Repeal Of Dodd-Frank Could Have Big Consequences

Early in November, the United States elected perhaps one of the most controversial political candidates to become the 45th President, with Donald Trump. To many, the results were quite shocking. In fact, overnight Dow Jones Industrial stock futures dropped over 800 points, but by morning, the market had recovered. Financial stocks rallied on the promise of Trump's Administration cutting the red tape and bonds dropped on the expectation of future inflation.

All the optimism in the financial markets is not without a lot of anxiety, however. One of Trump's many campaign promises was that he would repeal Dodd-Frank. In the days following the election, a slew of politicians are vowing to fight against any repeal of Dodd-Frank. They are calling it a step backward.

But, what does the data say?

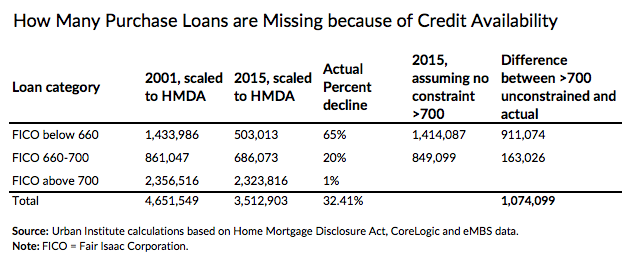

The left-leaning Urban Institute recently published an analysis of the mortgage market. They found that there are millions of missing loans due to a tight credit box. In fact, the total number of missing loans in 2015 was about 1.1 million, per their analysis. A previous analysis showed similar results in every year since the Financial Crisis of 2009. Last year, the Mortgage Bankers Association reported that the average purchase loan size was $294,900. So, by simple math, that indicates that about $317 billion was missing from mortgage lending volume in 2015 alone.

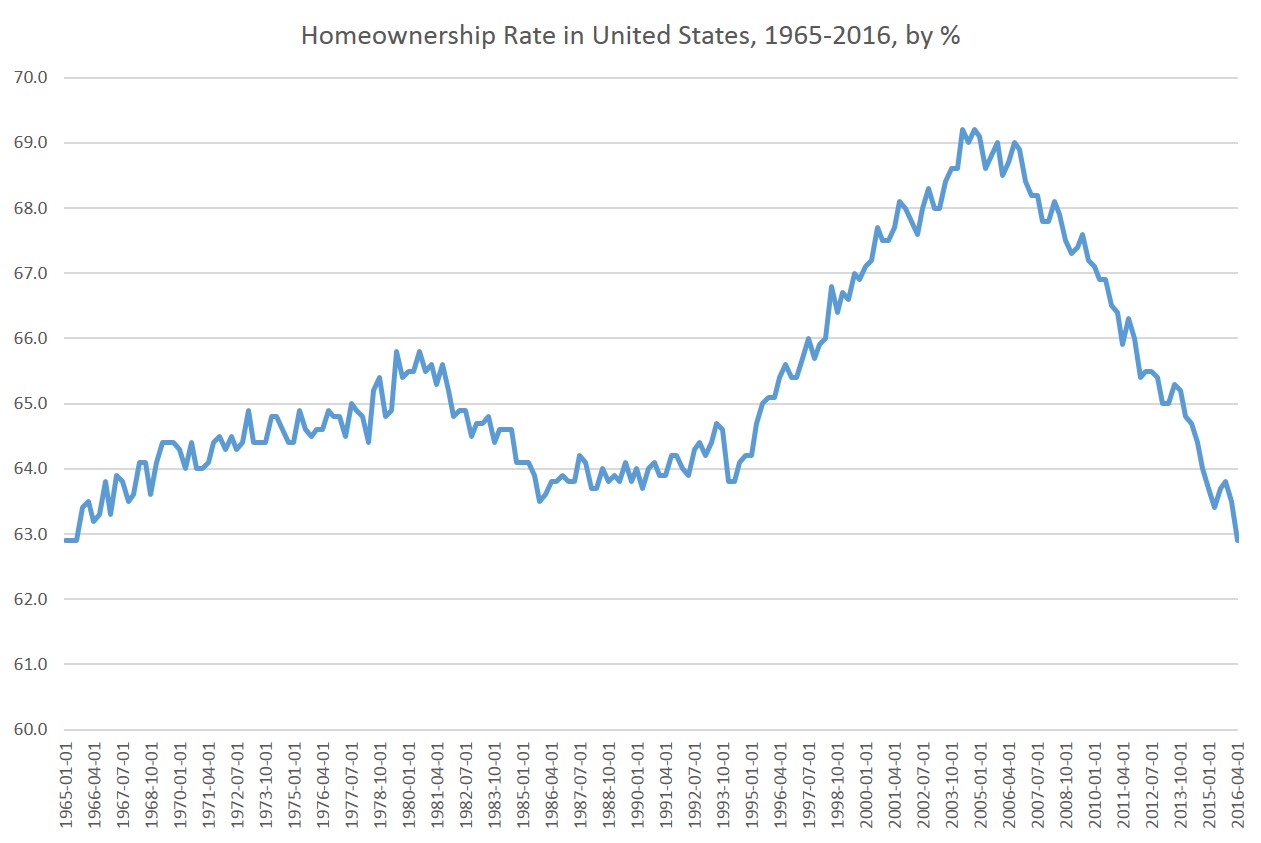

Some may look at the table above and immediately think, "Well, maybe that's a good thing because those borrowers not getting loans have the lowest credit scores." That's a true enough assessment by itself, but take a look at the next chart. This shows the U.S. home ownership rate from 1965 to the present.

