and up5.1 % year-over-year.

- unadjusted sales 3 month rolling year-over-year average growth accelerated 0.5 % month-over-month, up 4.8 % year-over-year.

(Click on image to enlarge)

- unadjusted sales (but inflation adjusted) up 3.3 % year-over-year

- this is an advance report. Please see caveats below showing variations between the advance report and the "final".

- in the seasonally adjusted data - the major strengths were automotive and non-store retailers.

- seasonally adjusted sales down 0.6 % month-over-month, up 4.5 % year-over-year.

- the market was expecting (from Bloomberg / Econoday):

| seasonally adjusted | Consensus Range | Consensus | Actual |

| Retail Sales - M/M change | 0.2 % to 0.8 % | +0.4 % | +0.6% |

| Retail Sales less autos - M/M change | 0.0 % to 0.4 % | +0.2 % | +0.2 % |

| Less Autos & Gas - M/M Change | 0.3 % to 0.5 % | +0.5 % | +0.3 % |

| Control Group - M/M change | 0.2 % to 0.6 % | +0.5 % | +0.4 % |

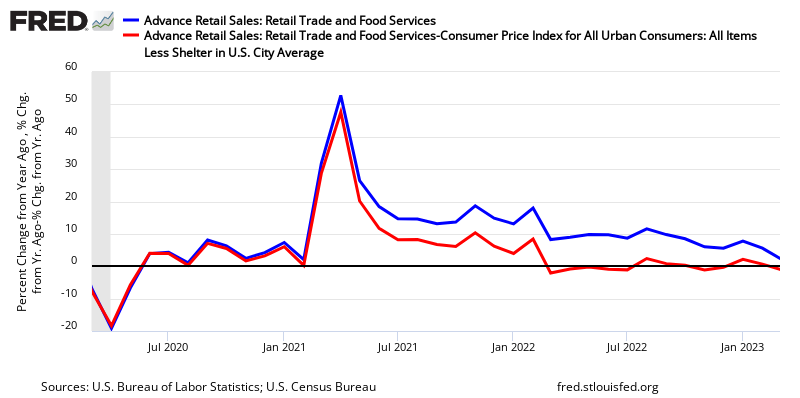

Year-over-Year Change - Unadjusted Retail Sales (blue line) and Inflation Adjusted Retail Sales (red line)

(Click on image to enlarge)

Retail sales per capita seems to be in a long term downtrend (but short term trends appear to be growing - see graph below).

Year-over-Year Change - Per Capita Seasonally Adjusted Retail Sales

(Click on image to enlarge)

From the U.S. Census Bureau press release:

Advance estimates of U.S. retail and food services sales for March 2018, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $494.6 billion, an increase of 0.6 percent (±0.5 percent) from the previous month, and 4.5 percent (±0.5 percent) above March 2017. Total sales for the January 2018 through March 2018 period were up 4.1 percent (±0.5 percent) from the same period a year ago. The January 2018 to February 2018 percent change was unrevised from down 0.1 percent (±0.2 percent) *. Retail trade sales were up 0.6 percent (±0.5 percent) from February 2018, and 4.7 percent (±0.5 percent) above last year. Gasoline Stations were up 9.7 percent (±1.6 percent) from March 2017, while Nonstore Retailers were up 9.7 percent (±1.4 percent) from last year.

Seasonally Adjusted Retail Sales - All (red line), All except food services (blue line), and All except motor vehicles (green line)

(Click on image to enlarge)

The differences between the headlines and Econintersect are due to different approaches to seasonal adjustment (see caveats at the end of this post). Long and medium term trends always agree comparing the adjusted to the unadjusted data - it is the short term trends and month-over-month change where the conflict occurs.

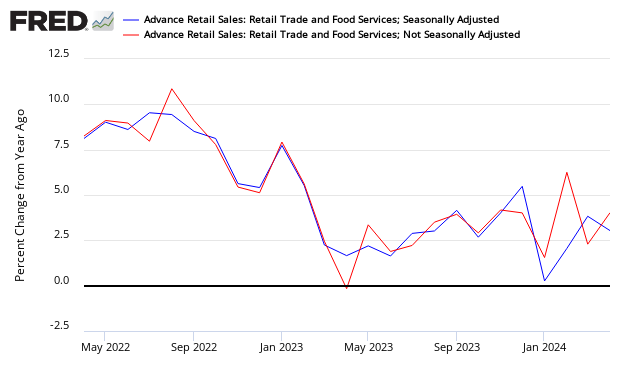

Comparison of the Year-over-Year Census Seasonally Adjusted Retail Sales (blue line) and Econintersect's Unadjusted Retail Sales (red line)

(Click on image to enlarge)

Declines of short duration often occur in the seasonally adjusted series without a recession resulting.

Retail and Food Services Sales - Seasonally Adjusted

(Click on image to enlarge)

Using employment as a gauge to check growth, employment in retail has been growing - but the rate of growth has been in a down trend since 2016.

Retail Employment - Total Seasonally Adjusted (blue line, left axis) and Year-over-Year Change Unadjusted (red line, right axis)

(Click on image to enlarge)

And finally, as retail sales can be a component of determining a recession start date, the zero line of the graph below could be an indicator a recession was underway (or about to begin).

Retail Sales - Recession Watch Graph

(Click on image to enlarge)

Caveats On Advance Retail Sales

This data release is based on estimates. However, the estimates have proven to be fairly accurate although tend to miss at economic turning points. Therefore up to three months are subject to backward revisions, although normally slight, can sometimes be modest.

The data in this series is not inflation adjusted - and Econintersect adjusts using CPI less shelter CUSR0000SA0L2. The St. Louis Fed also inflation adjusts the Census seasonally adjusted data. The last two recessions began as the inflation adjusted retail sales crossed the zero growth line.

Comparison of Real Year-over-Year Growth between FRED's Real Retail Sales (green line) and Econintersect's Inflation Adjusted Retail Sales

(Click on image to enlarge)

As in most US Census reports, Econintersect does not agree with the seasonal adjustment methodology used and provides an alternate analysis. The issue is that the exceptionally large recession and subsequent economic roller coaster has caused data distortions that become exaggerated when the seasonal adjustment methodology uses more than one year's worth of data. Further, Econintersectbelieves there is a New Normal seasonality. Using data prior to the end of the recession for seasonal analysis could provide the wrong conclusion.

The impact of the monthly retail sales data on GDP is not straight forward. Real GDP (of which the consumer is over 60%) is adjusted for inflation. Further, GDP is an analysis of quarter-over-quarter or year-over-year growth, while retail sales is a monthly data series.

Econintersect determines the month-over-month change by subtracting the current month's year-over-year change from the previous month's year-over-year change. This is the best of the bad options available to determine month-over-month trends - as the preferred methodology would be to use multi-year data (but the New Normal effects and the Great Recession distort historical data).

From Econintersect contributor Doug Short:

Those of us who routinely track this series know that the Advance Estimate will be followed by a second estimate next month and a third estimate the month after. How big are those revisions? Are they big enough to warrant skepticism about the Advance Estimate? Here is a visualization of the cumulative change from the first to third estimates from January 2007 through March 2014, the most recent month for which we have three data points.

(Click on image to enlarge)

Disclosure: None.