(Click on image to enlarge)

Home ownership rates are currently at historically low levels. This is a startling fact, considering that interest rates are also at record low levels. It has never been cheaper for an American to take on the dream of home ownership. This has been a primary method of wealth creation for many Americans since the Great Depression. It was during the Great Depression that Fannie Mae (FNMA) was created as part of the New Deal era of progressive policies that were intended to promote financial stability and a strong middle class. It was in 1968 that Fannie Mae was actually privatized. This brought forth a new era of increasing home ownership. It wasn't until recently that home ownership formed in a housing finance bubble that eventually popped.

We now live in an era in which it is increasingly difficult to finance a home. How difficult? In 2014, Ben Bernanke told the world that he could not refinance his mortgage due to tough lending standards. This is the former Federal Reserve Chairman, a man whot can command thousands of dollars just to show up and share his opinion. You'd think regulators might have been listening in 2014 and sought remedies to a problem like this. In reality, however, they did the opposite, creating new sets of regulations. Some of the regulations eventually led to mortgage company failures, indicating that regulations actually removed mortgage supply from the market.

Regardless, some forward-looking lenders are actually preparing for a day when common sense returns to mortgage lending. Impac Mortgage (IMH), based out of Irvine California, has forecast Non-Qualified Mortgage (Non-QM) originations of $1 billion in 2017, a significant increase over 2016. Impac has been targeting borrowers on the fringe of government Qualified Mortgage (QM) specifications, borrowers with lots of assets, but no W-2, for instance.

Investors may expect that Dodd-Frank repeal should occur rather rapidly, but I've spoken with several experts who don't appear to really know what that means. Would Dodd-Frank be repealed completely? Or would the Trump Administration offer a new set of guidelines for regulators? Perhaps both. Expect some provisions of Dodd-Frank to change early in 2017. In any case, lending standards could already be changing, as organizations have more confidence in regulators.

This all needs to happen in concert with efforts to reform Fannie Mae (FNMA) and Freddie Mac (FMCC). While it may be easy to tell lenders to simply loosen up standards, many of them are selling the majority of their loans for securitization through the government sponsored entities. Since 2012, those two companies have not been allowed to retain capital. If we repeal provisions of Dodd-Frank, increasing overall mortgage market risk, it would be prudent to allow these mortgage insurance companies to retain earnings. Again, common sense must prevail to prevent the next crisis.

Disclosure: Long Impac Mortgage (IMH), Fannie Mae (FNMA), and Freddie Mac (FMCC), primarily in the form of preferred stock shares.

Repealing the Frank-Dodd could have negative implications on an already repressed financial situation. This could open up doors to subprime lending, high risk lending and possibly deregulating the securitization of loans. The current state of things looks like we are headed for stability. Repealing Frank-Dodd could lead us in the opposite direction.

I've been following the mortgage market for many years. I think I may have felt similarly in 2009 to 2011, but I also follow a lot of the data. For instance, while the homeownership rate is at a 20 year low, the cost of renting has been higher than the cost of owning a home for several years. As a public policy goal, it is important to push policies that are good for the middle class. Homeownership is one of these things.

The Federal Reserve guides interest rate decisions based upon things like the Philips Curve. When unemployment goes up, they tend to lower interest rates, but only if inflation is also subdued.

What this country lacks is a economic housing policy based on data. Right now, we have housing policies based on public opinion and politics. People tend to think about things that happened eight years ago, as if they are true today. In 2005, people without jobs or assets were getting loans for homes that had $300,000 mortgages. No doc loans are a far swing away from the current mess.

Fannie's minimum credit score is a 620, but most banks won't talk to you without a score over 680 and strong W-2 documented income. This is also true for self-employed people that might have high credit scores and lots of assets. I know from experience. When I started my own RIA firm, I could not refinance my rental property or my home residence through HARP or the FHA streamline program. The risk of default remained the same for my banks in these cases, but they didn't want to do anything to draw the attention of regulators. (I have good credit and assets).

While the new normal pushes rates down, it would be great if rates were just a little higher, which would allow for #banks to take more risk in lending. I don't see rates exploding, however.

What do you mean by "missing loan? Where did they go?

By "missing," he means mortgage loans that lenders would have made, if reasonable lending standards were in place. But since they weren't, the loans weren't made. Here's the link the author included which explains this in more depth:

www.urban.org/.../overly-tight-credit-killed-11-million-mortgages-2015

What he said....